eToro Finally Goes Public On Nasdaq

2 min read

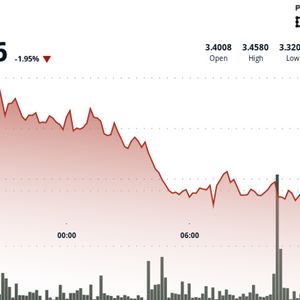

After four years of planning, eToro finally went public on the Nasdaq stock exchange on Wednesday. The trading platform, known for stocks and cryptocurrencies, took an essential step in its growth. eToro’s CEO, Yoni Assia, discussed the company’s history and role in the world of cryptocurrency during an interview on CNBC. eToro’s Early Bitcoin Bet Paid Off Yoni Assia said eToro was among the first companies to enter the crypto market. The company began buying Bitcoin (BTC) when it was priced at only $5, holding it as part of the company’s funds. The platform was also the first regulated company in Europe to offer crypto trading to its users. Assia shared that the company’s Bitcoin investment grew from $50,000 to $50 million. However, the board decided to sell the Bitcoin, feeling it was not part of their primary business. Assia said it has been impressive to watch cryptocurrency grow. He described crypto as a new kind of capital market growing worldwide. Outside the U.S., eToro offers more than 130 different cryptocurrencies for trading. At the same time, eToro remains focused on the stock markets. Assia explained that famous investor Warren Buffett advised him to pay more attention to stocks than crypto. However, Assia stayed committed to both. Last year, 25% of eToro’s revenue came from cryptocurrency, while 75% came from stocks. The company helps customers trade on more than 20 stock markets worldwide. eToro Settles SEC Charges but Posts Strong Profits in 2024 Last September, eToro agreed to pay $1.5 million to settle charges with the U.S. Securities and Exchange Commission (SEC). The SEC said eToro had operated as a broker and clearing agency without proper approval in its crypto business. The Israel-based firm did not admit to any wrongdoing but agreed to limit trading to a few cryptocurrencies, such as Bitcoin, Bitcoin Cash, and Ethereum (ETH), and to sell the rest of its crypto assets. Despite this, eToro reported strong financial results. In 2024, the company earned a net income of $192 million. About $12 million of this came from cryptocurrency trading. A quarter of all trading on the platform was in cryptocurrencies, showing a 10% increase from the previous year. eToro’s Stocks Climb Post IPO Debut eToro filed quietly for an initial public offering (IPO) in January, targeting a $5 billion valuation. The company initially set the IPO price range between $46 and $50 per share but raised it to $52 just before the launch . On the first day of trading, eToro’s stock price rose nearly 30% and closed around $67 per share. This strong start shows investors’ confidence in eToro’s approach, which combines cryptocurrency and traditional stock trading. It also points to a promising future as the company continues to grow. The post eToro Finally Goes Public On Nasdaq appeared first on TheCoinrise.com .

Source: The Coin Rise