XRP flirts with $2.50 resistance, MUTM climbs into top 10 most watched altcoins

3 min read

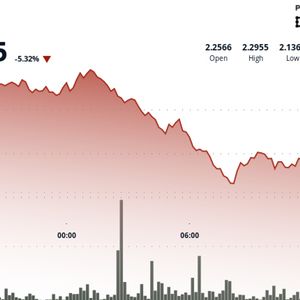

XRP tested the $2.50 resistance level, trading at $2.49 with a $129B market cap after a +0.14% weekly gain (June 14–20, 2025). Fueled by 90%+ ETF approval odds and a 12-year high of 2,700+ whale wallets, XRP’s symmetrical triangle breakout signals a potential 1.2x rally to $3.00. However, failure to break $2.50 risks a pullback to $2.10–$2.20 support, with macroeconomic volatility and regulatory uncertainty posing challenges. As XRP teases its $2.50 resistance level, another project has begun drawing serious attention: Mutuum Finance (MUTM) . Now ranked among the top 10 most-watched altcoins, Mutuum’s ongoing presale is attracting both early DeFi believers and seasoned traders exiting larger caps. With the current price fixed at $0.03, over $11.7 million raised so far, and more than 12,700 holders already locked in, Mutuum Finance (MUTM) is emerging as a major new name in the decentralized finance space. mtTokens will power passive income at scale Mutuum Finance (MUTM) is not just launching another DeFi protocol—it’s building an income layer designed to work for lenders, borrowers, and long-term holders. The core product revolves around mtTokens, which users will receive when they deposit cryptocurrencies into Mutuum’s smart contract pools. These mtTokens will represent the deposited amount and will grow in value automatically as borrowers pay interest. What separates Mutuum’s mtToken system from other lending protocols is that these tokens won’t sit idle. They will be usable as collateral for borrowing additional assets within the protocol, and stakers of mtTokens will be eligible for passive dividend rewards funded by buybacks. These dividends will be distributed in MUTM tokens, purchased using a portion of the protocol’s revenue. This means active and long-term participants will benefit from two sources: the interest generated through deposits and the value distributed through MUTM buyback cycles. Someone depositing $15,000 worth of stablecoins like USDC will receive mtUSDC. With a projected APY of 10% depending on liquidity utilization, they will earn $1,500 in passive interest by the end of the year. Later, by staking these mtTokens, the same user will also become eligible to receive additional MUTM rewards during protocol buyback events. From most-watched to most-rewarding: why timing matters As it enters Phase 5 of the presale, the MUTM token is still available at just $0.03. Investors who buy now are locking in that price before the next increase, which will kick in at Phase 6. This shrinking window is creating fear across the market, with crypto traders hunting for low-entry, high-upside tokens. A $4,000 investment in MUTM at today’s price would yield approximately 133,333 tokens. At a 30X valuation post-launch, that stake will be worth $120,000. And unlike tokens with no roadmap, Mutuum Finance (MUTM) has laid out a clear path. The team is preparing to release a beta version of the platform around the time of token listing. This rollout will be paired with Layer-2 integration for fast, low-cost transactions and the debut of a decentralized stablecoin system, giving users the ability to borrow against their collateral without leaving the platform or facing volatility risks. Only approved smart contracts, called issuers, will be able to mint the stablecoin, with limits in place to maintain protocol stability. All loans will remain overcollateralized and subject to automatic liquidation if needed to protect the system. To demonstrate its commitment to security, Mutuum Finance (MUTM) has also launched a $50,000 bug bounty program in partnership with CertiK, with rewards divided across four severity levels. With a Token Scan Score of 95 and Skynet Score of 77, the audit outcomes reinforce trust among investors looking to deploy larger amounts. Being among the most-watched tokens now is only part of the story. The price will rise again in the next presale phase, and those who delay will enter at a higher cost. With over 60% of tokens already sold and whales beginning to rotate capital from major caps into emerging projects like Mutuum Finance (MUTM), the opportunity to get in before the next breakout is rapidly closing. For more information about Mutuum Finance (MUTM) visit the links below: Website: https://mutuum.com/ Linktree: https://linktr.ee/mutuumfinance The post XRP flirts with $2.50 resistance, MUTM climbs into top 10 most watched altcoins appeared first on Invezz

Source: Invezz