ETH Strategy: Unlocking Revolutionary Ethereum Exposure with a $46.5M Raise

8 min read

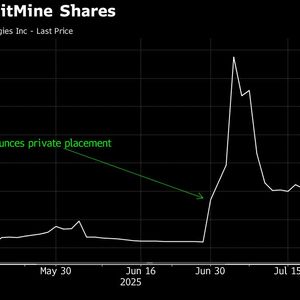

BitcoinWorld ETH Strategy: Unlocking Revolutionary Ethereum Exposure with a $46.5M Raise The cryptocurrency world is buzzing with anticipation as ETH Strategy , a promising new protocol designed to offer leveraged Ethereum exposure, has successfully concluded a significant fundraising round. Securing an impressive 12,342 ETH, equivalent to approximately $46.5 million, through a combination of private and public sales, as well as innovative puttable warrants, this venture is poised to make a substantial impact on the decentralized finance (DeFi) landscape. This substantial capital injection sets the stage for the highly anticipated launch of its native STRAT token, scheduled for July 29 at 13:00 UTC. What does this mean for the future of Ethereum and the broader crypto market? What is ETH Strategy and How Does It Work? At its core, ETH Strategy is a protocol engineered to provide users with leveraged exposure to Ethereum (ETH). In simpler terms, it allows participants to amplify their potential gains (and losses) from ETH price movements without directly holding a large amount of ETH themselves. This is achieved through sophisticated financial mechanisms that utilize staking and liquidity provisions. The protocol aims to bridge the gap between traditional finance leverage and the innovative world of decentralized assets, offering a new avenue for capital efficiency within the Ethereum ecosystem. The concept of leveraged exposure is not new, but its application within a decentralized, transparent, and user-controlled environment like ETH Strategy presents unique opportunities. By enabling users to take larger positions with smaller initial capital, the protocol caters to a segment of the market looking for enhanced returns on their ETH investments, albeit with increased risk. It’s designed for those who have a strong conviction in Ethereum’s long-term growth and are comfortable with the volatility inherent in the crypto market. The Impressive Funding Success of ETH Strategy The recent fundraising round for ETH Strategy was nothing short of spectacular, raising 12,342 ETH, valued at $46.5 million, as reported by The Block. This significant capital influx underscores strong investor confidence in the protocol’s vision and its potential to carve out a niche in the competitive DeFi space. The funds were secured through a multi-faceted approach: Private Sales: Early investors and institutions committed capital, often at preferential terms, signaling strong belief in the project’s foundational phase. Public Sales: Opened to a broader audience, allowing retail participants to contribute and become early stakeholders in the protocol. Puttable Warrants: An interesting inclusion, these financial instruments give the holder the right, but not the obligation, to sell a specified amount of the underlying asset (in this case, likely STRAT tokens or a related asset) at a predetermined price. This mechanism can offer flexibility and risk management for certain investors, potentially attracting a diverse range of participants. The success of this fundraising initiative highlights a growing appetite for innovative DeFi solutions that offer new ways to interact with established assets like Ethereum. It also reflects a maturing market where sophisticated financial instruments are increasingly being integrated into decentralized protocols. Why is Leveraged Ethereum Exposure Gaining Traction? Leveraged exposure to Ethereum is becoming increasingly popular for several reasons, primarily driven by the dynamic nature of the crypto market and the underlying strength of the Ethereum network. For many investors, it represents an opportunity to: Amplify Returns: If ETH’s price moves favorably, leveraged positions can yield significantly higher profits compared to simply holding ETH. Capital Efficiency: It allows investors to control a larger position with less capital upfront, freeing up other funds for diversification or other investments. Strategic Positioning: For those with high conviction in Ethereum’s future, leverage can be a tool to maximize exposure during periods of anticipated growth, such as after major network upgrades like the Merge or upcoming EIPs. However, it’s crucial to acknowledge the inherent risks. Leveraged positions also amplify losses, meaning a small adverse price movement can lead to substantial capital depreciation or even liquidation. Understanding these dynamics is paramount for anyone considering participation in protocols like ETH Strategy . Preparing for the STRAT Token Launch : What You Need to Know The crypto community is eagerly awaiting the official launch of the STRAT token, the native utility and governance token of the ETH Strategy protocol. The launch is set for July 29 at 13:00 UTC. This date marks a pivotal moment for the project, as the STRAT token will play a crucial role in the protocol’s ecosystem. Typically, native tokens like STRAT serve multiple functions: Governance: Holders of STRAT tokens will likely have the ability to vote on key protocol decisions, such as fee structures, upgrades, and treasury management. This decentralizes control and empowers the community. Utility: STRAT might be used for staking, earning rewards, or accessing specific features within the ETH Strategy platform. Value Accrual: As the protocol gains adoption and generates revenue, the value of the STRAT token could potentially appreciate, reflecting the success and utility of the underlying platform. Prospective participants should monitor official announcements from ETH Strategy for exact details on how to acquire STRAT tokens upon launch, whether through decentralized exchanges (DEXs) or other specified platforms. Strategic Allocation of Funds: Powering ETH Staking and Liquidity A significant portion of the $46.5 million raised by ETH Strategy is earmarked for two critical areas: ETH staking and liquidity provision. This strategic allocation is fundamental to the protocol’s operational efficiency and long-term sustainability. ETH Staking: By staking a substantial amount of the acquired ETH, ETH Strategy can participate in securing the Ethereum network and earn staking rewards. These rewards can then be reinvested into the protocol, used to support operations, or distributed to token holders, creating a sustainable economic model. Staking also enhances the protocol’s credibility and commitment to the Ethereum ecosystem. Liquidity Provision: Ensuring deep liquidity is vital for any DeFi protocol. A portion of the funds will be used to provide liquidity on various decentralized