Bitcoin Records 2nd Consecutive Week of Cash Inflows: Is a Breakout Rally Coming?

2 min read

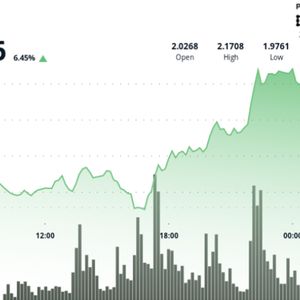

The post Bitcoin Records 2nd Consecutive Week of Cash Inflows: Is a Breakout Rally Coming? appeared first on Coinpedia Fintech News Bitcoin (BTC) demand by institutional investors has remained high amid rising fears of short-term crypto market capitulation. According to market data from CoinShares, Bitcoin’s investment product recorded the second consecutive week of cash inflow last week of about $1.1B. As a result, the BTC’s investment products have posted a net monthly flow of about $2.38 billion and a year-to-date cash inflow of around $12.7 billion. The United States led in net cash inflows of about $1.25 billion, while Hong Kong and Switzerland posted a net cash outflow of about $32.6M and $7.7M respectively. Is Bitcoin Price Ready for a Bullish Breakout? Bitcoin price has rebounded over 3 percent to trade about $104,100 on Monday, June 24, during the mid-North American trading session. The flagship coin, however, faces a significant resistance range between $110k and $112k. In the weekly timeframe, BTC price has been forming a potential macro double top coupled with a bearish divergence of the Relative Strength Index (RSI) . With the market data from Coinglass showing more than $12 billion in cumulative short liquidation leverage, BTC price faces further bearish sentiment in the coming weeks. As Coinpedia reported , crypto analyst Benjamin Cowen thinks that the wider crypto market, led by BTC, will record lower lows in the coming months and potentially establish a local low in August or in September, 2025. From a technical analysis standpoint, if BTC price consistently closes below $100k in the coming week, a selloff towards the support level around $96k will be inevitable.

Source: coinpedia