Crackdown on Solana Ecosystem: PumpFun and Major KOLs Blocked Amid Regulatory Scrutiny

5 min read

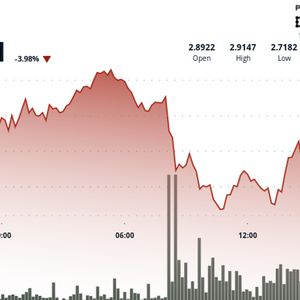

A shocking twist of fate has turned the spotlight on several major figures in the Solana development community. This week, a number of them, as well as some entire projects, found themselves on the receiving end of the social media suspension tool. The most pronounced effect so far has been on PumpFun , a popular memecoin platform that had already started adjusting its business model in anticipation of needing to comply with a clearer, emerging regulatory framework. A legal complaint about a user who lost only $231 on the memecoin $Peanut started this whole thing. But now? It’s turned into something that could seriously shake up the crypto industry. Why? Because it’s uncovering some very shady practices. And authorities are starting to look at those practices quite a bit more closely. PumpFun, along with Solana KOLs, devs, founders, and bots, were suddenly BLOCKED on all socials! > What Happened & What Does This Mean for Memecoins? and most importantly: >> HOW WE CAN PROFIT FROM THIS? lets break this down Turns out there was an old lawsuit from… pic.twitter.com/nK6OdEGCgG — RDeni (@rostikdeni) June 17, 2025 The Ripple Effect of a $231 Loss The dispute stems from an early memecoin, $Peanut, in which a disgruntled investor lost money and decided to sue. Even when this case started making headlines, most everyone who isn’t an investigator thought it might be too inconsequential to matter. We were proven wrong on that front when the case in question turned up a whole lot of dirt not just on $Peanut and its creators but also—for reasons that are unclear, to us at least—on a bunch of Solana projects that were supposedly doing fine and are now under a very bright spotlight. Concerns over not just price manipulation but also the behavior of these projects has regulators looking their way. That’s because they’re not just apps that let people trade crypto. They’re also promoting what you might call gambling-ish behavior—and doing so with virtually no oversight. Some projects didn’t even seem to be trying to adhere to basic rules or that KYC stuff I mentioned earlier. They pretty clearly ignored altogether the part where you’re supposed to do some due diligence before letting people get involved in something that’s going to be as volatile as a crypto market. And when it comes to the tokens involved, pretty much anything went. Another facet of the problem is the financial opacity that surrounds these memecoins. Even though they allow for trading that reaches into the millions of dollars, many of the people and organizations involved seem to have little to no actual tax obligations. If enforcement actions are taken, some are predicting that the fines might total $500 million or more. Sweeping Suspensions Rock the Solana Community In the face of intensifying regulatory pressure, platforms have started to act with increased speed—and sometimes in a precautionary manner. X (formerly known as Twitter) has taken the extraordinary step of either banning or suspending a variety of differing accounts associated with cryptocurrency. In many instances, these accounts are linked to the recent surge in the value of cryptocurrencies like those associated with the Solana memecoin boom. Accounts that have gone dark include notable ones from the GMGN team: @gmgnai, @haze0x, @arthur_gmgn, @ivyflame, and @gmgnaiJapanese. The Bloom team has also seen its social presence vanish, including handles like @BloomTrading, @imBFFF00, @nftraian, and @CookerFlips. Independent accounts from the likes of @shawmakesmagic, @ElizaOS, and @bullx_io have also been caught up in the wave. Numerous connections exist between these accounts and sniper bots, Telegram-based memecoin launch infrastructure, and Twitter API tools that allow for real-time tracking of both wallets and sentiment. Increasingly, these associations have led to speculation that using Twitter’s API for anything other than what one would consider to be normal operational use—monitoring behavior of Twitter users, for example—may have gotten these accounts flagged and then banned. Memecoins Face a Regulatory Crossroads The fallout from all this is immediate and directly affects the memecoin market. But what we really don’t know is what this means for the memecoin sector as a whole. If regulators come down on memecoins and say they are securities, then what happens to the memecoins we trade on centralized exchanges? Do they get delisted? Do we lose access to them altogether? The memecoin market is already on shakier footing than other crypto subsectors. A mass delisting of key memecoins from exchanges could trigger not just a market crash for these tokens but something more serious that drags down the whole crypto market. Certain traders are taking countermeasures against this prospective situation. They’ve started to open up short positions in many tokens that are based on Solana. Their logic is this: The market has not yet fully accounted for the possibility of forced liquidation or of some teams being compelled to shut down their platforms. And what about all the tokens that are in limbo because they’re under compliance review? The traders I spoke with think those tokens—I won’t name any specific ones here—are also being inadequately discounted. Pumpfun( @pumpdotfun ), recently suspended by X, has sold a total of ~4.1M $SOL ($741M) at an average price of ~$180 since May 19, 2024. 264,373 $SOL was sold for 41.64M $USDC at $158. 3.84M $SOL ($699M) was deposited to #Kraken at $182. pic.twitter.com/LB80CZgnUB — Lookonchain (@lookonchain) June 17, 2025 Meanwhile, behind the scenes, PumpFun—the epicenter of much of the controversy—has been moving large volumes of capital. Since May 19, 2024, the platform has sold roughly 4.1 million SOL, equating to $741 million, at an average price of $180. A portion of that—264,373 SOL—was converted into 41.64 million USDC at a much lower price of $158. More significantly, 3.84 million SOL, worth approximately $699 million, was deposited directly to Kraken, suggesting an attempt to secure liquidity or hedge against possible enforcement action. PumpFun is trying to raise a reported $1 billion in funding. Meanwhile, the regulatory dragnet and platform bans may be halting that momentum altogether. What began as an underground meme experiment on Solana is now a regulatory flashpoint—and potentially a turning point for the future of memecoins. Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services. Follow us on Twitter @nulltxnews to stay updated with the latest Crypto, NFT, AI, Cybersecurity, Distributed Computing, and Metaverse news !

Source: NullTx