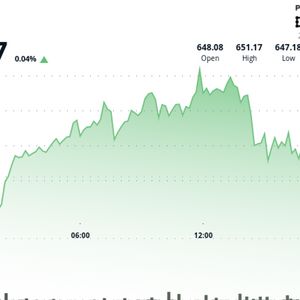

LTC recovers from lows in June, a DeFi newcomer promises 20x gains

4 min read

Litecoin (LTC) may be rebounding from its June lows, but those chasing real acceleration are turning toward a newcomer that’s already rewriting what early gains look like— Mutuum Finance (MUTM) . Priced at just $0.03 in Phase 5, and with over 50% of tokens already snatched up, MUTM is delivering what most altcoins can’t: pure upside with zero sell pressure. Because it’s still in its presale phase—no price dumps, no unlocks, just structured growth toward a $0.06 Phase 11 ceiling. What’s more impressive is how investors are reacting. Several ETH holders, watching Ethereum hover in tight ranges, have already diversified 25%–30% of their portfolios into MUTM, citing its Layer-2 friendly lending utility and smoother path to alpha. One investor dropped $3,500 in Phase 2 and is already sitting on a $7,000 position. With launch projections ranging from $0.60 to $0.80, a buy at $0.03 today will return 20x or more, especially as the beta platform goes live with the token. As Phase 6 pricing kicks in at $0.035, this is not just another buy—it’s the last discounted entry before the curve steepens. Wait any longer, and you’ll be watching the gains you missed play out in real time. Mutuum Finance (MUTM) The key lies in how the platform will make use of capital. Unlike passive speculation, Mutuum Finance (MUTM) will deliver dynamic earning opportunities through its peer-to-contract (P2C) lending pools. These pools will let users deposit blue-chip tokens and stablecoins, such as ETH or USDT, into audited smart contracts. Borrowers, in turn, will supply overcollateralized backing to draw liquidity. As borrowing demand increases, the pool utilization rises, triggering an automatic increase in interest rates for depositors. This system keeps capital moving efficiently while rewarding those who contribute early. One of the most underappreciated benefits of this system is the introduction of mtTokens. These ERC-20 compliant tokens will represent each user’s share of the pool—mtETH, mtUSDT, or even mtLTC—and they will accumulate interest over time. Users will be able to trade them, use them as collateral, or stake them in designated contracts to receive dividend rewards funded through protocol buybacks. That’s the crucial difference: instead of relying on token hype to deliver returns, Mutuum Finance (MUTM) will build revenue into its model—buying back tokens using actual lending fees and distributing those directly to loyal stakers. Mutuum’s full DeFi stack gives LTC profits a new home With Layer-2 infrastructure being implemented from the ground up, Mutuum Finance (MUTM) will offer users a faster and lower-cost environment for transacting, borrowing, and staking. This ensures that the platform will remain functional even during periods of network congestion—a common obstacle in traditional Ethereum-based lending protocols. Every component, from the smart contract system to token issuance, is designed to scale without sacrificing speed or affordability. For LTC holders looking to put their recent gains to work in the future, the platform’s upcoming features open new doors. Profits from Litecoin (LTC) trades will be offered to be deposited into the Mutuum protocol and gain mtLTC in return—an interest-bearing token that grows in value while remaining fully usable across other lending and staking strategies. These mechanics not only preserve capital, but allow it to grow passively without having to liquidate positions or chase new trades. Adding to the protocol’s long-term potential is its unique decentralized stablecoin system. Rather than relying on centralized reserves or volatile market pegs, Mutuum Finance (MUTM) will allow users to mint a dollar-pegged asset by locking in collateral like ETH. The stablecoin will be automatically burned when loans are repaid or liquidated, keeping its supply tightly managed. A protocol-governed interest rate will keep the peg close to $1, and arbitrage behavior is expected to help correct any deviation—adding another layer of resilience to the lending framework. Security is also baked in from the start. Mutuum Finance (MUTM) has already passed through a comprehensive CertiK audit, receiving a TokenScan score of 95 and a Skynet score of 77. A public bug bounty is also in place, ensuring that the code base will remain fortified before the platform launches. These protections are essential as users prepare to allocate significant capital toward staking and liquidity operations. Beta launch and price lock-in offer rare entry window One of the most strategic elements of the Mutuum Finance (MUTM) roadmap is its Phase 3 beta launch, which is expected to go live at the time of token listing. This will give early supporters direct access to the core lending features for testing, mtToken staking, and stablecoin minting—at a moment when most new users are still discovering the project. Such an approach flips the typical launch model. Instead of releasing a token and scrambling to deliver utility afterward, Mutuum Finance (MUTM) is preparing the functionality first, ensuring that demand meets function on day one. This forward-focused design is supported by a carefully managed presale structure. With a hard cap on total token supply set at 4 billion, and a current price of just $0.03, entry during Phase 5 represents a unique advantage. Early contributors will also benefit from the ongoing $100,000 giveaway , where ten winners will be selected to receive $10,000 worth of MUTM tokens each—further rewarding those who engage before the public rollout. For more information about Mutuum Finance (MUTM) visit the links below: Website: https://mutuum.com/ Linktree: https://linktr.ee/mutuumfinance The post LTC recovers from lows in June, a DeFi newcomer promises 20x gains appeared first on Invezz

Source: Invezz