From Bricks to Bitcoin: Murano’s $500M Treasury Play

3 min read

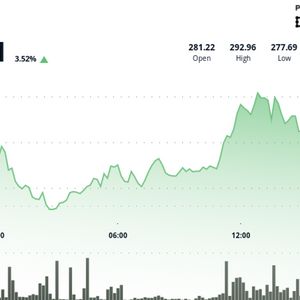

Murano Global Investments, a Nasdaq-listed real estate developer and hotel owner, launched a record $500 million Bitcoin treasury program, among the largest non-tech corporate crypto moves to date. The plan: exchange real estate equity for reserves of BTC, taking a cue from MicroStrategy and Semler Scientific in employing digital currencies for balance sheet volatility. How Murano Is Funding Its Bitcoin Treasury Murano purchased a $500 million Standby Equity Purchase Agreement (SEPA) with Yorkville Advisors whereby it has the ability to sell stock over time and invest proceeds into Bitcoin. In the first instance, 21 BTC (considerably more than $2.1 million at today’s prices) was purchased, with a view to scaling up to the full $500 million depending on market conditions. In order to tap into more capital, Murano is exploring sale-leaseback deals and strategic asset disposals—basically converting illiquid real estate value into liquid high-yielding BTC assets. While this move follows in the steps of MicroStrategy (which used debt and equity to buy over 200,000 BTC) and Semler Scientific, it marks a first for the hospitality and real estate sectors. Strategic Reasoning: Why Bitcoin, Why Now? Murano CEO Elias Sacal explained: ”We consider Bitcoin to be an innovative asset that not only provides long-term growth potential but is also a complement to our balance sheet versus inflation and systemic risk.” By joining the ”Bitcoin for Corporations” alliance (led by BTC Inc and Strategy of Michael Saylor), Murano signals its intent to be among the best industry crypto adoption leaders. The corporation also anticipates starting to accept BTC as payment for accommodations and starting Bitcoin reward schemes to attract crypto-beneficial travelers and diversify its revenue streams. Balance Sheet Impact: Bullish vs. Bearish Scenarios Scenario BTC Price Path Potential Impact on Murano’s Treasury Bullish $110,000+ $500M equity could yield 4,500+ BTC Bearish $50,000 $500M equity yields 10,000 BTC, but value drops to $500M Volatile Swings between $50K–$110K Treasury fluctuates with market Murano’s move is designed to hedge against inflation and currency risk, but also exposes the company to Bitcoin’s notorious price swings. The phased approach—gradually converting equity and real estate value—lets the company adapt to market conditions and manage risk. MicroStrategy, Semler, and the New Corporate BTC Wave MicroStrategy was the initial corporate Bitcoin trailblazer to utilize bonds and share issues to accumulate the world’s largest corporate BTC holding. As a tech-industry participant, MicroStrategy’s highly leveraged accumulation process established the template for public companies interested in utilizing digital assets as a treasury reserve. Their procedure relied on elevated leverage and prominent chief executive officer, so Bitcoin featured centrally in their brand message and investor narrative. Semler Scientific was top story as a medical device company that switched to a Bitcoin treasury model in 2024. Semler’s move, in contrast with MicroStrategy’s tech roots, meant the move into Bitcoin was spreading beyond software and finance. The company’s move to buy a significant portion of its balance sheet in BTC demonstrated that even traditionally fiscally conservative sectors could value digital assets as both a hedge and a growth opportunity. Murano is venturing into new territory as the first big real estate developer to use property equity and sale-leasebacks to fund a BTC war-chest. This strategy is new: rather than tapping pure debt or cash reserves, Murano is literally converting illiquid real estate worth into liquid holdings of Bitcoin. In the process, the company is hedging not just against currency risk and inflation but sending a message that the next leg of corporate adoption of Bitcoin is extending into traditional sectors like real estate and hospitality. Murano’s action can set the stage for a broader set of industries to consider digital assets as a strategic balance sheet asset, taking the corporate BTC wave much further than its origins in the tech industry.

Source: Coinpaper