The Smarter Web Company secures $56M, aims for top 30 Bitcoin holders

3 min read

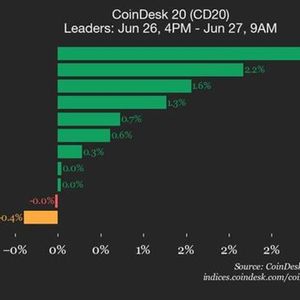

The Smarter Web Company has raised approximately $56 million, days after spending over $20 million on a Bitcoin investment. According to a Thursday announcement , the UK-based web design and marketing firm secured the funding through an accelerated bookbuild, a fast-track fundraising process typically involving institutional investors. The offering included £36.27 million ($49.8 million) raised via the bookbuild and an additional £4.97 million ($6.82 million) raised through subscription. Shares were priced at £2.90 ($3.98) each. The newly issued stock is expected to begin trading on July 1. The Smarter Web Company said the capital was raised to support its broader business objectives. While the official filing did not explicitly state whether any of the proceeds would be allocated toward additional Bitcoin purchases, the move follows a pattern of BTC accumulation that has intensified over the past month. Following the 10-year plan The Smarter Web Company, which trades on the OTCQB market in the United States under the ticker TSWCF, has been executing a long-term Bitcoin treasury strategy since April as part of its “10 Year Plan.” Under this strategy, the company plans to systematically accumulate Bitcoin as a treasury asset over the next decade. While the firm has accepted Bitcoin payments from clients since 2023, it began accumulating the asset in late spring this year. Two days before the fundraising was announced, the company invested over $20 million to acquire 196.8 BTC at an average price of $103,290, which brought its total holdings to 543.52 BTC, valued at approximately $58.19 million as of the latest update. The average acquisition price across its Bitcoin treasury stands at $104,450. Prior to that, the company had executed a total of four Bitcoin purchases since late May, gradually increasing its holdings from 83.24 BTC to 346.63 BTC through acquisitions totalling approximately £17.9 million. On June 26, CEO Andrew Webley met with Michael Saylor, co-founder of Strategy, the largest corporate holder of Bitcoin, for what he described as a “good meeting” on Bitcoin strategy. A day later, Webley confirmed in an X post that The Smarter Web Company is now the 39th largest corporate BTC holder and intends to climb into the top 30. For many publicly listed companies, reports of Bitcoin acquisitions often spark bullish momentum. But that wasn’t the case for The Smarter Web Company. Its shares fell 15% on Thursday, closing at $3.56 after touching an intraday low of $3.19, according to Google Finance. Bitcoin’s growing appeal as a treasury asset Bitcoin has been showing strong resilience against macro jitters, and part of that can be attributed to its growing role as a treasury asset. Over the past year, several publicly listed companies have added Bitcoin to their balance sheets, citing its scarcity, liquidity, and potential as a hedge against currency debasement and a means to improve shareholder value. The trend is particularly prominent in the US, where firms like Strategy and BlackRock have led the way. Strategy alone now holds over 576,000 BTC, and more than 60 other public companies have followed suit, using Bitcoin as a core strategic reserve. Similarly, in the UK, despite the lack of regulatory clarity around digital assets, a number of listed firms are beginning to adopt Bitcoin treasury strategies. Alongside The Smarter Web Company, firms like Vinanz and Abraxas Capital have made sizeable Bitcoin allocations in recent months. The post The Smarter Web Company secures $56M, aims for top 30 Bitcoin holders appeared first on Invezz

Source: Invezz