SharpLink Gaming Deepens Ether Holdings with $6B Equity Plan Amid ETH Treasury Success

2 min read

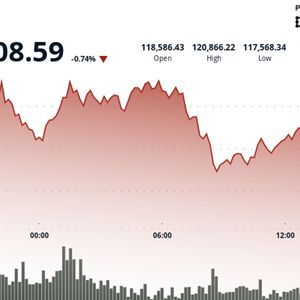

SharpLink Gaming, supported by Ethereum co-founder Joseph Lubin, has taken another aggressive step into the crypto market by drastically expanding its plans to acquire Ether (ETH). The company has boosted the equity it intends to sell, signaling a deep commitment to building one of the world’s largest corporate ETH treasuries. Equity Offering Expands from $1B to $6B In a new filing submitted to the U.S. Securities and Exchange Commission (SEC) on Thursday, SharpLink revealed it would raise its common stock sale authorization by an additional $5 billion. This brings the total offering size to $6 billion, up from the $1 billion target laid out in a previous May 30 filing. The firm reaffirmed its intention to funnel most of the proceeds into buying Ether. “We intend to contribute substantially all of the cash proceeds that we receive to acquire Ether,” the company stated in the prospectus supplement. “We also intend to use the proceeds from this offering for working capital needs, general corporate purposes, operating expenses and core affiliate marketing operations.” If SharpLink were to use the full $6 billion for ETH purchases at current prices, it would hold approximately 1.38% of the total circulating ETH supply. SharpLink Sets Sights on 1 Million ETH SharpLink recently claimed the title of largest corporate ETH holder. In a recent post on X (formerly Twitter), the company suggested that it plans to eventually hold 1 million ETH. As of Tuesday, the firm had accumulated more than 280,000 ETH. Nearly all of it — 99.7% — has been staked, allowing the company to earn additional income from the network. Between June 2 and July 15, SharpLink earned 415 ETH in staking rewards, valued at $1.49 million. On the heels of its latest regulatory filing, SharpLink added another 32,892 ETH, worth about $115 million. This brought its total ETH acquisitions over the past nine days to $515 million, according to blockchain analytics firm Lookonchain. Implications for Ethereum Ecosystem SharpLink’s aggressive accumulation has even outpaced the Ethereum Foundation’s own ETH holdings. This milestone is seen as a bullish signal for Ethereum’s long-term fundamentals. Galaxy Research described the move as a “positive catalyst for the ecosystem,” suggesting it demonstrates strong corporate conviction in Ethereum’s future. SBET Shares Decline Despite Bullish ETH Play Despite its crypto-heavy strategy, SharpLink’s stock (SBET) declined 2.62% on Thursday, closing at $36.40. It dropped a further 4.95% in after-hours trading to finish at $34.60, according to Google Finance. Year-to-date, SBET is still up 350%. However, it has fallen 54% from its May 29 high of $79.21. The company reported a 24% year-over-year decline in revenue for the March quarter. Its net profit margin also took a significant hit, decreasing by 110%. SharpLink is expected to report its next quarterly earnings on August 13, as listed on Nasdaq.

Source: CryptoIntelligence