What Next as XRP Sets Record Highs, $4 Expected in Short Term

2 min read

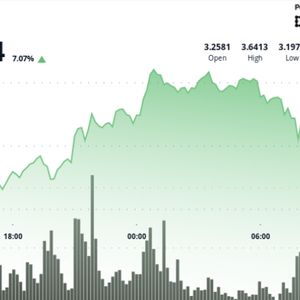

XRP extended its breakout rally on Wednesday, jumping nearly 8% to $3.47 and closing in on 2025 highs amid strong whale accumulation and growing institutional interest. The move brings XRP within striking distance of its 2018 record of $3.84 (recorded on Korean exchanges), as leveraged positioning and ETF optimism help sustain momentum. Trading volume surged past 490 million units during the session, double the daily average. Technical charts show a breakout above key resistance levels, with buyers now defending the $3.42–$3.43 range as a new support zone. What to know XRP rose 7.8% over a 24-hour period from July 17 at 13:00 UTC to July 18 at 12:00 UTC, pushing from $3.25 to $3.47 as traders piled in following a sharp breakout above $3.40. The rally was fueled by over 2.2 billion XRP in fresh whale accumulation and growing speculation around ETF-related inflows. Volume peaked at 490 million XRP during the breakout window — more than twice the token’s average daily flow. News background Momentum around XRP has been building as traders price in higher institutional participation and potential approval of an XRP-based ETF. Grayscale’s rebalancing of its Digital Large Cap Fund to include XRP, alongside growing use in cross-border settlements, has supported bullish sentiment. XRP also briefly overtook BNB in 24-hour trading volumes, further validating its renewed relevance among top digital assets. Price action summary XRP surged from $3.25 to $3.47 over 24 hours, peaking at $3.64 before profit-taking kicked in The session saw a 14.8% intraday range ($0.47), with the sharpest move at 21:00 UTC Volume hit 490.04 million XRP during the breakout, more than 2x the 24-hour average The final hour added 0.37% as XRP moved from $3.46 to $3.47, with a 4.3 million unit spike at 11:43 UTC Technical analysis XRP cleared prior resistance near $3.40 and established $3.42–$3.43 as strong support. A high-volume spike to $3.53 during the breakout confirmed bullish control, while the peak of $3.64 now serves as near-term resistance. RSI remains elevated but not overbought, and MACD continues to favor upside extension. Hourly charts show tightening consolidation above $3.45, setting the stage for a potential leg toward $3.80–$4.00. What traders are watching All eyes are on a potential breakout above $3.53, which could open the path to a retest of $3.84 — XRP’s 2018 record high — and even $4.00+. Traders are also monitoring ETF approval rumors and whale activity as institutional flows remain strong. The $3.42–$3.43 zone is now key: hold that level, and the bulls likely remain in charge. ( Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.)

Source: CoinDesk