US auto tariffs turned into a national crisis for Japan, prompting trade talks

3 min read

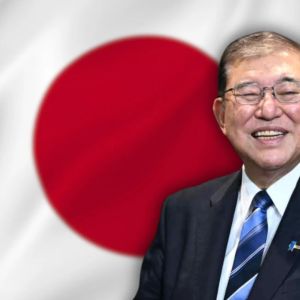

Japan’s top tariff negotiator Ryosei Akazawa plans to return to the United States on May 30 for a fourth round of trade talks. This trip follows the coming weekend’s third round in Washington, involving Commerce Secretary Howard Lutnick and U.S. Trade Representative Jamieson Greer. The talks aim to address deep divisions over U.S. auto and steel tariffs, but the outcome remains uncertain. Reuters sources familiar with the matter said on Friday. Akazawa aims to meet U.S. Treasury Secretary Scott Bessent during next week’s trip. Economic Revitalisation Minister Akazawa told reporters on Friday before departing for Washington that “our position remains unchanged” and that Japan “strongly demands the elimination of U.S. tariffs, but we must reach an agreement.” He added that any deal must be mutually “win-win” after careful study of U.S. proposals and perspectives. When asked if Bessent would attend this weekend, he dodged a direct answer, saying participation depends on each official’s schedule. TV Tokyo later reported Bessent had told him in an unofficial call that he could only meet next week. A source said that to protect its key auto industry, Japan is ready to boost cooperation in shipbuilding, ease certification for imported vehicles, and increase U.S. imports of corn and soybeans. Japan’s Prime Minister has called the U.S. auto tariff a “national crisis” Major automakers have quietly urged their U.S. branches to support Japanese suppliers. Letters seen by Reuters show Toyota, Nissan, and Ford asking for help without spelling out details. Nissan told its vendors to stick to agreed prices and said it was “not obliged” to pay the duties but would cover them for up to four weeks. Toyota said it would work “in good faith” and asked suppliers to share ideas for easing the impact. Ford said it was checking how exposed its suppliers are and may change processes or sourcing. At Kyowa Industrial in Takasaki, which makes prototype parts and race-car components for 120 staff, the mood is tense. “What in the world are we going to do?” said President Suzuki after the tariffs were announced. Although Kyowa does not send auto parts to the U.S., Suzuki fears carmakers will push suppliers to cut prices to cover extra costs. One Subaru supplier told Reuters they are looking for partners outside the U.S. to lower their risks. Analysts warn these tariffs threaten a whole chain of small makers. Julie Boote of Pelham Smithers Associates called it an “emergency” that could force suppliers to merge. Sayuri Shirai, a former Bank of Japan board member, said long‐term tariffs would hurt regions already facing population decline. David Boling, a former U.S. trade official, noted that car exports are too vital for Japan to bear a 25% levy for long. Under current rules, the 25% auto tariff stands, and a 24% duty on other goods is cut to 10% for 90 days, ending in July. A U.S. State Department official said the administration wants “fairness and balance” in trade and to protect economic security. Ashikaga Bank, which backs about 200 auto parts companies, fears higher U.S. prices will cut orders. Toa Kogyo, a suspension maker near Takasaki, warned that extra costs will touch dealers, makers, and buyers alike. Subaru, where about 70% of sales are in the U.S., said this week it will raise prices on some models. Its CFO, Shinsuke Toda, said the firm is ready to talk with suppliers about sharing the burden, but that the path ahead is still unclear. Your crypto news deserves attention – KEY Difference Wire puts you on 250+ top sites

Source: Cryptopolitan