BONK Surges 12% as Grayscale Monitoring Sparks Institutional Momentum

2 min read

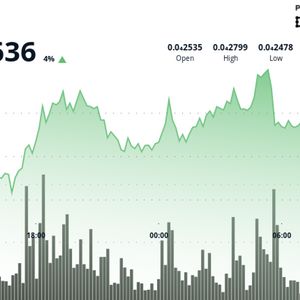

BONK posted a sharp 12% intraday gain during the last 24 hours, climbing from $0.0000250 to $0.0000281 before settling at $0.0000265, up 6.2%. The Solana-based meme token surged following news that Grayscale Investments included BONK in its expanded institutional monitoring framework , signaling rising interest from asset managers and potential future product development. Trading momentum intensified beginning around 15:00 UTC on July 13, culminating in a high-volume breakout by 05:00 UTC on July 14. BONK recorded 2.6 trillion tokens in trading volume at its peak, more than double typical daily activity. Technical levels confirmed resistance at $0.0000281, where price action encountered sell-side pressure. However, support was established at $0.0000264, with institutional traders seen re-entering positions during pullbacks, potentially setting up for a future breakout, particularly if BONK can maintain momentum above $0.0000260. BONK also experienced a 3% swing during the final 60-minute session between 09:37 and 10:36 UTC, ranging from $0.0000260 to $0.0000268. While brief profit-taking drove prices to session lows around $0.0000260, renewed buying interest quickly stabilized the market. Technical Analysis Highlights Trading range: $0.0000247–$0.0000281, representing 14% volatility during the institutional breakout window. Peak volume: 2.6T tokens traded at 05:00 UTC, reflecting high conviction interest from large buyers. Resistance zone: $0.0000281 confirmed by rejection pattern; next test could signal breakout continuation. Support zone: $0.0000264 identified as institutional accumulation band; firmed by multiple bounces. Intraday dip: Brief move to $0.0000260 met with heavy buying; volume exceeded 75B tokens in late-session activity. Recovery zone: Market stabilized around $0.0000266 as selling pressure eased, forming bullish continuation structure. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk’s full AI Policy .

Source: CoinDesk