Is $10.83 a Real Target? SUI Price Prediction 2026 Reviewed as Qubetics Real World Tokenization Gains Steam

4 min read

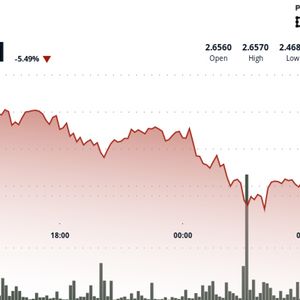

The 2026 outlook for Layer-1 ecosystems is intensifying, as platforms position themselves to either lead the next wave of utility-focused blockchain adoption or fade beneath the weight of rising disruptors. Among the prominent contenders, Sui is rapidly regaining momentum after a sharp 64% correction. On the other hand, Qubetics, a new infrastructure project focused on tokenizing real-world assets, is gaining attention for solving on-chain utility at the enterprise level. This comparison examines SUI price prediction 2026 prospects and explores how Qubetics may redefine how assets function on-chain. Sui Price History: From Correction to Comeback Sui launched in 2023 with impressive expectations, debuting around $1.40. Its early trajectory was defined by rapid scaling and a flurry of DeFi integrations. Following the release of protocol upgrades and the Sui Bridge, SUI rallied to an all-time high of $5.35 in January 2025. However, macro pressures and profit-taking led to a retracement to $1.93 by April 2025, shaking confidence across its community. Despite this downturn, Sui quickly bounced back, climbing more than 40% to reach $3.60 by late April. This recovery wasn’t arbitrary. Backed by a strong developer base, over $1.8 billion in total value locked (TVL), and institutional interest in its composable gaming tools, Sui has reestablished itself as a viable Ethereum alternative. Now, with a $12.6 billion market cap and bullish sentiment, analysts see a $6.95 average and a $10.83 high-end SUI price prediction 2026 as plausible targets. SuiPlay 0X1 and the Consumer Web3 Strategy What differentiates Sui from other chains is its attempt to own both infrastructure and consumer touchpoints. The launch of SuiPlay 0X1, a handheld gaming console designed for Web3-native gameplay, marks a pivotal move. Touted as the “Steam Deck of crypto,” the device allows seamless wallet integration and onboarded gaming, eliminating the friction that plagues many GameFi platforms. This launch aims to capture a broader audience across Asia, Europe, and North America by combining high-speed Layer-1 technology with accessible user experiences. The integration of SuiPlay 0X1 into the ecosystem could significantly drive TVL, user count, and developer migration away from congested alternatives like Solana. If adoption metrics rise accordingly, the $10.83 SUI price prediction 2026 becomes increasingly realistic under favorable macroeconomic policies. Key Catalysts Behind the SUI Price Prediction 2026 Target A number of metrics support the bullish projection: Suilend and NAVI Protocol continue expanding Sui’s DeFi ecosystem, underpinning the $1.8 billion in TVL. The $SUI token maintains utility across gas fees, governance, and staking, attracting risk-averse stakers. Regulatory sentiment in 2025 and 2026 is leaning more crypto-friendly in major jurisdictions, increasing institutional appetite. Assuming continued demand in GameFi and DeFi, and absent any large-scale macroeconomic shocks, analysts suggest $6.25 to $6.95 is the conservative range, while $10.83 remains within reach in a high-liquidity environment. Qubetics and the Rise of Real World Asset Tokenization While Sui builds consumer interfaces, Qubetics is streamlining backend infrastructure that traditional chains have overlooked. At the core of Qubetics lies its Real World Asset Tokenization Marketplace, a system enabling tokenized ownership of physical and financial assets. From real estate to vehicles and corporate equity, these assets can be legally structured and digitized for compliant trading and global exposure. For example, an SME in Texas can tokenize a commercial fleet, issue stake-based tokens to accredited participants, and manage the entire transaction lifecycle on Qubetics. The platform’s focus on regulatory compliance, traceability, and DeFi compatibility positions it as an alternative to fragmented, Layer-1 solutions that struggle with real-world integration. This use-case-driven architecture makes Qubetics more than just a utility token; it’s a functional protocol layered with enterprise relevance. With growing demand for tokenization solutions across financial and real estate sectors, its growth trajectory aligns closely with the evolving narratives around capital efficiency and asset liquidity. Qubetics Presale Metrics and ROI Potential Qubetics is currently in Stage 35 of its presale, priced at $0.2785. To date, it has raised over $17.2 million and sold more than 513 million $TICS tokens, with over 26,800 wallets holding the asset. Each stage lasts 7 days and ends with a 10% price increase every Sunday, adding urgency for early participants. Should $TICS reach $1 after its Q2 2025 mainnet launch, early backers would secure a 258.95% return. More aggressive projections place $TICS at $5 to $15, delivering ROIs from 1,694.74% to 5,284.21%, respectively. These numbers aren’t arbitrary—they align with Qubetics’ positioning as a best crypto presale for those seeking practical infrastructure plays, not just narrative momentum. Qubetics continues to dominate best crypto to watch now lists due to this real-world focus. Unlike Layer-1 hype cycles, its value proposition is tethered to measurable enterprise solutions and cross-industry demand. Final Outlook: Sui Gains Speed, Qubetics Builds Depth The 2026 market may bifurcate between chains offering consumer-facing products and those delivering infrastructure. Sui belongs to the former, optimizing its DeFi and GameFi stack to compete with established networks. Its path to $10.83 isn’t guaranteed, but the confluence of user growth, utility, and pro-crypto policies give it a fighting chance. Qubetics , meanwhile, is less about speculation and more about structural transformation. As asset tokenization becomes a cornerstone of on-chain finance, Qubetics is offering a framework that scales horizontally across industries. In that light, $TICS isn’t just a token—it’s a stake in a tokenization engine designed for long-term relevance. For those scanning the market for best crypto to watch now opportunities, both projects offer strong narratives. But while Sui might capture attention, Qubetics may ultimately capture adoption. For More Information: Qubetics: https://qubetics.com Presale: https://buy.qubetics.com/ Telegram: https://t.me/qubetics Twitter: https://x.com/qubetics The post Is $10.83 a Real Target? SUI Price Prediction 2026 Reviewed as Qubetics Real World Tokenization Gains Steam appeared first on TheCoinrise.com .

Source: The Coin Rise