Ethereum Treasuries: Tom Lee’s Bold Bet on ETH Outpacing Bitcoin

2 min read

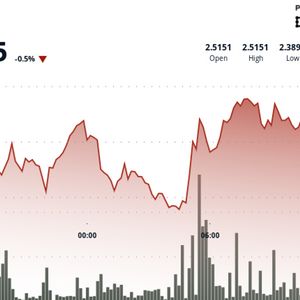

Tom Lee, chairman of Bitmine, believes Ethereum’s upside could be larger than Bitcoin’s historical 100x rally . He thinks Ethereum has a strong chance of flipping Bitcoin in network value, driven by the rapid growth of ETH treasury companies. Bitmine, which already holds nearly 1% of all ETH, aims to secure 5% of the supply, moving much faster than Bitcoin treasury giants like MicroStrategy. According to Lee, ETH treasuries are not just asset holders. By staking their ETH, these companies become critical infrastructure for Ethereum , earning native yields and actively supporting the network. Unlike ETFs, treasury companies can accumulate ETH faster, create supply scarcity, and benefit from Ethereum’s growing ecosystem of tokenized assets and real-world financial applications. Lee compared Ethereum’s current state to Bitcoin’s 2017 breakout moment, emphasizing that Wall Street hasn’t fully grasped Ethereum’s role as the backbone of tokenization, AI, and decentralized finance (DeFi) . He expects Ethereum to revisit $4,000 soon and sees potential for a price surge to $7,000–$15,000 by year-end. Long term, Lee believes Ethereum could reach 100x its current value, mirroring Bitcoin’s trajectory. While some investors worry about a potential bubble in crypto treasuries, Lee argues that as long as these companies avoid exotic debt structures and leverage, their value will grow sustainably. He dismisses rigid spreadsheet models, stating that ETH’s price will be driven by broader adoption, velocity of ETH accumulation, and the liquidity of these treasury firms. For traditional investors seeking exposure to Ethereum, treasury companies like Bitmine offer a unique route, especially for institutions unable to buy ETH directly or through ETFs. Lee points out that Bitmine’s strategy of accumulating ETH at scale, while remaining fully compliant with US regulations, positions it as a key player in Ethereum’s future. In his view, Ethereum’s undervaluation today presents a rare opportunity. As Wall Street and global institutions pivot towards blockchain, Ethereum treasuries could become the new “Exxon Mobiles” of the digital economy—valued not just for their assets, but for their role in securing and scaling blockchain infrastructure.

Source: Coinpaprika