Capital B’s Bold Bitcoin Acquisition: 126 BTC Added to Holdings

4 min read

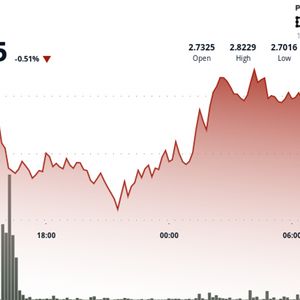

BitcoinWorld Capital B’s Bold Bitcoin Acquisition: 126 BTC Added to Holdings Exciting news from the crypto world! Capital B, a prominent publicly listed European company, recently announced a significant Capital B Bitcoin acquisition . This strategic move, shared on their official X account, involved purchasing an additional 126 BTC. This acquisition dramatically boosts their total Bitcoin holdings to an impressive 2,201 BTC, highlighting a growing trend of institutional Bitcoin adoption across the globe. What Does This Capital B Bitcoin Acquisition Reveal? Capital B’s latest move isn’t just another transaction; it’s a powerful statement of confidence. Acquiring 126 more BTC solidifies their position as a major player holding significant digital assets. This consistent BTC investment strategy underscores their belief in Bitcoin’s long-term value and its crucial role in a diversified corporate portfolio. This recent Capital B Bitcoin acquisition demonstrates several key aspects: Growing Exposure: Capital B now holds 2,201 BTC, establishing itself as a notable corporate holder. Strategic Alignment: The company aligns with a broader trend where traditional businesses integrate digital assets into their balance sheets. Market Confidence: Such significant acquisitions often signal strength and stability, reassuring the wider cryptocurrency market. Why Are European Companies Increasingly Investing in BTC? The increasing interest from a European company Bitcoin strategy like Capital B’s reflects several underlying factors. Companies are recognizing Bitcoin as a robust hedge against inflation, a reliable store of value, and a potential growth asset in uncertain economic times. Moreover, the evolving regulatory landscape within Europe is providing clearer guidelines, making it more appealing for businesses to engage with cryptocurrencies. Many corporations are actively exploring how institutional Bitcoin adoption can benefit their financial health. They seek to diversify assets away from traditional fiat currencies and bonds, which often face inflationary pressures. Bitcoin offers a decentralized alternative with a fixed, predictable supply, appealing greatly to forward-thinking treasuries. How Does This BTC Investment Shape the Market? Every major BTC investment by a publicly listed entity like Capital B sends positive ripples through the market. It validates Bitcoin’s legitimacy and encourages other institutional investors to consider similar moves. Consequently, this incremental demand contributes to Bitcoin’s inherent scarcity and potentially influences its price trajectory positively. As more companies secure substantial Bitcoin holdings , the asset gains further mainstream acceptance and credibility. The continuous flow of capital from established businesses into the crypto space suggests a maturing market. This shift moves Bitcoin beyond speculative trading and firmly into the realm of serious asset management. Ultimately, this change is crucial for the long-term health and stability of the entire cryptocurrency ecosystem. What’s Next for Institutional Bitcoin Adoption? Capital B’s consistent accumulation of Bitcoin positions them as a pioneer among European company Bitcoin strategies. Their proactive approach in building their Bitcoin holdings could inspire other corporations to follow suit. Therefore, this trend of institutional Bitcoin adoption is not just about a single company’s strategy; it reflects a fundamental shift in how global businesses view and integrate digital assets. As the digital economy evolves, the integration of cryptocurrencies into corporate treasuries is becoming less of an anomaly and more of a strategic imperative. The ongoing Capital B Bitcoin acquisition story is a compelling example of this paradigm shift, signaling a future where digital assets play a central role in corporate finance. In conclusion, Capital B’s latest Bitcoin acquisition of 126 BTC is more than just a purchase; it’s a testament to the growing confidence in digital assets among publicly listed entities. Their expanding Bitcoin holdings underscore a significant trend of institutional Bitcoin adoption , particularly among European company Bitcoin strategies. This ongoing BTC investment signals a maturing market where digital currencies are increasingly viewed as legitimate and valuable assets. It’s a compelling narrative that highlights Bitcoin’s evolving role in the global financial landscape. Frequently Asked Questions (FAQs) Q1: Who is Capital B? A1: Capital B is a publicly listed European company that has been actively investing in digital assets like Bitcoin. Q2: How much Bitcoin does Capital B now hold? A2: Following its latest acquisition of 126 BTC, Capital B’s total Bitcoin holdings have increased to 2,201 BTC. Q3: Why are companies like Capital B investing in Bitcoin? A3: Companies are investing in Bitcoin for various reasons, including its potential as a hedge against inflation, a store of value, and a growth asset, along with increasing clarity in regulatory environments. Q4: What is institutional Bitcoin adoption? A4: Institutional Bitcoin adoption refers to the increasing trend of large corporations, financial institutions, and public companies integrating Bitcoin into their balance sheets, investment portfolios, or operational strategies. Q5: How does this acquisition impact the crypto market? A5: Acquisitions by publicly listed entities like Capital B validate Bitcoin’s legitimacy, increase demand, and can positively influence its price trajectory, contributing to broader mainstream acceptance. Did Capital B’s latest move inspire you? Share this article on your social media to spread the word about growing institutional Bitcoin adoption and how major players are shaping the future of digital finance! To learn more about the latest Bitcoin trends, explore our article on key developments shaping Bitcoin institutional adoption. This post Capital B’s Bold Bitcoin Acquisition: 126 BTC Added to Holdings first appeared on BitcoinWorld and is written by Editorial Team

Source: Bitcoin World