BITO: On The Verge Of A Break To New Highs

5 min read

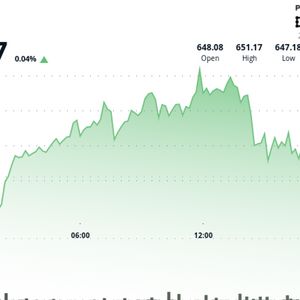

Summary BITO provides convenient Bitcoin exposure via futures, offering strong correlation and significant income distributions, though not a perfect 1:1 price tracker. Distributions are highly volatile but meaningful, totaling nearly half the share price over the past year, making total return analysis essential. While direct Bitcoin ownership outperformed BITO on total return, BITO’s accessibility and income potential make it an attractive alternative for many investors. Technical patterns and momentum indicators suggest further upside, so I maintain my strong buy rating on BITO for continued Bitcoin exposure. As alt-coin OG Bitcoin is knocking on the door to all-time highs once again, it’s a good chance to review which funds are best to gain exposure, if you so choose. Cryptos are firmly in the mainstream of investing now, as the rise of exchange-traded funds in their dozens, making it easier than ever to gain exposure to Bitcoin and other cryptocurrencies. One very popular choice for Bitcoin exposure is the ProShares Bitcoin ETF ( BITO ) , a $2.5 billion fund that tracks the price of Bitcoin, but with a twist. The last time I covered BITO was last October, and I called it a strong buy on the idea that its downtrend was ending. It’s up 61% on a total return basis since then, so we’ll call that one a win. But what about now? I’m still quite bullish, and I’m doubling down on my strong buy rating. What is BITO? BITO seeks to track the performance of Bitcoin over time, minus fees and expenses. That’s a familiar goal as there are numerous funds that look to do the very same thing. But rather than owning Bitcoin directly, BITO owns a huge position in Bitcoin futures. Here’s what the fund owns as of the close on Friday. Fund website The fund owns $2.5 billion in July Bitcoin futures, and it rolls its positions regularly so it’s always got what is essentially spot exposure to Bitcoin futures. That, in turn, tracks spot Bitcoin prices without owning Bitcoin directly. This is a slightly different philosophy to funds that directly own Bitcoin, but as we’ll see below, owning futures works as well. StockCharts This is the 20-day rolling correlation between BITO and Bitcoin itself, and its current value is 0.89. That’s actually a bit lower than it has been in recent months, when it spent a lot of time very near 1.00. At any rate, 0.89 is still almost perfect, so if you’re looking for Bitcoin exposure, you can do much worse. The other thing is that BITO is not just a way to gain exposure to Bitcoin pricing; it offers massive distributions as well. Some funds do not offer distributions, and therefore, their price charts will more closely reflect the movements of Bitcoin itself. BITO offers that exposure to Bitcoin, but also a huge amount of distributions. ProShares has an explanation of how BITO (and its other similar funds) generate distribution, if you’re curious. And those distributions are extremely consequential to total returns for BITO. Seeking Alpha We can see that distributions are extremely volatile, so this is nothing like owning a Dividend King where you know what you’re getting with reasonable accuracy. BITO distributes based upon the formula in the link above, and the payout changes every single month. Over time, the distributions are meaningful to say the least, but the monthly payout range for the past year has been 36 cents to $1.77. Total distributions in the past 12 months is almost $12 per share , or more than half the current share price. That means that if we’re going to track BITO’s progress against simply owning Bitcoin itself – which is a logical alternative – we need to look at total returns, not simply price returns. Seeking Alpha For the past year, Bitcoin itself has outperformed BITO on a total return basis by about 15%. That’s a lot, and if you want to get the best exposure to Bitcoin, you’ll need a way to do that directly. However, if you like the ease and accessibility of owning it through an exchange-traded fund, BITO offers a nice alternative. The other thing is that BITO offers strong income possibilities, whereas Bitcoin obviously doesn’t, and never will. That income can be reinvested for more shares of BITO, or it can fund your lifestyle. It’s just a different way to gain exposure, and it’s not for everyone. Where is BITO headed? I have remained bullish on Bitcoin and linked funds for some time, and nothing about that has changed. The pattern in BITO looks very much to me like a bull flag, and if that’s right, BITO (and Bitcoin) are headed much higher. StockCharts BITO ran from the April low of $15 to a new high of $22.56, all the while paying its distributions. There was a 50-day SMA test in the past week, from which BITO bounced immediately and significantly. The flag pattern is filling out very nicely, the upper and lower bounds of which you can see above. In addition, the PPO has made a centerline test and the histogram is looking like it’s about to go positive. If that occurs, it makes the breakout direction from the flag much more likely to be up. Flags are consolidation patterns, so they are likely to resolve in the direction of prior trend. That was obviously an uptrend, and it amounted to about $7 per share from the April low. Should the flag resolve to the upside – which I fully expect – we should be looking at a similar move in BITO. That would be something like $29 as a target. We’ll see, but the risk/reward here is excellent as you can use the 50-day SMA, or the bottom of the flag pattern as a stop. Wrapping up If you are looking for direct exposure one-for-one with Bitcoin, BITO probably isn’t the best choice for that. The price doesn’t strictly track Bitcoin because BITO pays such massive distributions, and has a bit of tracking error from the futures it owns. On a total return basis, as well as the correlation of prices between the two, it is quite good. BITO offers income in a big way, but also the ease and convenience of owning Bitcoin exposure through an exchange-traded product rather than needing a wallet to hold Bitcoin. I continue to like Bitcoin, and I continue to like BITO as an alternative way to gain exposure to Bitcoin upside. I’m retaining my strong buy on BITO here.

Source: Seeking Alpha