Crypto Investment Products Sees $2.7B in Weekly Inflows

2 min read

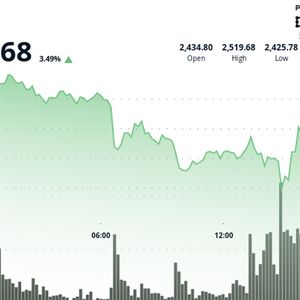

The crypto investments continues to show strong momentum, with digital asset funds experiencing another week of gains. In CoinShares’ latest report, it was revealed that digital fund investment attracted $2.7 billion into the market last week, pushing the total for the year to $17.8 billion. This marks the 11th consecutive week of inflows, showing steady interest and rising confidence in the crypto space. Crypto Confidence Grows as Investments Top $184 Billion The recent surge in cryptocurrency investments has increased the total value of digital asset funds to over $184 billion. This indicates steady market growth, as more people recognize the long-term value of digital assets. Experts attribute this growing interest partly to global political changes and uncertain financial policies. These factors are leading more investors to turn to crypto, especially Bitcoin, as a safer investment option. Bitcoin Takes the Lead in Growing Crypto Market Bitcoin remained the top choice for investors last week. Products linked to the world’s largest cryptocurrency drew $2.2 billion in inflows, representing 83% of the total inflow. This brings Bitcoin’s total inflows for the year to $14.9 billion. At the same time, products that bet against the digital coin experienced small outflows. These short-Bitcoin funds saw $2.9 million leave last week and have lost a total of $12 million this year. This trend suggests that market sentiment toward Bitcoin has turned more positive in 2025. Bitcoin has performed well this year, mainly due to increased crypto investment in spot Bitcoin exchange-traded funds (ETFs), particularly in the United States. BlackRock’s Bitcoin fund IBIT is one of the most popular. According to CoinShares’ report, BlackRock’s IBIT raised over $1.5 billion last week and more than $17 billion since its launch in January 2024. These successful ETFs have made the U.S. the leading destination for crypto investments. In 2025 alone, over $16.8 billion has flowed into the U.S.-based crypto products. Ethereum and Other Coins Keep Growing Ethereum investment products also did well last week, attracting $429 million. This brings the total amount invested in ETH this year to $2.9 billion. Analysts say Ethereum’s recent Pectra upgrade and growing interest from major investors have helped sustain its momentum. Other digital assets are also attracting attention. Solana (SOL) saw $5.3 million in new investments last week, bringing its yearly total to $91 million. However, XRP outpaced Solana, raking in $219 million this year, while Sui brought in $104 million. While the U.S. remains the leader in crypto investments, other countries are also making strong contributions. Germany saw $939 million in inflows this year, followed by Canada with $164 million and Australia with $148 million. This shows that crypto interest is spreading globally, not just in the U.S. The post Crypto Investment Products Sees $2.7B in Weekly Inflows appeared first on TheCoinrise.com .

Source: The Coin Rise