Asia market mixed, China rises on stimulus bets; U.S. stock futures dip after Trump slaps tariffs on Canada

3 min read

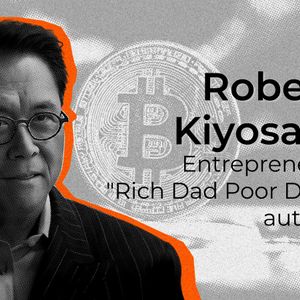

Asia stock markets trade mixed on Friday, reacting to renewed worries about U.S. trade tariffs following President Donald Trump’s announcement of significant duties against Canada. Meanwhile, China’s markets outperformed the region, driven by expectations of further stimulus measures. Meanwhile, President Trump reportedly plans to impose blanket tariffs of 15–20% on most major trade partners after announcing 35% tariffs on Canadian imports starting August 1. Gold rose to around $3,330 per ounce on Friday, gaining for a third straight session, supported by safe-haven demand amid escalating trade tensions. Bitcoin surged past $116,000 in mid-July, setting a new all-time high, driven by strong institutional demand and supportive policies from the Trump administration. Japan ( NKY:IND ) fell 0.10% rose 0.1% to around 39,690 while the broader Topix Index gained 0.35 to 2,820 on Friday, recouping losses from the previous session. The Japanese yen weakened toward 147 per US dollar on Friday, nearing a three-week low, as the greenback gained strength amid rising global trade tensions. Japan is actively pursuing ministerial-level tariff talks with the U.S., targeting meetings between negotiator Ryosei Akazawa and U.S. Treasury Secretary Scott Bessent during the latter’s visit in Osaka next week, according to the Yomiuri newspaper. The Bank of Japan stated on Thursday that U.S. tariffs have had a limited impact on Japan’s exports and factory output thus far. However, the central bank’s quarterly meeting summary with regional branch managers revealed that many Japanese companies are increasingly concerned about weakening global demand. Bessent is scheduled to attend the U.S. “National Day” event on July 19 at Expo 2025. China ( SHCOMP ) rose 1.05% to above 3,560 while the Shenzhen Component gained 0.6% to 10,700 on Friday, with mainland stocks scaling multi-month highs as investors looked ahead to trade data due over the weekend, and the offshore yuan strengthened past 7.16 per dollar on Friday, extending gains from the previous session, supported by the robust fixing from the People’s Bank of China. Earlier this week, China announced fresh initiatives to stabilize employment. These measures come as the nation grapples with a prolonged trade war with the U.S. and persistently high youth unemployment. The jobless rate for individuals aged 16 to 24 (excluding college students) stood at 14.9% in June, a slight decrease from 15.8% in May, but still elevated. In China, investors are bracing for key economic releases next week. Hong Kong ( HSI ) rose 1.84% to 24,454 on Friday morning, extending gains from the prior session and hitting a two-week-high. India ( SENSEX ) flat Australia ( AS51 ) fell 0.02% opened flat to around 8,589 on Friday, and on track for its first weekly decline in three, as investors weighed fresh US tariff actions from President Donald Trump. The Australian dollar weakened to below $0.658 on Friday, ending its three-day winning streak, as sentiment turned cautious following a fresh wave of tariff threats from US President Donald Trump. In the U.S., on Thursday, all three major indexes ended higher as investors looked past President Trump’s latest tariff threats and focused on strong corporate results and record-setting gains. U.S. stock futures held steady on Friday following another strong session on Wall Street, where both the S&P 500 and Nasdaq Composite closed at fresh record highs: Dow -0.27% ; S&P 500 -0.23% ; Nasdaq -0.20% . Currencies: ( JPY:USD ), ( CNY:USD ), ( AUD:USD ), ( INR:USD ), ( HKD:USD ), ( NZD:USD ). More on Asia: Japan PPI growth hits 10-month low to 2.9% y/y in June China CPI sees slight rise up 0.1%, PPI drops most in two years amid weak demand and tariff risks Trump puts 25% tariff on Japan and South Korea, others (updated) U.S.-China trade agreement leads to lifted chip design software restrictions Australia’s manufacturing contraction deepens in May; retail sales miss estimates

Source: Seeking Alpha