exchanges, facilitating seamless trading of the STRAT token and other assets within the ETH Strategy ecosystem. Robust liquidity minimizes slippage for traders and ensures a healthier market for the token. This dual focus on staking and liquidity demonstrates a well-thought-out strategy to not only generate revenue but also to ensure the stability and accessibility of the protocol for its users. How Will ETH Strategy Impact the Broader DeFi Landscape? The emergence of ETH Strategy could significantly influence the broader DeFi landscape by introducing a new, robust platform for leveraged Ethereum exposure. Its success could: Spur Innovation: Other protocols might be inspired to develop similar or complementary leveraged products, leading to a more diverse and sophisticated DeFi market. Increase Capital Efficiency: By allowing users to achieve more with less capital, ETH Strategy contributes to the overall capital efficiency of the DeFi ecosystem, potentially attracting more institutional and sophisticated retail investors. Deepen Ethereum’s Utility: By integrating deeply with ETH staking and providing liquidity, the protocol further cements Ethereum’s role as the foundational layer for complex financial instruments in the decentralized world. While the long-term impact remains to be seen, ETH Strategy has certainly positioned itself as a project to watch in the evolving DeFi space. Navigating the Future: Challenges and Opportunities for ETH Strategy Like any innovative venture in the fast-paced crypto world, ETH Strategy faces both exciting opportunities and formidable challenges. On the opportunity front, the growing institutional interest in Ethereum and the continued maturation of DeFi could provide fertile ground for adoption. The protocol’s ability to offer a unique form of leveraged exposure could attract a significant user base looking for sophisticated financial tools. However, challenges abound: Regulatory Scrutiny: Leveraged products often attract heightened regulatory attention. ETH Strategy will need to navigate an evolving global regulatory landscape. Market Volatility: While leveraged exposure offers amplified gains, it also means amplified losses. Extreme market volatility could test the protocol’s liquidation mechanisms and user resilience. Competition: The DeFi space is highly competitive, with new protocols emerging constantly. Maintaining a competitive edge will require continuous innovation and strong community engagement. Security Risks: Smart contract vulnerabilities are a constant threat in DeFi. Robust auditing and ongoing security measures will be crucial for maintaining user trust. Addressing these challenges effectively will be key to ETH Strategy ‘s long-term success and its ability to deliver on its ambitious vision. Key Takeaways for Investors and Enthusiasts For those considering engaging with ETH Strategy or simply observing its trajectory, here are some actionable insights: Do Your Own Research (DYOR): Before investing in STRAT tokens or utilizing the protocol’s leveraged services, thoroughly understand its mechanisms, risks, and potential rewards. Understand Leverage: Be acutely aware that leverage amplifies both gains and losses. Only use capital you can afford to lose. Monitor Tokenomics: Pay attention to the STRAT token’s distribution, vesting schedules, and utility, as these factors will influence its long-term value. Stay Informed: Follow official announcements from ETH Strategy and reputable crypto news sources for updates on development, partnerships, and market performance. Conclusion: A New Chapter for Leveraged Ethereum Exposure The successful $46.5 million raise by ETH Strategy marks a significant milestone for a protocol aiming to redefine leveraged Ethereum exposure within the DeFi ecosystem. With its STRAT token launch imminent, the project is poised to introduce a new layer of financial sophistication and capital efficiency to the crypto market. By strategically allocating funds to ETH staking and liquidity, ETH Strategy is building a robust foundation for sustainable growth. While the path ahead presents both opportunities and challenges, its innovative approach could pave the way for a new era of decentralized financial instruments, offering exciting prospects for those looking to engage with Ethereum in novel ways. The crypto world watches with keen interest as ETH Strategy embarks on its journey to unlock revolutionary potential. Frequently Asked Questions (FAQs) Q1: What is ETH Strategy ‘s primary purpose? ETH Strategy is a decentralized protocol designed to offer users leveraged exposure to Ethereum (ETH), allowing them to amplify potential gains (and losses) from ETH price movements without directly holding a large amount of ETH. It aims to provide capital-efficient access to ETH market trends. Q2: How did ETH Strategy raise $46.5 million? The protocol raised 12,342 ETH, equivalent to $46.5 million, through a combination of private sales to early investors, public sales open to a broader audience, and the issuance of puttable warrants. This multi-faceted approach attracted significant capital from diverse participants. Q3: When is the STRAT token launching? The native STRAT token of the ETH Strategy protocol is scheduled to launch on July 29 at 13:00 UTC. This launch will introduce the token that will be used for governance, utility, and value accrual within the platform. Q4: How will the raised funds be used by ETH Strategy ? According to reports, most of the $46.5 million raised will be primarily used for ETH staking and providing liquidity. ETH staking will help secure the Ethereum network and generate rewards, while liquidity provision will ensure smooth trading of the STRAT token and other assets within the protocol. Q5: What are the main risks associated with using ETH Strategy ? The primary risk involves leveraged exposure, which amplifies both potential gains and losses. Users could face significant capital depreciation or liquidation if ETH’s price moves unfavorably. Other risks include smart contract vulnerabilities, regulatory changes, and overall market volatility inherent in cryptocurrencies. If you found this article insightful, consider sharing it with your network! Your support helps us bring more valuable insights into the exciting world of cryptocurrency and decentralized finance. Spread the word about ETH Strategy and its groundbreaking potential! To learn more about the latest Ethereum trends, explore our article on key developments shaping Ethereum institutional adoption . This post ETH Strategy: Unlocking Revolutionary Ethereum Exposure with a $46.5M Raise first appeared on BitcoinWorld and is written by Editorial Team

Source: Bitcoin World