Bullish Crypto Bets Liquidated for $595M as U.S. Bombs Iran Nuclear Sites

1 min read

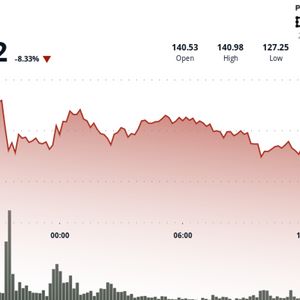

Crypto bulls were blindsided Friday after the U.S. military launched airstrikes on Iran’s key nuclear sites, triggering a sharp selloff and $595 million in long-position liquidations. The move, announced by former President Donald Trump, saw bombers hit Fordow, Natanz, and Isfahan — three of Iran’s main uranium enrichment facilities. The geopolitical jolt rattled global markets and sent crypto into a tailspin on Sunday. In the past 24 hours, 172,853 traders were liquidated, with total losses hitting $681.8 million, meaning 87% of it was from longs. Ether (ETH) traders took the biggest hit with $282 million in liquidations, followed by bitcoin (BTC) tracked trades at $151 million.Futures tracking other majors, such as SOL, XRP, and DOGE also faced heavy losses, with at least over $22 million in losses.Liquidation refers to when an exchange forcefully closes a trader’s leveraged position due to a partial or total loss of the trader’s initial margin. It happens when a trader is unable to meet the margin requirements for a leveraged position (fails to have sufficient funds to keep the trade open).A cascade of liquidations often indicates market extremes, where a price reversal could be imminent as market sentiment overshoots in one direction. Prices briefly plunged before stabilizing. Bitcoin held near $102,000, while Ethereum traded just above $2,280, both down intraday but avoiding freefall. Bybit and Binance accounted for two-thirds of all liquidations. And with the U.S. threatening “far greater” strikes, traders are likely bracing for more volatility.

Source: CoinDesk