Bitcoin’s Explosive Triumph: New All-Time High Against Korean Won on Upbit

5 min read

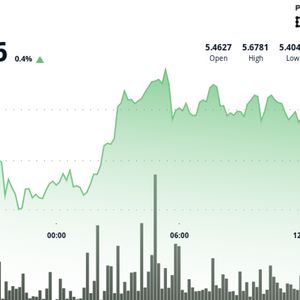

BitcoinWorld Bitcoin’s Explosive Triumph: New All-Time High Against Korean Won on Upbit The cryptocurrency world is buzzing with excitement as Bitcoin (BTC) has once again shattered records, achieving a monumental new all-time high against the South Korean Won on the prominent local exchange, Upbit . This remarkable milestone, with Bitcoin soaring to 164.04 million won (approximately $118,970), not only surpasses its previous peak of 163.325 million won set on January 20th but also signals robust demand and a surging confidence within the cryptocurrency market . What does this significant achievement truly mean for investors and the broader digital asset landscape? Bitcoin’s Historic Surge: What Does a New All-Time High Mean? The recent surge of Bitcoin to a fresh all-time high against the Korean Won is more than just a number; it is a powerful indicator of sustained bullish momentum and increasing investor appetite. Reaching 164.04 million won on Upbit, Bitcoin has demonstrated its resilience and capacity for growth. This latest peak follows a period of consolidation and renewed interest, reflecting global trends where major economies are increasingly acknowledging the role of digital assets. For many, an all-time high is a psychological barrier. Once breached, it often paves the way for further price discovery as previous resistance levels turn into support. This particular record is significant because it highlights strong buying pressure from a region known for its highly engaged and influential crypto community. The consistent breaking of new records underscores Bitcoin’s position as a leading digital store of value and a compelling asset in the current financial climate. The Korean Won Connection: Why South Korea Matters in Crypto South Korea holds a unique and often outsized influence on the global cryptocurrency market . The nation boasts one of the most active and enthusiastic crypto trading populations, often leading to distinct market dynamics. The phenomenon known as the ‘Kimchi Premium’ – where Bitcoin trades at a higher price on South Korean exchanges compared to international ones – is a testament to this intense demand. While the premium fluctuates, its existence underscores the high liquidity and fervent interest among Korean investors. The fact that Bitcoin has set a new record against the Korean Won indicates that local demand is not just strong, but escalating. This could be driven by a confluence of factors, including increasing retail participation, a growing acceptance of crypto assets, and potentially, local economic conditions influencing investment decisions. Understanding the Korean market’s sentiment is crucial for gauging broader market trends, as it often acts as a bellwether for shifts in global crypto enthusiasm. Upbit’s Dominance: A Gateway to Global Crypto Trading At the heart of this record-breaking performance is Upbit , South Korea’s largest cryptocurrency exchange. Upbit’s robust trading volume and deep liquidity make it a pivotal platform for price discovery in the region. Its user-friendly interface, comprehensive security measures, and wide range of supported cryptocurrencies have cemented its position as the go-to exchange for millions of Korean traders. When an all-time high is set on a dominant platform like Upbit, it sends a clear signal of strong domestic conviction. The exchange’s ability to handle significant trading volumes without major issues further instills confidence among its users. Upbit’s role in facilitating this milestone cannot be overstated; it acts as a critical conduit for capital flows into the crypto space within South Korea, influencing global prices and market sentiment. Beyond the Numbers: The Significance of an All-Time High What does an all-time high truly signify beyond a simple price point? It reflects a culmination of factors, including increasing institutional adoption, growing retail interest, positive regulatory developments in various jurisdictions, and Bitcoin’s narrative as a hedge against inflation. Each time Bitcoin breaks a new record, it garners significant media attention, drawing in new investors and further legitimizing the asset class. This achievement reinforces the narrative of Bitcoin’s scarcity and its potential as a long-term store of value. It suggests that despite past volatility, a growing number of participants view Bitcoin as a viable component of a diversified investment portfolio. This consistent upward trajectory, marked by new highs, can create a powerful feedback loop, encouraging more capital to flow into the asset. Here are some key implications of this new all-time high: Enhanced Investor Confidence: New highs often boost morale and encourage existing holders to retain their assets, reducing selling pressure. Increased Mainstream Visibility: News of record prices attracts attention from traditional media, potentially drawing in new retail and institutional investors. Market Validation: It reinforces Bitcoin’s position as a leading digital asset, validating its underlying technology and economic model. Potential for Price Discovery: With no historical resistance levels above, Bitcoin enters uncharted territory, where its price can move more freely based on demand. Navigating the Cryptocurrency Market: Opportunities and Challenges The broader cryptocurrency market often takes its cues from Bitcoin’s performance. When Bitcoin rallies, altcoins frequently follow suit, creating a bullish environment across the board. This new all-time high could catalyze a broader market uptrend, potentially leading to increased activity and gains in other digital assets. However, the cryptocurrency market is also known for its volatility. While opportunities for significant gains exist, so do risks. Investors should remain vigilant and exercise caution, understanding that corrections can occur even after major breakthroughs. Regulatory landscapes continue to evolve globally, which can also impact market sentiment and asset prices. For those looking to engage with the market, here are some actionable insights: Stay Informed: Keep abreast of market news, technical analysis, and regulatory developments. Diversify Wisely: While Bitcoin is strong, consider a diversified portfolio tailored to your risk tolerance. Understand Market Cycles: Recognize that crypto markets operate in cycles, and price movements can be swift. Risk Management: Only invest what you can afford to lose, and consider dollar-cost averaging to mitigate volatility. This latest Bitcoin record on Upbit against the Korean Won is a powerful testament to the enduring appeal and growing maturity of the cryptocurrency market . It highlights the strong demand from key regions like South Korea and reinforces the asset’s position as a significant player in the global financial landscape. While the journey of digital assets is always dynamic, moments like these underscore the revolutionary potential they hold. To learn more about the latest crypto market trends, explore our article on key developments shaping Bitcoin price action. This post Bitcoin’s Explosive Triumph: New All-Time High Against Korean Won on Upbit first appeared on BitcoinWorld and is written by Editorial Team

Source: Bitcoin World