XRP slips, ADA stalls, but MUTM heats up with 2100% potential

4 min read

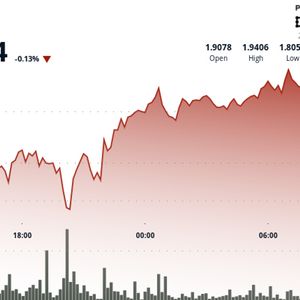

Crypto markets slipped recently, with altcoins showing a temporary decline. One of the biggest losers in the recent slide was XRP, which is down over 7% in the past month. Meanwhile, Cardano (ADA) is down over 8% in the past week. The main trigger for this decline in the crypto market is rising military tensions in the Middle East. Trump’s recent threat to escalate tensions with Iran into military conflict has also been a major contributing factor. However, Bitcoin has shown its resilience, remaining above $104,000 since the conflict began. Amid this depressed performance of XRP and ADA, investors are looking for new opportunities for growth. One of the most exciting prospects in Mutuum Finance (MUTM) , which could be one of the biggest gainers of 2025. On-chain data shows that whales are quietly shifting capital into Mutuum Finance (MUTM) in anticipation of the coming surge once things cool down in the Middle East. So far, investors in the project’s presale have raised over $10.95 million in the ongoing presale. A major factor for the optimism in the market is the recent passing of the GENIUS Act in the US Senate. The bill will provide regulatory clarity in the crypto sector and is expected to spur massive growth in the coming years. It could also increase enterprise adoption, leading to a flood of institutional capital into the crypto sector. To position yourself for the expected flood of capital, Mutuum Finance (MUTM) is the perfect option. A deep dive into Mutuum Finance (MUTM) Mutuum Finance (MUTM) is a project in the decentralized finance (DeFi) sector that is built for utility and scalability. The project is a decentralized non-custodial protocol that allows users to participate as lenders or borrowers. As lenders, they can deposit their assets in the protocol’s pools to earn interest. The interest payments they receive are based on the pool utilization rate. To determine the pool utilization rate, the pool measures the amount of assets being actively borrowed from a pool compared to the total amount of assets in that pool. As the utilization rate rises, and thus the interest rate, it pushes borrowers to repay their loans to avoid the higher rates. At the same time, it encourages lenders to deposit more liquidity in the pools to benefit from the rising yields. The result is that liquidity in the pools increases, which lowers the interest rates, creating a self-sustaining loop that ensures optimal capital utilization. To protect liquidity in the pools, all loans must be overcollateralized. That means that a borrower deposits collateral that is worth more than the value of the assets they acquire. If a loan falls below a set level of collateralization, liquidators step in and acquire the debt at a discount. This discount can be adjusted upwards to ensure speed liquidations. An internal stablecoin Mutuum Finance (MUTM) plans to launch a stablecoin that will be based on the blockchain and pegged to the value of the USD. To mint stablecoins, users of the protocol will need to deposit collateral that is over-collateralized. The main difference between Mutuum Finance’s stablecoin and other decentralized stablecoins is that it will allow multi-asset collateralization. That means a user will be able to back a single position with a basket of assets. They will also be allowed to top up their collateral to ensure the position remains collateralized. Best of all, they will earn interest from assets used as collateral for the stablecoin. This interest will go towards the interest payments for their stablecoin position, lowering their rates. The MUTM token presale Mutuum Finance (MUTM) is currently in phase 5 of its presale, where tokens are going for $0.03 per token. So far, investors in the presale have raised over $10.95 million, with the figures rising daily as new investors rush to secure their tokens. The current token price in phase is a 200% increase from the phase 1 price of $0.01. In the upcoming phase 6 of the presale, the token price will go up by 16.67% to $0.035. That will reduce the guaranteed ROI from the current 100% to 71.43%. Many investors understand this metric, which has led to a surge of interest in the presale. So far, 45% of the tokens set aside for phase 5 have been sold, barely two weeks after they launched. Summary Mutuum Finance (MUTM) is a CertiK-audited presale project that is built on utility. That means it will continue to deliver value for its community long after it launches. Unlike meme coins, which run purely on hype, Mutuum Finance (MUTM) will never run out of steam. At the current price of $0.03 per token, you are getting your tokens at a 50% discount to the planned listing price of $0.06. This could be a life-changing opportunity, with analysts forecasting that the price of MUTM tokens could rise 2,100% after the tokens go live. For more information about Mutuum Finance (MUTM), visit the links below: Website: https://www.mutuum.com/ Linktree: https://linktr.ee/mutuumfinance The post XRP slips, ADA stalls, but MUTM heats up with 2100% potential appeared first on Invezz

Source: Invezz