Unstoppable Ethereum ETF Inflows: $192.3M Milestone Reached

9 min read

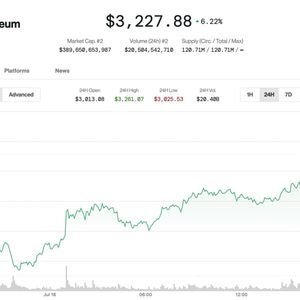

BitcoinWorld Unstoppable Ethereum ETF Inflows: $192.3M Milestone Reached Are you watching the latest movements in the cryptocurrency space? If so, you’ve likely noticed a significant buzz around Spot Ethereum ETFs . The digital asset market is once again showing its dynamic nature, with these new investment vehicles capturing substantial investor interest. On July 15, U.S. spot Ethereum ETFs recorded a combined net inflow of an impressive $192.3 million, marking the eighth consecutive day of positive flows. This consistent influx of capital signals a growing confidence in Ethereum’s long-term potential and its evolving role within the broader financial ecosystem. This isn’t just a fleeting moment; it’s a clear indicator of shifting investor sentiment and the increasing mainstream acceptance of digital assets. Understanding the Rise of Spot Ethereum ETFs Before diving deeper into the recent financial figures, let’s briefly clarify what Spot Ethereum ETFs are and why they are such a pivotal development for the crypto market. An Exchange-Traded Fund (ETF) is an investment fund traded on stock exchanges, much like stocks. A ‘spot’ ETF specifically holds the underlying asset directly, meaning a Spot Ethereum ETF holds actual Ether (ETH), rather than derivatives or futures contracts. This direct exposure is a key reason for their appeal, offering investors a regulated and accessible way to gain exposure to Ethereum without the complexities of direct crypto ownership, such as setting up wallets or managing private keys. Accessibility: ETFs simplify access for traditional investors, allowing them to buy and sell ETH exposure through their existing brokerage accounts. Regulation: Being listed on regulated exchanges provides a layer of oversight and investor protection that is often perceived as lacking in direct crypto markets. Diversification: For institutional investors, ETFs offer a straightforward way to diversify portfolios into digital assets within established investment frameworks. Liquidity: ETFs are generally highly liquid, making it easy for investors to enter and exit positions. The approval and launch of these ETFs have been eagerly anticipated, following the successful introduction of Spot Bitcoin ETFs earlier this year. Their arrival marks a significant step in the institutionalization of the crypto space, bridging the gap between traditional finance and the innovative world of blockchain technology. This bridge is crucial for attracting new capital and legitimizing digital assets in the eyes of a wider investor base. The Unprecedented Surge in Ethereum ETF Inflows The recent data from Farside Investors paints a compelling picture: U.S. spot Ethereum ETFs recorded a combined net inflow of $192.3 million on July 15. This figure is not just a standalone number; it represents the eighth straight day of positive flows, indicating a sustained and robust demand. Such a streak is a powerful signal of market conviction, suggesting that investors are not merely dipping their toes but are committing significant capital to these new investment products. The consistency of these inflows is particularly noteworthy, as it demonstrates a foundational shift rather than a speculative blip. Let’s break down the contributions: ETF Name Inflows (July 15) BlackRock’s ETHA $171.5 million Fidelity’s FETH $12.2 million Grayscale’s mini ETH $8.6 million Remaining ETFs No change This distribution highlights a clear leader in the race for capital, but also demonstrates participation from other key players. The consistent positive Ethereum ETF inflows are not just numbers; they reflect a growing appetite for exposure to the second-largest cryptocurrency by market capitalization, signaling a broader acceptance and integration into traditional investment portfolios. This sustained interest suggests that institutional and retail investors alike are increasingly recognizing Ethereum’s fundamental value proposition and its potential for future growth, moving beyond speculative trading to long-term strategic investments. BlackRock’s Dominance and Shifting Investor Sentiment A closer look at the inflow data reveals a significant trend: BlackRock’s ETHA led the pack with an astounding $171.5 million in inflows on July 15. This figure alone accounts for nearly 90% of the total net inflows for the day, underscoring BlackRock’s powerful influence and the trust it commands among institutional and retail investors. BlackRock, as the world’s largest asset manager, brings unparalleled credibility and reach to the digital asset space. Its active participation and success with ETHA send a strong signal to the market, often interpreted as a vote of confidence in Ethereum’s long-term viability and its potential as an investment asset. The performance of BlackRock ETHA is not just about its individual success; it’s indicative of a broader shift in investor sentiment . Historically, many traditional investors were hesitant to venture into the volatile crypto