Japan says only 1–2% represents actual investment from US deal

3 min read

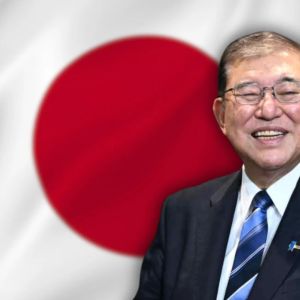

Japan says that of the $550 billion US agreement, only 1–2% represents actual investment, while the rest will be provided through loans and guarantees. Some have raised concerns about the investment plan . However, chief negotiator Ryosei Akazawa assured them that the overall tariff reductions under the US deal would save Japan approximately ¥10 trillion, or about $68 billion. Japan’s Akazawa claims they will make money from the loans and guarantees Akazawa said the $550 billion plan will blend investments with loans and government-backed guarantees, with just 1–2% in actual investment. Profits from the framework will also be split 90-10 between the two states, far from Tokyo’s initial 50-50 proposal, which many nationals don’t seem as pleased with, believing it leaves the country at a disadvantage. Akazawa, however, is convinced that their agreement with the US is a win. He commented, “By letting the US have 90% of the profits rather than 50%, I think Japan’s loss will be at most a couple of tens of billions of yen. People are saying various things, such as ‘You sold out Japan,’ but they’re wrong.” He argued that the nation would earn interest on the loans provided and collect fees on the loan guarantees. Assuming no defaults occur, the country would only stand to gain from the agreement. Additionally, he said the program was not restricted to Japanese and American companies, noting that other countries’ businesses could profit from the initiative, such as a Taiwanese semiconductor manufacturer building a factory in the United States. Both parties have yet to sign a joint document Meanwhile, Japan has designated JBIC and NEXI as the lead financial institutions for project financing. However, several key details of the deal are still unclear, including the timeline for the new tariff rates and the launch of the investment vehicle. Besides, no joint agreement has been signed yet, although the White House issued a fact sheet. Akazawa warned that asking for a joint document could delay progress, suggesting the US might insist on finalizing and signing the document before pushing through with tariff reductions. Nonetheless, he said they will urge the US to issue an executive order promptly, irrespective of the joint document’s completion. Last week, Akazawa stated that universal tariffs on their nation’s shipments would be reduced to 15% on August 1, though he did not specify his timely expectations for the 15% car tariffs. So far, the Trump administration has pitched the deal as a blueprint for future trade agreements. On Sunday, Washington and the EU struck an almost similar agreement to Japan, agreeing on 15% tariffs on most EU exports, with the bloc promising $600 billion in investments. Analysts are concerned that Trump’s tariffs on Japan’s cars are still high While the US has lowered tariffs on Japanese automobiles from 25% to 15%, analysts warn that the remaining duties could still hinder exports. Stefan Angrick, head of Japan and Frontier Market Economics at Moody’s Analytics, noted that although the reduction brings some relief and clarity, a 15% tariff is still far above Japan’s starting point and higher than most anticipated. Most other analysts acknowledged that China is gaining ground in the automobile market; US tariffs on Japan could cause it to lose some of its competitive advantage to Chinese manufacturers. Karl Brauer, executive analyst at iSeeCars, even described Chinese-made vehicles as the greatest threat to Japan’s automotive industry and overall economic prospects. Your crypto news deserves attention – KEY Difference Wire puts you on 250+ top sites

Source: Cryptopolitan