Chart of the Week: Wall Street’s ‘Infinite Money Glitch’ Moves From Bitcoin to Altcoins

3 min read

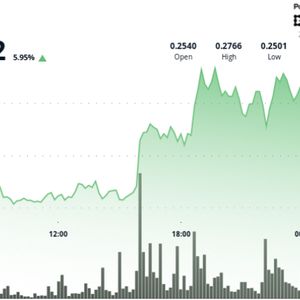

Wall Street has long mastered the creative art of turning complexity into a money-printing machine. How do they do it? Financial engineering — an art of structuring debt, equity, and derivatives to squeeze out returns in ways that often defy convention. It’s a playbook that made fortunes — and nearly broke the system in 2008. Now, this complex engineering of money has entered the crypto market. With Wall Street’s takeover of crypto, financial engineering is fast becoming a pillar of the crypto market. It is now at the center of the latest iteration of one of the hottest trends in the space: the crypto treasury strategy. This trend is championed by Michael Saylor, whose company — MicroStrategy (MSTR), now rebranded simply as Strategy — began acquiring bitcoin as both a corporate reserve asset and a market signal. But the real innovation wasn’t just buying BTC and holding it. It was how the firm financed those purchases: issuing convertible notes and equity to raise capital, then cycling that capital into buying more bitcoin. Each announcement triggered a surge in Strategy’s share price, which in turn made new capital raises easier and more lucrative. Others took note. What began as a bitcoin bet turned into a blueprint for a new kind of treasury management: announce crypto treasury strategy, stock pumps, raise funds, buy tokens, watch the share price pop more, repeat. This is the new “Infinite Money Glitch,” according to Animoca Brands Research. “This financial engineering approach of utilizing debt and equity issuances, such as convertible notes and stock offerings, specifically to raise funds for continuous crypto asset acquisitions creates a “flywheel” effect,” the firm said in a research note . Obviously, this money printing machine didn’t stop with bitcoin. Smaller firms started to apply this to other popular altcoins, including XRP, ETH and SOL. But why altcoins? After all, the bitcoin market has matured, the cycle has been well defined, and the likes of Michael Saylor have shown that the returns serve the shareholders well while enabling firms to continue to raise funds. It’s the early-stage advantage, according to Animoca’s research. “Applying this ‘flywheel’ model to altcoins might offer a more extended runway for growth and profitability compared to bitcoin. While bitcoin’s market is more mature and its price discovery has undergone several major cycles, the vast and diverse altcoin market is still, in many respects, in its nascent stages,” the research noted. A quick look at the return charts shows that in the short term, this altcoin treasury strategy has paid off for the firms and their shareholders. “On the day of the [altcoin treasury] announcement, share prices saw an average increase of 161%. This upward trend persisted, with average gains of 150% one day after, 185% after seven days, and 226% after 30 days,” the note said. “This immediate market response also underscores the market’s willingness to invest in publicly traded ‘wrappers’ for altcoin exposure.” Interestingly, launching these treasury strategies didn’t impact the actual prices of the underlying tokens, Animoca’s data shows. This perhaps makes a compelling case for investors to flock to these equity “wrappers” rather than to the actual tokens. Also, the lack of altcoin exchange-traded funds (ETFs) means that Wall Street has limited options but to buy into these strategy companies to capture the upside. For investors, these massive short-term gains are hard to ignore, and as long as there is an appetite for such financial engineering, capital will continue to flow into them. The only question is: Is this sustainable? “Should market sentiment shift or altcoin prices experience a prolonged decline, the leveraged nature of some of these strategies that could be employed carries substantial inherent risks,” Animoca Brands research analysts said. “Nevertheless, the trend highlights a significant addressable market for structured products that bridge traditional finance with crypto,” the report added. So for now, the “Infinite Money Glitch” is here for the win. Read more: Altcoin Season Returns? Bitcoin Consolidates With ETH, SUI, SEI Among Those Taking Charge

Source: CoinDesk