market. However, the introduction of regulated products like BlackRock’s ETHA provides a familiar and secure gateway. This comfort level is crucial for unlocking significant institutional capital. The consistent inflows suggest that investors are increasingly comfortable with Ethereum’s fundamentals, including its robust ecosystem, its role in decentralized finance (DeFi), NFTs, and its transition to a proof-of-stake consensus mechanism which offers staking rewards. This positive sentiment is likely fueled by several factors: Regulatory Clarity: The SEC’s approval of these ETFs, even if initially hesitant, provides a degree of regulatory legitimacy. Ethereum’s Ecosystem Growth: Continuous innovation and adoption of Ethereum’s blockchain for various applications, from stablecoins to enterprise solutions. Staking Yield Potential: The ability for ETF providers to potentially offer staking yields from the underlying ETH holdings adds an attractive income component for investors. Market Maturation: As the crypto market matures, investors are becoming more sophisticated in their understanding of different digital assets beyond just Bitcoin. The strong performance of ETHA, alongside contributions from Fidelity’s FETH and Grayscale’s mini ETH, collectively reinforces the narrative that institutional interest in Ethereum is not just theoretical but is actively translating into significant capital allocation. This could pave the way for even greater adoption and a more stable growth trajectory for Ethereum in the coming months and years. Comparing Ethereum ETFs to Bitcoin ETFs: Lessons Learned for the Crypto Market The journey of Spot Ethereum ETFs shares many parallels with the earlier launch of Spot Bitcoin ETFs. The Bitcoin ETFs, approved in January, saw a similar initial surge in inflows, followed by periods of consolidation and renewed interest. This precedent offers valuable insights into what might lie ahead for Ethereum ETFs and the broader crypto market . Key comparisons and lessons include: Initial Hype vs. Sustained Interest: Both Bitcoin and Ethereum ETFs experienced significant initial excitement. However, the sustained eight-day positive flow for Ethereum ETFs suggests a robust underlying demand that goes beyond mere speculation. For Bitcoin ETFs, initial inflows were often offset by Grayscale Bitcoin Trust (GBTC) outflows, which is less of a factor with Ethereum ETFs due to the different structure of Grayscale’s ETH product. Institutional Adoption Pace: The rapid uptake by major players like BlackRock for both Bitcoin and Ethereum ETFs indicates a streamlined process for institutional entry. Once the regulatory hurdle is cleared, large asset managers are quick to offer these products, signaling their readiness to embrace digital assets. Market Impact: While ETF inflows don’t directly dictate price, they certainly contribute to positive market sentiment and can absorb selling pressure. The consistent demand from ETFs can act as a significant buy-side force, potentially stabilizing prices and supporting upward momentum for the underlying asset. Diversification within Crypto: The success of Ethereum ETFs highlights a growing trend among investors to diversify their crypto exposure beyond just Bitcoin. Ethereum’s unique utility as a platform for decentralized applications makes it an attractive complementary asset in a diversified digital portfolio. Regulatory Evolution: The SEC’s cautious approach, initially approving Bitcoin ETFs and then Ethereum ETFs, demonstrates a gradual but clear path towards integrating digital assets into regulated financial products. This evolution is critical for long-term growth and broader market acceptance. The experience with Bitcoin ETFs has likely informed the strategies of asset managers and investors for Ethereum ETFs. The market is now more familiar with the mechanics, potential benefits, and risks associated with these products. This learning curve has perhaps contributed to the relatively smooth and consistent inflow pattern observed with Ethereum ETFs, suggesting a more mature and informed approach from the investor community. This maturing landscape bodes well for the overall stability and growth of the digital asset economy, as it moves from niche speculation to a recognized asset class within global finance. Challenges and the Road Ahead for Spot Ethereum ETFs While the recent surge in Ethereum ETF inflows is undeniably positive, it’s important to acknowledge that challenges and uncertainties remain. The path forward for these investment vehicles, and indeed the broader crypto market , is not without its potential hurdles. Understanding these challenges is crucial for a balanced perspective and informed decision-making. Some key challenges include: Regulatory Scrutiny: Despite the initial approvals, the regulatory landscape for cryptocurrencies remains fluid and complex. Future regulatory changes, interpretations, or even new legislation could impact the operation or appeal of these ETFs. For instance, the SEC’s classification of Ethereum as a commodity, rather than a security, was crucial