Swiss bank AMINA offers custody and trading for SUI, staking coming soon

3 min read

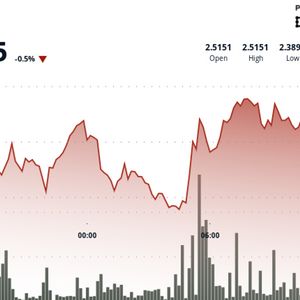

Sui, a Layer-1 blockchain designed for institutional-grade applications, is rapidly gaining traction in 2025. In just two years since its launch, the network has reached over $2.2 billion in total value locked (TVL), outperforming several peers in decentralised finance. Now, with a $441 million allocation by a US-listed firm and newly enabled regulated access from a Swiss bank, Sui is moving deeper into the financial mainstream. The surge in decentralised exchange volumes, developer activity, and institutional interest places Sui among the fastest-growing blockchains this year. Swiss-regulated bank adds custody and trading for SUI In a notable milestone, Zug-based AMINA Bank has become the first regulated financial institution to offer both trading and custody services for SUI, the native token of the Sui blockchain. The services are live and come with no volume caps, allowing institutional and retail clients to manage SUI holdings without restrictions. AMINA’s upcoming plans include staking support for SUI, expected to go live within months. The bank’s custody and trading offering includes full control over deposits and withdrawals and compliance tools for audit readiness. Built to help companies transition from Web2 to decentralised infrastructure, Sui’s integration by AMINA supports Switzerland’s broader ambition to lead in digital asset regulation and adoption. AMINA Bank @AMINABankGlobal · Follow 🚀 Another #AMINAFirst : SUI Trading & Custody Now Available on AMINA We are proud to be the first regulated bank with global reach to offer both trading and institutional-grade custody for SUI. @SuiNetwork isn’t just another Layer 1. Built by the team behind Meta’s Diem Watch on Twitter View replies 12:41 pm · 5 Aug 2025 59 Reply Copy link Read 11 replies Sui overtakes Solana in stablecoin transfers, posts record $14.27B DEX volume According to DeFiLlama, Sui recorded $14.27 billion in DEX volume in July 2025, its highest monthly figure to date. The blockchain also surpassed Solana in monthly stablecoin transfer volume during the same period, solidifying its position in high-throughput, real-world DeFi applications. Sui @SuiNetwork · Follow THIS JUST IN: As tracked by @DefiLlama , Sui set a new all-time high in monthly DEX volume, reaching $14.265B in July.Real onchain usage. Real liquidity. Probably nothing. 1:04 am · 2 Aug 2025 964 Reply Copy link Read 220 replies These numbers reflect growing market confidence and usage, particularly as Sui ramps up its work on infrastructure supporting AI agents and decentralised automation. The Sui Foundation has been actively investing in artificial intelligence integration throughout 2025. $441M allocation by Mill City Ventures signals growing public market exposure One of the biggest votes of confidence came from Mill City Ventures, a Nasdaq-listed firm, which allocated $441 million—98% of its $450 million raise—directly into SUI. The investment marks the first time a publicly traded company has built its treasury strategy around the token. This move positions Sui as a treasury asset within the corporate finance space, opening the door for other institutional investors to follow. ETF interest and developer participation drive momentum ETF filings by 21Shares, Bitwise, and Canary Capital have added fuel to Sui’s rise in the investment community. While none have been approved yet, the filings themselves signal a growing appetite to securitise exposure to SUI. Developer activity on the blockchain has also accelerated. Nearly 3,000 developers participated in the Summer 2025 campaign, a 50% year-on-year increase according to Electric Capital. This influx is helping to expand Sui’s decentralised ecosystem and further institutional use cases. The post Swiss bank AMINA offers custody and trading for SUI, staking coming soon appeared first on Invezz

Source: Invezz