Asia FX: Decoding Remarkable Gains Amidst Japan’s Political Crossroads

7 min read

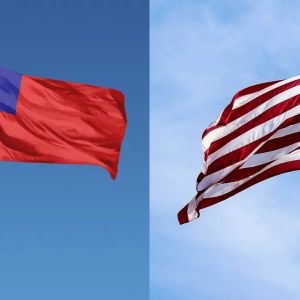

BitcoinWorld Asia FX: Decoding Remarkable Gains Amidst Japan’s Political Crossroads In the fast-paced world of global finance, understanding the intricate dance of traditional markets can offer crucial insights, even for those deeply immersed in the cryptocurrency space. Just as digital assets react to macro shifts, so too do national currencies. Currently, a compelling narrative is unfolding in the East: Asia FX is ticking up, showing resilience and strength. Yet, within this broader positive trend, Japan markets find themselves at a unique crossroads, grappling with a delicate balance between promising trade developments and an evolving domestic political landscape. Let’s decode what’s truly happening and why it matters. Asia FX: Riding the Wave of Global Dynamics Across the Asian continent, local currencies are demonstrating a robust performance. This isn’t merely a coincidence; it’s a reflection of several underlying economic currents. Many Asian economies are export-driven, and a recovering global economy, particularly strong demand from key markets like the US and Europe, directly translates into increased trade volumes. This influx of foreign currency strengthens the local exchange rates. Furthermore, stable inflation, prudent monetary policies by central banks, and improving economic fundamentals contribute to investor confidence, making Asian assets more attractive. Consider the performance of several key currencies: South Korean Won (KRW): Often buoyed by strong technology exports and robust manufacturing data. Taiwan Dollar (TWD): Benefits from its critical role in the global semiconductor supply chain, with demand for chips remaining high. Singapore Dollar (SGD): A safe-haven currency in the region, supported by a strong financial sector and stable political environment. Chinese Yuan (CNY): Its stability is often influenced by China’s vast trade surplus and managed exchange rate policy. These currencies, among others, are collectively painting a picture of an economically resilient Asia. This upward trend in Asia FX reflects a broader optimism about the region’s economic trajectory, even as global uncertainties persist. Japan Markets: A Tale of Two Forces While the broader Asian currency landscape shows strength, Japan’s situation presents a nuanced case. The Yen’s movements and the performance of Japan markets are influenced by a dual narrative: the promising prospects of increased trade and the inherent uncertainties stemming from domestic political shifts. It’s a dynamic that keeps investors on their toes, constantly weighing potential gains against potential risks. On one hand, there’s significant reason for optimism. Japan has been actively pursuing and benefiting from various trade agreements. On the other, the domestic political scene, characterized by changes in leadership and policy debates, introduces an element of unpredictability that can affect market sentiment and investment decisions. Understanding this interplay is key to comprehending the Yen’s behavior and the broader Japanese economic outlook. Navigating Trade Optimism: Opportunities and Headwinds One of the primary drivers for positive sentiment in Japan markets is the prevailing trade optimism . Japan is a major global trading nation, and its economy heavily relies on exports. Several factors contribute to this positive outlook: Global Economic Recovery: As major economies rebound, demand for Japanese goods and services, from high-tech components to automobiles, increases. Key Trade Agreements: Japan is a signatory to significant trade pacts such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Regional Comprehensive Economic Partnership (RCEP). These agreements reduce tariffs and non-tariff barriers, facilitating smoother and more profitable trade flows. Yen Depreciation (Historically): While the current trend for Asia FX is upward, periods of Yen weakness have historically made Japanese exports more competitive, boosting corporate earnings. This trade-driven growth can lead to stronger corporate profits, which in turn can boost equity markets and attract foreign direct investment. However, headwinds exist, including geopolitical tensions affecting global supply chains and the potential for protectionist policies in other major economies. Despite these challenges, the underlying momentum from robust trade relations continues to provide a significant tailwind for Japan’s economic prospects. The Impact of Political Flux on Investor Confidence Contrasting with the bright spots of trade, the political flux in Japan introduces a layer of uncertainty. Frequent changes in leadership, shifts in policy priorities, and debates over fiscal stimulus measures can create an environment of caution for investors. While Japan prides itself on its democratic stability, the rapid succession of prime ministers or significant policy pivots can lead to questions about long-term economic strategy. Consider these aspects of political influence: Leadership Changes: A new prime minister often brings a new cabinet and potentially different economic priorities, which can range from monetary policy stances to spending on infrastructure or social programs. Fiscal