for ETF approval, but this classification could theoretically be revisited. Market Volatility: Ethereum, like other cryptocurrencies, is known for its price volatility. While ETFs offer a regulated wrapper, they do not insulate investors from the inherent price swings of the underlying asset. Significant price drops in ETH could lead to outflows from the ETFs, mirroring the market’s broader sentiment. Competition: As more asset managers launch their own Spot Ethereum ETFs, the competition for market share will intensify. This could lead to fee wars, potentially impacting the profitability of these funds for providers, though it could benefit investors through lower costs. Technological Risks: While blockchain technology is robust, it’s not entirely immune to risks such as network congestion, security vulnerabilities, or protocol changes. These could indirectly affect the perceived value of Ethereum and, consequently, its ETFs. Global Regulatory Divergence: Different countries have varying approaches to crypto regulation. While U.S. approvals are significant, a lack of global regulatory harmonization could create complexities for international investors or multi-jurisdictional funds. Despite these challenges, the future outlook for Spot Ethereum ETFs appears promising. The consistent inflows suggest a strong foundational demand, and the increasing institutional participation points towards a continued trend of mainstream adoption. As the Ethereum ecosystem continues to evolve, with ongoing developments in scaling solutions (like sharding and Layer 2 networks) and its role in emerging technologies (such as Web3 and enterprise blockchain), the underlying asset’s utility and value proposition are likely to grow. The ability of some ETFs to potentially offer staking yields on the underlying ETH could also be a significant long-term draw, providing a unique income component not typically found in other commodity-based ETFs. This innovation could further solidify their appeal to a wider range of investors looking for both growth and yield in their portfolios. Actionable Insights for Investors The emergence and success of Spot Ethereum ETFs present new opportunities for investors. Here are some actionable insights to consider, whether you’re new to crypto or a seasoned participant: Do Your Due Diligence: While ETFs simplify access, it’s crucial to understand the underlying asset, Ethereum. Research its technology, use cases, and market dynamics. Consider Your Investment Goals: Are you looking for long-term growth, diversification, or short-term trading opportunities? ETFs can serve different purposes, so align your investment with your objectives. Diversify Your Portfolio: Even within the crypto space, diversification is key. Consider how Ethereum ETFs fit into your overall portfolio alongside other assets, both traditional and digital. Stay Informed on Market Trends: Keep an eye on Ethereum ETF inflows , regulatory developments, and broader crypto market sentiment. These factors can significantly influence performance. Consult a Financial Advisor: For complex investment decisions, especially involving new asset classes, seeking advice from a qualified financial professional is always recommended. The consistent positive flows are a testament to the growing confidence in Ethereum’s ecosystem. However, like any investment, it comes with risks. Understanding the nuances and staying informed will be key to navigating this exciting new frontier. A New Era of Investment: The Power of Ethereum ETFs The remarkable $192.3 million in net inflows into U.S. Spot Ethereum ETFs on July 15, marking an impressive eight consecutive days of positive momentum, truly signifies a pivotal moment for the cryptocurrency landscape. This sustained demand, overwhelmingly led by BlackRock ETHA , underscores a profound shift in investor sentiment , indicating not just fleeting interest but a robust and growing institutional appetite for Ethereum. As these ETFs provide a regulated and accessible gateway to the second-largest cryptocurrency, they are effectively bridging the gap between traditional finance and the innovative blockchain world. The lessons learned from the Bitcoin ETF journey are clearly being applied, leading to a more informed and perhaps more stable integration of digital assets into mainstream investment portfolios. While challenges such as regulatory shifts and market volatility persist, the consistent positive Ethereum ETF inflows paint a compelling picture of a maturing crypto market , poised for continued evolution and broader acceptance. This influx of capital is a powerful validation of Ethereum’s foundational technology and its expansive ecosystem, heralding a new era of investment opportunities for both seasoned and nascent participants in the digital economy. To learn more about the latest crypto market trends, explore our article on key developments shaping Ethereum institutional adoption. This post Unstoppable Ethereum ETF Inflows: $192.3M Milestone Reached first appeared on BitcoinWorld and is written by Editorial Team

Source: Bitcoin World