US Dollar’s Worst Year Since 1973 Becomes the Catalyst for Bitcoin’s Rise

1 min read

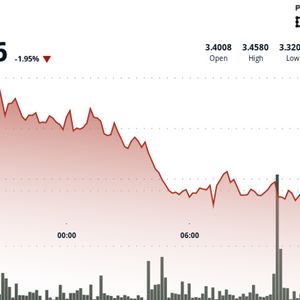

US Dollar Index (DXY) has plunged about 10.8% in the first half of 2025 Rising US debt, trade policy instability, and a less independent Fed are eroding the dollar’s dominance When the Fed signaled a dovish pivot in 2020, Bitcoin rallied from approximately $10k to about $60k in under a year The US Dollar Index (DXY) has plunged about 10.8% in the first half of 2025, marking its worst start to a year since 1973. This historic weakness is being driven by a combination of political uncertainty and eroding confidence in U.S. fiscal policy, a dynamic that is creating a powerful tailwind for hard assets like gold and Bitcoin. Factors Driving the Dollar’s Decline There are several factors contributing to this development, with political doubt being one of them. For instance, markets are worried about renewed Trump-era tariffs and ballooning deficits, in addition to constant pressure from Trump’s administration on the Fed to introduce rate cuts. There’s also the fact that some investors are shifting from the dollar to safe-haven assets like gold and bonds from Europe and Asia. Interestingly enough, despite the dollar’s decline, US equities and Treasu… The post US Dollar’s Worst Year Since 1973 Becomes the Catalyst for Bitcoin’s Rise appeared first on Coin Edition .

Source: Coin Edition