Kraken’s Ink network sees surge in activity with transaction volume and number of smart contracts increasing

3 min read

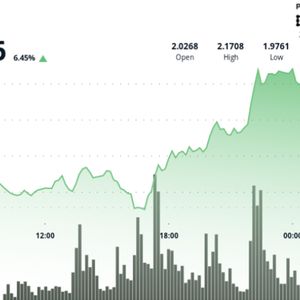

Kraken’s Layer-2 network, Ink, has seen an increase in on-chain activity, with transaction volume surpassing 550,000 for the first time since it launched. The activity surge follows Ink Foundation’s announcement that the network would soon have a native token. According to Dune Analytics data , the network’s daily volume has increased significantly over the past week and first hit 557,557 on June 18, a day after the INK token was announced. Since then, it has averaged more than 550,000 daily transactions, peaking at 563,677 on June 20. With the constant high volume of activity, the network now has a 30-day moving average (MA) for transactions at over 490,000. Kraken Ink L2 transaction count (Source: Dune Analytics) This represents a positive development for Ink, which launched in December 2024. Built with an Optimism stack, the network has struggled to gain much traction since its launch, with other Ethereum L2s dominating the activity, including Coinbase’s Base and Arbitrum. Meanwhile, other metrics are also trending upward on the network, increasing the number of active contracts. Dune data shows daily active contracts peaked on June 20, with 5,693 returning and 1,249 new contracts. However, other metrics measuring network activity have declined, with daily active addresses now around 70,000, a far cry from the peak of over 100,000 addresses daily. The network total value locked (TVL) also continues to struggle. While bridged TVL is around $94 million, TVL in Ink DeFi protocols has fallen below $8 million. An upcoming airdrop could be the catalyst that Ink needs Meanwhile, the surge in the L2 activity is being fueled by the expected airdrop that will accompany the INK token launch. Although there is no set date for the token launch yet, the announcement is enough to drive more users to the network. However, the first use case for the INK token is still in the works. In its announcement, Ink Foundation said the token will be introduced through a native liquidity protocol powered by Aave. Early users of the liquidity protocol are expected to get an airdrop of INK. While the foundation did not provide full details on its plans, it stated that the protocol is a crucial building block in developing the DeFi ecosystem on Ink. Given the minimal activity and few DeFi protocols, this is a lofty ambition. Meanwhile, a token launch for the Ink network comes as a surprise given that Base, the L2 network from Coinbase that uses the same Optimism infrastructure, does not have a token and has said there are no plans to launch any token. However, a token could help Ink differentiate itself from Base, even though the foundation has said INK will not serve governance functions. Ethereum sees new ATH in weekly addresses Interestingly, Ethereum has reached a new all-time high in active addresses, with more than 20 million addresses interacting with the ecosystem last week. Layer-2 networks dominate interaction with 17.699 million of the addresses (87.55%) being single Layer-2 networks. According to growthepie on X, multiple L2s account for 2.05% of addresses, while cross-layer had 1.2%. The Ethereum mainnet only had 1.858 million addresses during the week, accounting for just 9.19% of all addresses. Ethereum weekly engagement (Source: growthepie) The dominance of L2s in driving transaction volume is best seen in Base, which recently reached a new all-time high of 3.59 million addresses per day. The network has over 8.74 million transactions today, surpassing the ETH mainnet with only 1.23 million. Meanwhile, ETH has seen a 3.66% increase in the last 24 hours as it begins recovery after crashing below $2,200 for the first time since May. The drop was due to concerns about the US getting involved in a war with Iran, which led to Bitcoin dropping below $100,000 for the first time in months. However, ETH is now trading around $2,250, with the rest of the crypto market also seeing an upward correction in price as the market expects the conflict not to last for long. Still, the Fear & Greed Index has now dropped to 37 according to CoinMarketCap, suggesting that Fear is the prevailing sentiment. Cryptopolitan Academy: Want to grow your money in 2025? Learn how to do it with DeFi in our upcoming webclass. Save Your Spot

Source: Cryptopolitan