Dogecoin Retreats Despite Bit Origin’s $500M Allocation, RSI Hits Overbought

2 min read

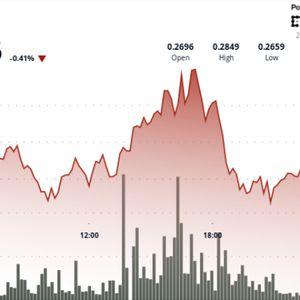

Dogecoin tumbled nearly 7% over the past 24 hours, reversing gains after briefly touching the $0.29 level — its highest price in over 10 months. The decline comes despite Bit Origin’s headline-grabbing $500 million DOGE treasury allocation, which included over 40 million tokens acquired this week. Traders cited overbought conditions and lack of sustained buy pressure as key reasons for the retracement. DOGE is now consolidating just above the $0.26 mark. News Background Bit Origin, a Hong Kong-based commodities and treasury firm, announced a major corporate commitment to Dogecoin with a $500 million treasury strategy involving a phased purchase of 1 billion DOGE. The move was initially seen as a validation of DOGE as a corporate asset. However, price failed to hold highs above $0.29, raising questions over DOGE’s ability to sustain institutional rallies amid broader market headwinds and historically volatile trading conditions. Price Action Summary • DOGE surged to $0.29 at 17:00 on July 21 following news of Bit Origin’s treasury plan, before falling to $0.27 by session close. • The 24-hour trading range spanned $0.26–$0.29, marking a 9% volatility window. • Final-hour trading (03:06–04:05 UTC on July 22) saw DOGE drop from $0.27 to $0.26, its lowest since Thursday, with volume rising to 37.2 million during the decline. • DOGE is now down 7% from session highs, despite institutional buying. Technical Analysis • RSI spiked to 85.95 on the move to $0.29, indicating overbought conditions. • Trading volumes peaked at 1.703 billion tokens during the breakout, nearly 2.5x the daily average. • Resistance remains firm at $0.29 with repeated rejections. • Support weakened from $0.27 to $0.26 as buyers failed to hold levels. • DOGE now trades at the lower end of its recent range, risking further downside if $0.26 fails. What Traders Are Watching Traders are eyeing whether DOGE can hold above $0.26, which has served as short-term support amid institutional flows. Failure to hold this level may trigger a retest of the $0.245-$0.25 zone. Any renewed buying from corporate treasuries or ETF-related speculation may help DOGE reclaim the $0.275-$0.29 resistance band — but momentum remains fragile.

Source: CoinDesk