Pi Coin stalls after 100-day update as MUTM keeps building momentum

4 min read

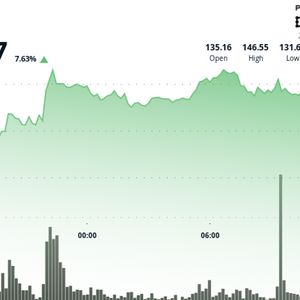

Recently, the Pi Core Team released an update on its achievements in the first 100 days after the network launch in February 2025. They announced key milestones, including Pi Domains, Pi Ventures, and the FurityPi game. Additionally, they released updates on the user base. The team revealed network growth, with over 3 million new Pioneers joining the mainnet. According to the update, there are now over 13 million users, and they have activated over 400k nodes. The Ecosystem interface has also undergone upgrades, and the launch of the Pi Ad Network for Pi App developers. Additionally, they released several apps. However, there are still concerns from the community. For instance, PI has not secured a listing on a major exchange. There are also no mainnet dApps yet. Another point of contention is the PI coin price, which has been moving sideways. Amid the price of PI coins stalling, investors are looking for growth elsewhere, and one of the options they are turning to is Mutuum Finance (MUTM) . The project is turning heads in the ecosystem as investors make positive forecasts about its future. According to the latest analysis, MUTM tokens could soar 3,300% once they go live. These positive forecasts are driven by the massive utility of the Mutuum Finance ecosystem. In a market increasingly focused on utility over hype, the MUTM tokens could be your biggest winner of 2025. A deep dive into Mutuum Finance (MUTM) The Mutuum Finance (MUTM) protocol is a decentralized, non-custodial protocol that allows users to participate as lenders or borrowers. As lenders, they can deposit their assets into a pool on the protocol to earn interest. The interest rate that they earn on their assets is based on the pool utilization rate. When the utilization rate increases, it pushes up the interest rate, which causes borrowers to start repaying their loans. At the same time, it incentivizes lenders to deposit more liquidity in the pools to benefit from the rising yields. These actions collectively push up the total liquidity in the pools, which also leads to optimal capital efficiency. To protect liquidity in the pools, the Mutuum Finance protocol requires that all loans be overcollateralized. That means the value of collateral in a loan position must be worth more than the value of the loan it covers. This overcollateralization is required due to the apparent volatility in the crypto market. When a loan falls below the required level of collateralization, it becomes eligible for liquidation. In that situation, liquidators step in and purchase the debt at a discount. The discount is used as an incentive to make them act fast to stabilize the ecosystem. As such, based on the level of instability a position poses to the ecosystem, the discount can be turned up to get liquidators to act with haste. Besides the overcollateralization, Mutuum Finance will use other tools to stabilize the ecosystem. One of these is the use of liquidity rewards, which will see the team offer MUTM token rewards to liquidators to boost liquidity on the protocol. The liquidity rewards program will be reserved for high-quality assets that are in high demand from the crypto market. These will be stable assets like ETH and USDT. In contrast, high volatility assets will be excluded from the program due to the significant challenge of instability that they pose. Mutuum Finance (MUTM) plans on vetting tokens to protect the long-term liquidity. That vetting process will entail checking the volatility and liquidity of a token, its centralization, and the complexity of the code. As part of that vetting process, assets may be restricted to limited functionality, or they may not be allowed on the protocol at all. Additionally, the team may impose caps on certain assets to limit the possible impact on the long-term health of the ecosystem. In general, every decision taken by the Mutuum Finance team will aim to find a perfect balance between the long-term health of the ecosystem and ensuring mass ecosystem participation. The MUTM token presale The Mutuum Finance (MUTM) presale has been a roaring success so far. It has raised over $11 million from around 12,400 unique buyers, with this figure growing daily. In the current phase of the presale, tokens are going for $0.03, a 200% increase from the phase 1 price of 40.01. 47% of the tokens set aside for phase 5 have already been sold as investors rush to take advantage of the massive 50% discount on the MUTM tokens based on the $0.06 listing price. A major driver for this presale has been the planned beta version release on the token listing day. The massive 50% discount, coupled with the planned beta version launch, makes the MUTM token presale one of the most exciting growth opportunities of 2025. Do not be left out of this massive opportunity for growth. For more information about Mutuum Finance (MUTM), visit the links below: Website: https://www.mutuum.com/ Linktree: https://linktr.ee/mutuumfinance The post Pi Coin stalls after 100-day update as MUTM keeps building momentum appeared first on Invezz

Source: Invezz