Coinbase Head of Strategy Talks About Bitcoin and Gold’s Rise: Why They’re Soaring Together?

2 min read

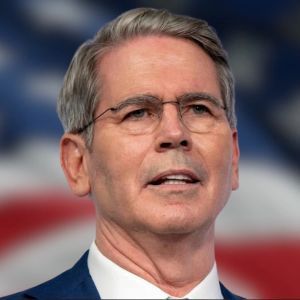

Bitcoin (BTC) and gold are seen as two key pillars of protection against inflation and economic uncertainty, according to John D’Agostino, Head of Institutional Strategy at Coinbase. Speaking on CNBC’s Squawk Box, D’Agostino outlined why large institutional investors and sovereign wealth funds are turning their attention to these assets amid global financial upheaval. As Bitcoin has climbed to nearly $94,000 after its recent lows around $76,000, D’Agostino noted that its rally has been largely driven by large, patient pools of capital. “We’re seeing sovereign wealth funds and long-term institutional investors accumulating Bitcoin,” Agostino said, pointing to the April 2 tariff announcements and the broader de-dollarization trend as key catalysts. According to D’Agostino, investors concerned about the weakening of the US dollar due to the decline in global trade in US dollars are increasingly holding Bitcoin in their home currency and only converting it into dollars when needed. Underlying this strategic shift is the belief that holding Bitcoin directly can provide better protection than traditional fiat currencies during a period of monetary transition. Related News: Expert Analysts Share the Reason for Bitcoin’s Surge and What to Expect Next He also noted that Bitcoin has shed its association with tech stocks in the post-COVID era and returned to its core value propositions of scarcity, immutability, and portability — characteristics that bring Bitcoin closer to gold, especially as a long-term inflation hedge. Gold ETF inflows rose by about $8.5 billion in April, while bitcoin ETFs saw net outflows of about $470 million. But D’Agostino emphasized that this divergence underscores a shift in buyer demographics: retail investors were exiting via ETFs, while institutions were buying Bitcoin directly. “Institutional investors seem to trust Bitcoin’s long-term store of value,” Agostino said, likening the asset to gold in terms of mining scarcity and increasing mining difficulty. “Portability is also a big factor, moving $400 million in Bitcoin is much easier than physical gold.” D’Agostino added that some investors who thought they missed out on gold’s rally are now looking to Bitcoin as the next viable hedge. *This is not investment advice. Continue Reading: Coinbase Head of Strategy Talks About Bitcoin and Gold’s Rise: Why They’re Soaring Together?

Source: BitcoinSistemi