Policy Debates: Discussions around government debt, consumption tax hikes, or large-scale stimulus packages can impact market expectations for inflation, interest rates, and overall economic growth. Regulatory Environment: Changes in regulations affecting specific industries, particularly those related to technology, finance, or energy, can influence investment decisions. This political fluidity means that while economic fundamentals might be strong, investor confidence can be swayed by perceived instability or a lack of clear, consistent policy direction. For instance, delays in implementing growth-oriented reforms due to political gridlock could dampen enthusiasm, even amidst positive trade news. The Yen, in particular, often reacts sensitively to these domestic political developments, as they can signal future shifts in monetary policy or economic trajectory. Understanding Currency Trends in the Asian Landscape For investors, grasping the broader currency trends in Asia is paramount. While Japan navigates its unique challenges, the overall picture for Asia FX suggests a region poised for continued economic expansion. Several factors contribute to these trends: Interest Rate Differentials: As central banks in Asia potentially move towards tightening monetary policy or maintain higher rates than Western counterparts, this can attract capital flows, strengthening local currencies. Economic Growth Outlook: Asia is projected to be a key driver of global growth in the coming years. Robust GDP expansion, growing middle classes, and increasing domestic consumption provide a strong foundation for currency appreciation. Geopolitical Stability (Relative): While regional tensions exist, many Asian economies offer a relatively stable investment environment compared to other parts of the world, attracting long-term capital. Commodity Prices: For commodity-exporting Asian nations, rising global commodity prices can boost national income and strengthen their currencies. These overarching trends suggest that the current uptick in Asia FX is not merely a fleeting phenomenon but potentially part of a more enduring shift. Monitoring these trends, alongside specific country-level developments, is crucial for making informed investment decisions, whether in traditional forex markets or even in understanding the macro backdrop for crypto assets. Challenges and Opportunities for Investors in Asia FX The current environment in Asia presents both challenges and opportunities for investors. While the general strength of Asia FX is appealing, the specifics matter, especially when considering the Japanese market’s unique dynamics. Here are some actionable insights: Diversification is Key: Don’t put all your eggs in one basket. While some Asian currencies are strong, others might face headwinds. A diversified portfolio across different Asian economies can mitigate risks. Monitor Economic Data Closely: Keep an eye on inflation rates, GDP growth, trade balances, and central bank announcements across the region. These indicators provide real-time insights into currency strength. Understand Political Nuances: For Japan, specifically, pay close attention to political developments. Leadership changes, election outcomes, and major policy announcements can significantly impact the Yen and equity markets. Consider Carry Trades (with caution): In a rising interest rate environment, carry trades (borrowing in a low-interest-rate currency and investing in a high-interest-rate currency) might become attractive in some Asian markets, but they come with inherent risks. Long-Term vs. Short-Term: For long-term investors, the underlying economic growth story of Asia remains compelling. Short-term traders, however, will need to be agile to navigate the daily fluctuations driven by news and sentiment. Ultimately, navigating the complexities of Asia FX and Japan markets requires a blend of macro-economic understanding, political awareness, and a keen eye on specific currency trends . The opportunities are substantial for those who do their homework. A Balanced Perspective for the Savvy Investor The current landscape in Asia offers a compelling narrative for global investors. While Asia FX broadly exhibits an upward trajectory, driven by robust economic fundamentals and strong trade performance, the situation in Japan markets presents a more intricate picture. Here, the undeniable boost from trade optimism is carefully weighed against the uncertainties stemming from domestic political flux . Understanding these dual forces and the broader currency trends is vital for making informed decisions. Whether you’re a seasoned forex trader or a crypto enthusiast looking to understand the wider financial ecosystem, the interplay of economic strength, trade dynamics, and political stability in Asia provides a fascinating case study. The region continues to be a pivotal player in the global economy, and its currency movements will undoubtedly remain a focal point for market watchers worldwide. To learn more about the latest Forex market trends, explore our article on key developments shaping currency liquidity and institutional adoption. This post Asia FX: Decoding Remarkable Gains Amidst Japan’s Political Crossroads first appeared on BitcoinWorld and is written by Editorial Team

Source: Bitcoin World