Internet Computer Slides Amid Broader Altcoin Pullback

2 min read

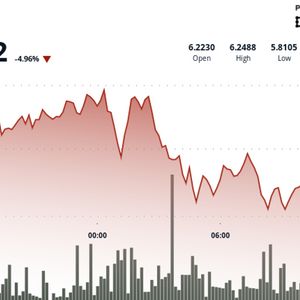

Internet Computer (ICP) dropped 4.85% to $5.9149 on Tuesday, posting a low of $5.81 after peaking at $6.25 the previous day. Despite bullish headlines – a new partnership between Internet Computer developers DFINITY Foundation and indexing firm Maestro – the token succumbed to broad market rotation out of altcoins, including AI- and DeFi-linked assets. Read more: Solana Defies Market Drop, Touches $200 as Altcoins Retreat: Crypto Daybook Americas Maestro’s infrastructure, funded by DFINITY, aims to build a Bitcoin metaprotocol index on the Internet Computer, enabling institutional-grade access to Ordinals and Runes , two of the most prominent primitives in the Bitcoin DeFi ecosystem. However, technical action reflected a more pessimistic short-term outlook. After opening at $6.2230, ICP steadily declined, breaking below $6.00 around 01:00 UTC and accelerating losses toward $5.83 support. Volume swelled above 1.3 million tokens during this segment, signaling large selling pressure, according to CoinDesk’s technical analysis data model. ICP fell 2% from $5.97 to $5.87 during the U.S. morning, with concentrated sell pressure visible as the price pierced multiple support zones. Despite a brief rebound attempt near $6.02, the token failed to reclaim bullish footing, suggesting short-term momentum remains with the bears unless the $6.00 resistance is convincingly reclaimed, the data showed. Technical Analysis Highlights Price Range: $5.8105–$6.2488, representing 7.3% intraday spread. Volume: 1.94 million tokens traded; highest during breakdown below $5.90. Resistance: Strong rejection at $6.00–$6.02 range with no sustained breakout. Support: Critical base formed at $5.83–$5.87 amid heavy buying interest. From 13:09 to 14:08 UTC, ICP fell 2%, driven by sharp volume spikes exceeding 50K tokens/minute. Volatility: Full-day spread of $0.4383 reflects heightened intraday instability. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk’s full AI Policy .

Source: CoinDesk