ATOM Consolidates After Precipitous Decline, Critical Support Levels Tested

2 min read

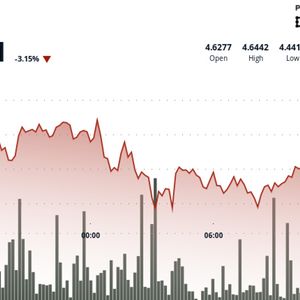

Cosmos’ ATOM token fell victim to a market-wide sell-off on Tuesday, retreating from $4.65 to $4.56 amid a wave of volatility. While several key areas of support have been tested, the recent rebound from $4.52 to $4.58 at 13:00 UTC, accompanied by heightened volume metrics, signals potential stabilization above the $4.50 psychological support threshold. Technical Indicators Breakdown ATOM experienced considerable volatility during the preceding 24-hour period from 14th July 15:00 to 15th July 14:00, declining from $4.65 to $4.56, representing a 2 per cent drop with an aggregate range of $0.22 (5 per cent). The cryptocurrency confronted substantial selling pressure during nocturnal hours, reaching a critical low of $4.43 at 03:00 before establishing support around the $4.47-$4.50 zone. Robust volume activity exceeding the 24-hour average of 854,000 during the 03:00 decline and subsequent 12:00-13:00 recovery suggests institutional participation at these levels. The recent bounce from $4.52 to $4.58 during the 13:00 hour, accompanied by elevated volume, indicates potential stabilization above the $4.50 psychological support level. Throughout the preceding 60 minutes from 15th July 13:08 to 14:07, ATOM exhibited significant volatility with zero net change but experiencing substantial intraday movement with a peak at $4.58 and trough at $4.52, representing a 1 per cent intraday range. Volume patterns proved particularly noteworthy, with elevated activity during the 13:19 decline (46,270 units) and subsequent recovery phases, suggesting institutional participation at key support and resistance levels. The terminal minutes revealed concerning weakness as ATOM retreated from its hourly highs, closing the period with diminished momentum and zero volume in the last three minutes, indicating potential market uncertainty. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Source: CoinDesk