Analysts Notice Ethereum and Solana Whales Secretly Loading Up MAGACOIN FINANCE and Optimism

3 min read

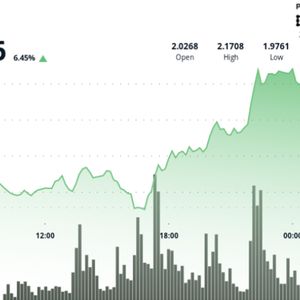

In a rapidly evolving crypto market, analysts are tracking a new trend: major Ethereum and Solana whales are discreetly accumulating MAGACOIN FINANCE and Optimism, signaling a shift in institutional and high-net-worth investor strategies as 2025 unfolds. Ethereum (ETH): Strategic Accumulation and Bullish Outlook Ethereum remains a cornerstone of institutional portfolios, with whales recently adding over 818,000 ETH in a single day—an investment exceeding $2.5 billion. Despite a volatile macro environment and a Q1 drop of 45%, ETH’s fundamentals remain robust, buoyed by network upgrades like Pectra and strong ETF inflows. Technical analysts point to a potential breakout, with projections for ETH to reach $6,000–$8,000 in 2025 if current momentum persists. Exchange reserves are at historic lows, reinforcing the accumulation narrative and suggesting whales are positioning for a major rally. Solana (SOL): Institutional Demand and Network Strength Solana is experiencing a surge in core metrics, including a 156% year-to-date rise in stablecoin supply and a 25% jump in DeFi total value locked (TVL). The network now leads all blockchains in decentralized exchange (DEX) volume, capturing nearly 28% market share, and daily transactions have soared to 58 million. Institutional capital is quietly flowing into SOL, with technical analysts watching a bull flag pattern that could drive prices toward $220 and possibly as high as $400 in 2025, according to bullish forecasts. Security upgrades and growing restaking protocols are further solidifying Solana’s position as a top Layer 1 contender. Why Whales Are Positioning Into MAGACOIN FINANCE MAGACOIN FINANCE is drawing capital for entirely different reasons — early positioning, locked tokenomics, and strategic staking behavior. Recent on-chain activity confirms that whale wallets — including some previously active in Ethereum and Solana — have been accumulating MAGACOIN FINANCE without triggering large price movements. What’s driving this quiet rotation? Fixed Supply Framework: With a hard cap of 170 billion tokens and zero minting capability, MAGACOIN FINANCE provides rare inflation protection for early buyers. Audit and Ownership: A clean HashEx audit and full community ownership — no VC override — makes this token a favorite among institutional-style analysts. Momentum With Retail: Telegram and social growth are surging, offering added confidence for whales who want liquidity without overexposure. Optimism (OP): Bullish Signals and Whale Repositioning Optimism is also attracting whale attention. While large holder netflows have declined by 62% in the past week—suggesting some profit-taking after a sustained accumulation phase—spot and derivatives demand remains strong. Network activity is up, with daily active addresses and new users both rising over 6% last week. Analysts expect OP to trade between $0.55 and $2.04 in 2025, with its Layer-3 innovations and Superchain expansion fueling long-term growth.. Whale repositioning could set the stage for renewed volatility and potential price surges as the market cycle matures. Conclusion The secretive accumulation of MAGACOIN FINANCE and Optimism by Ethereum and Solana whales underscores a broader shift toward high-upside, early-stage assets as the next bull market approaches. While ETH and SOL remain foundational, the strategic moves into MAGACOIN FINANCE and OP highlight the growing appetite for asymmetric opportunities and the evolving playbook of crypto’s largest investors. To learn more about MAGACOIN FINANCE, visit: Website: https://magacoinfinance.com Exclusive Access Portal: https://magacoinfinance.com/entry Continue Reading: Analysts Notice Ethereum and Solana Whales Secretly Loading Up MAGACOIN FINANCE and Optimism

Source: BitcoinSistemi