Shiba Inu’s Futures Open Interest Tops 7M SHIB as Price Recovery Meets Whale Selling

2 min read

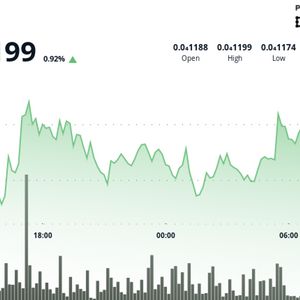

Shiba Inu (SHIB) whales have stepped up their sales as the cryptocurrency’s price recovery looks to gather steam alongside an uptick in futures market activity. The path of least resistance still appears to be on the higher side. SHIB, the world’s second-largest meme token by market value, traded above the 23.6% Fibonacci retracement of the May-June sell-off as of writing, up over 1% on a 24-hour basis, according to CoinDesk data. Bullish RSI Prices have gained over 5% in one week alongside bullish signals from key indicators such as the 14-day relative strength index. The momentum oscillator has crossed into the bullish territory above 50 for the first time since May 23. Supporting the bull case are volume figures, which have exceeded the daily average of 307.5 billion tokens during the recent price recovery phase, according to data tracked by CoinDesk’s AI research. Open Interest Rises as Whales Sell Meanwhile, open interest in perpetual futures listed on Binance has surged past the 7 million SHIB mark for the first time since May 23, according to data source Velo. The upswing, accompanied by positive funding rates, suggests an increased investor interest in betting on continue price gains. The ascent, however, could be challenged by whale and insiders moving trillions of coins to exchanges, with ten wallets controlling over half of the total token supply. Key AI insights Support zone at $0.00001172-$0.00001175 attracts high-volume buying interest. Resistance at $0.00001196 caps upside moves with consistent reversals. Volume exceeds 307.5 billion token daily average during recovery phase. Intraday high $0.00001195 represents 1% gain from session open. 7.25 billion token volume spike marks resistance test during breakout attempt. ( Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk’s full AI Policy .)

Source: CoinDesk