Bitcoin Trades Above $117K as Whale Deposits Decline and Stablecoin Inflows Rise

2 min read

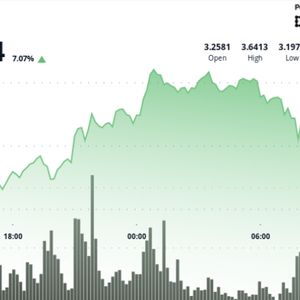

Bitcoin continues to maintain upward momentum despite a recent pullback from its all-time high. Currently trading at $117,847, the asset has recorded nearly a 10% gain over the past week. The dip from peak levels, approximately a 4.1% decline, has not dampened broader investor sentiment, with several on-chain indicators suggesting renewed buying interest and reduced selling pressure. Related Reading: Bitcoin Retail Demand Rebounds – $0–$10K Transfer Volume Turns Positive Bitcoin Whale Withdrawals Decline, While Stablecoins Flow In In a recent analysis posted to CryptoQuant’s QuickTake platform, analyst Amr Taha shared insights pointing to a strategic change in behavior among key Bitcoin holders and investors. The report, titled “Stablecoin Flood and Whale Retreat: Binance Moves Foreshadow Risk-On Sentiment”, outlined significant trends in whale activity and stablecoin flows that may support continued bullish momentum in the near term. Taha’s research highlighted a steep reduction in whale-level Bitcoin deposits on Binance. Over the past 30 days, these deposits have dropped from $6.75 billion to $4.5 billion, a $2.25 billion decline. Historically, large deposits from whales to centralized exchanges often signal an intention to sell, so the recent drop may imply a reduction in immediate sell-side pressure. This could stabilize Bitcoin’s price in the short term, especially if whales continue to hold or move assets to cold storage instead of preparing them for sale. At the same time, stablecoin flows have increased dramatically across major exchanges. On July 16, Binance and HTX saw combined stablecoin inflows exceeding $1.7 billion. Taha interpreted this as an indication that large entities, possibly institutions or whales, are preparing to accumulate digital assets. Large stablecoin deposits often precede significant buying activity, suggesting that the market could be gearing up for another leg higher, particularly if paired with reduced sell-side movements. Macroeconomic Developments and Miner Sentiment Add Context This on-chain activity is unfolding amid broader economic and political developments. Taha’s report also pointed to speculation around President Donald Trump’s comments during a private meeting, in which he reportedly considered replacing Federal Reserve Chair Jerome Powell. Though later denied, the remark sparked reactions in traditional markets, including a weaker dollar and rising bond yields. These shifts signaled a rotation into risk assets, potentially benefiting crypto markets as investors reallocate capital in anticipation of a more accommodative monetary stance. Related Reading: This Bitcoin Thesis ‘Will Retire Your Bloodline,’ Says Expert Separately, CryptoQuant analyst Arab Chain analyzed Bitcoin’s miner profitability using the Puell Multiple indicator. The data shows that while miners are currently making solid profits, the level has not reached historical peaks seen during prior market tops. In the 2017 and 2021 cycles, extreme miner profitability (indicated by Puell readings exceeding 2.0–3.0) often preceded sharp price corrections. At current levels, Arab Chain believes the market is not in a euphoric state, reducing the likelihood of imminent volatility due to miner-driven selloffs. Featured image created with DALL-E, Chart from TradingView

Source: NewsBTC