Bad News Came Yesterday for the Three Major US Cryptocurrency Bills! Trump Intervened, Problem Solved! Crucial Vote Today! Here Are the Details

2 min read

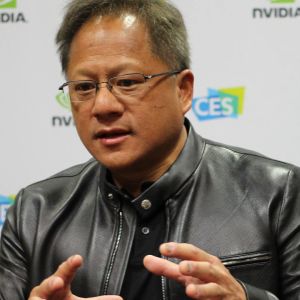

Cryptocurrency week in the US has started with negativity. Accordingly, cryptocurrency legislation that was expected to be voted on in the US House of Representatives this week has been postponed due to a procedural vote failure. In the vote held yesterday, the proposal, which would have paved the way for the discussion of three important cryptocurrency bills, was rejected with 223 “no” votes against 196 “yes” votes. Following the rejection decision, there was a positive development in laws that are of great importance to US President Donald Trump. Trump intervened and announced a meeting with House members who oppose the procedural agreement for the GENIUS Act. At this point, Trump said that an agreement had been reached to hold a vote again on July 16 and advance the stablecoin bill in the US. Donald Trump said on Truth Social that he met with 11 of the 12 people needed for the passage of the GENIUS Act in the Oval Office. According to Trump’s post, the group agreed to vote on the morning of July 16. House Speaker Mike Johnson joined the meeting by phone and stated that he was ready to move forward with a vote as soon as possible. This update came after the House failed to hold a procedural vote on the bill. “I’m currently in the Oval Office at the White House with 11 of the 12 members of the House of Representatives whose approval is needed for passage of the GENIUS Act. After a brief discussion, they all agreed to vote yes tomorrow morning. I hope the vote will take place as soon as possible tomorrow. I extend my gratitude to the representatives for their prompt and positive response.” What Are These Laws? This week, dubbed “Crypto Week,” features two important bills on the House agenda: the National Innovation Guidelines and Establishment for U.S. Stablecoins Act (GENIUS) and the Digital Asset Market Openness Act (Clarity). The GENIUS law stipulates that stablecoin issuances must be fully collateralized only by US dollars or similar liquid assets, requires annual audits for issuers with a market capitalization over $50 billion, and establishes rules for overseas stablecoin issuance. The Clarity Act, meanwhile, aims to clarify the regulatory framework for crypto assets by offering a more comprehensive approach. It clarifies the roles and jurisdictions of the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), as well as requiring digital asset service providers to notify individual investors and segregate client funds from company assets. *This is not investment advice. Continue Reading: Bad News Came Yesterday for the Three Major US Cryptocurrency Bills! Trump Intervened, Problem Solved! Crucial Vote Today! Here Are the Details

Source: BitcoinSistemi