Final chance to buy this lending token at a discount before phase 6 price jump

3 min read

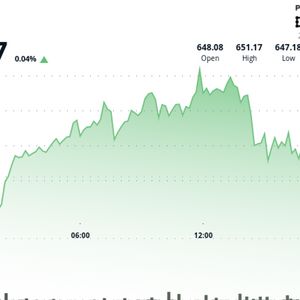

With Phase 6 around the corner, the window to grab Mutuum Finance (MUTM) at just $0.03 is closing fast. Over 50% of Phase 5 is already sold, and once it hits 100%, the price automatically rises to $0.035, then progressively to $0.06 by Phase 11. Early investors who entered at $0.01 in Phase 1 are already enjoying 200% gains, and even those who came in at $0.015 have nearly doubled their investment. A simple $2,000 investment in Phase 1 is now worth $6,000. Investors who previously backed meme coins like SHIB, PEPE, and FLOKI are now pivoting into Mutuum—not for hype, but for its beta-ready DeFi lending utility and massive upside potential. If MUTM hits $1.50 post-launch (as projected by top DeFi analysts), a $3,000 buy at today’s $0.03 price could grow to $150,000. Smart yield dynamics backed by real utility What separates Mutuum Finance (MUTM) from short-term DeFi experiments is the actual financial logic coded into its lending infrastructure. In the P2C model, users will deposit blue-chip assets like ETH, USDC, and SOL into liquidity pools, earning mtTokens (e.g., mtETH) in return. These mtTokens will track the underlying deposit plus interest, functioning like a dynamic, interest-bearing receipt. But these aren’t just passive placeholders—they’ll be tradable, stakeable, and usable as collateral for new loans. As more borrowers tap into these pools, interest rates will automatically increase, pushing yield higher for depositors. Meanwhile, the P2P model opens high-yield opportunities in riskier tokens like Dogecoin (DOGE), Pepe (PEPE), and Shiba Inu (SHIB). There won’t be any shared pools in this setup; instead, users will deal directly with one another, setting their own loan terms. This ensures that high-return, high-risk lending remains isolated and optional. The combination of two distinct lending layers makes Mutuum highly adaptive to varying market appetites—an approach that will become increasingly valuable as crypto credit markets mature. This dual-model structure will also support a new kind of stablecoin built on collateralized borrowing. Each time a user locks up ETH to borrow, new units of a decentralized stablecoin will be minted, always targeting a $1 value. The mint-and-burn system, combined with interest rate adjustments and arbitrage incentives, will keep the peg in check—while giving users a predictable borrowing tool within the platform’s native ecosystem. Passive income, layer-2 speeds, and a utility-rich token MUTM isn’t just a conventional token—it’s the backbone of a system designed for sustained participation and real reward. When users stake their mtTokens in designated contracts, they will become eligible to receive dividend payouts in MUTM from the protocol’s revenue. This will happen through regular buybacks of MUTM from open markets, redistributing purchased tokens to committed mtToken stakers. With 4 billion tokens as total supply, and nearly half of Phase 5 already sold, this current $0.03 pricing represents the last chance to secure the deepest discount. Once the token hits toward public exchange levels, investors who entered now will already be positioned for a 2x return even before the full platform goes live. This isn’t a wait-and-see presale as development is already in motion. Phase 1 of the roadmap has majorly wrapped with a CertiK audit (Skynet Score: 77, Token Score: 95), AI helpdesk deployment, and presale foundation. Now, Phase 2 is actively building core systems: front-end dApp, smart contracts, back-end APIs, analytics dashboards, and risk controls. When Phase 3 begins, the team plans to roll out a testnet beta and finalize compliance protocols ahead of mainnet. Mutuum Finance (MUTM) is also incorporating Layer-2 scaling, making it vastly more efficient than legacy Ethereum-only protocols. Fast transaction speeds and low fees will give users an experience that rivals centralized lending apps—without ever giving up custody or compromising transparency. And while the fundamentals are strong, Mutuum hasn’t forgotten the community. A $100K giveaway is still ongoing, set to reward ten early backers with $10,000 worth of MUTM each. Now is the moment that matters All indicators are pointing to a price shift, and investors are watching closely. Once Phase 6 goes live, the entry point jumps by over 16% to $0.035—and from there, all eyes will be on the $0.06 target. This is your final moment to buy the most discounted allocation of MUTM before everything advances. The fundamentals are already in motion. The tokenomics are built to reward early participation. And the roadmap is unfolding with utility-first milestones. For more information about Mutuum Finance (MUTM) visit the links below: Website: https://mutuum.com/ Linktree: https://linktr.ee/mutuumfinance The post Final chance to buy this lending token at a discount before phase 6 price jump appeared first on Invezz

Source: Invezz