NEAR Rallies 6.9% as Bulls Reclaim Control After Overnight Selloff

1 min read

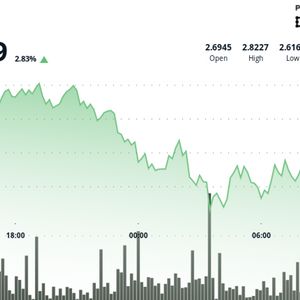

NEAR Protocol bounced 0.7% between 11:10 and 12:09 UTC on Thursday, erasing a brief $2.77 dip in a volatile trading window marked by sudden institutional inflows. The token whipsawed from $2.79 to $2.77 before reclaiming session highs, highlighting a two-phase move characterized by consolidation near $2.78, followed by a selloff and swift recovery. The rebound was triggered by a sharp uptick in volume, with more than 123,000 units traded after 12:01, breaking through resistance levels and signaling potential accumulation by large players. The move capped a broader 6.9% rally from $2.61 overnight support to a $2.79 close during the July 24–25 trading window, fueled by increased volatility and revived bullish sentiment. Analysts view the surge as a potential setup for a test of the $2.83 resistance level, with longer-term projections placing NEAR in a $1.95–$9.00 range for 2025 and as high as $71.78 by 2030. Continued development of cross-chain bridging with Solana and TON is cited as a catalyst for institutional interest and potential price expansion. Technical Breakout Signals Bullish Momentum $0.22 trading range represents 8.50% volatility between $2.83 maximum and $2.61 minimum during 23-hour period. Strong $2.61 support level confirmed with volume exceeding 3.18 million daily average. Recovery momentum from $2.69 to $2.79 close targets $2.83 resistance zone breakthrough. $2.78 consolidation precedes sharp $2.77 support test during mid-session volatility. Exceptional 123,000+ unit volume during final-hour surge confirms institutional accumulation phase. Multiple resistance levels broken during recovery establishing new $2.79 session highs. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk’s full AI Policy .

Source: CoinDesk