SEC Ripple Case: Judge Torres Issues Crucial Denial on Penalty Reduction

7 min read

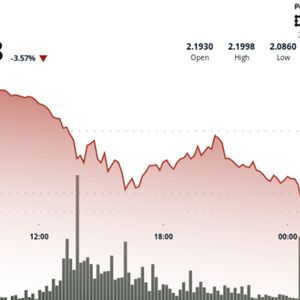

BitcoinWorld SEC Ripple Case: Judge Torres Issues Crucial Denial on Penalty Reduction The crypto world just received another significant update in the long-running SEC Ripple case , a legal battle that has kept investors and enthusiasts on the edge of their seats for years. In a move that sends a clear message about the court’s current stance, Judge Analisa Torres of the U.S. District Court for the Southern District of New York has officially denied a joint request from the U.S. Securities and Exchange Commission (SEC) and Ripple Labs. This denial, confirmed by reports, specifically targeted a motion seeking an ‘indicative ruling’ to dissolve a permanent injunction and significantly reduce Ripple’s proposed monetary penalty by more than half. The motion was officially terminated on June 26, marking a pivotal moment in this high-stakes legal drama. But what does this mean for Ripple, XRP, and the broader cryptocurrency landscape? Understanding the SEC Ripple Case : A Legal Saga Unpacked To truly grasp the gravity of Judge Torres’s recent decision, it’s essential to revisit the origins of the SEC Ripple case . This legal saga began in December 2020 when the SEC filed a lawsuit against Ripple Labs, its CEO Brad Garlinghouse, and co-founder Chris Larsen. The core of the SEC’s accusation was that Ripple had engaged in an unregistered, ongoing offering of securities through the sale of its digital asset, XRP, to retail investors. The regulatory body alleged that XRP functioned as an investment contract, thereby falling under the purview of U.S. securities laws, which Ripple vehemently denied. Ripple, on the other hand, argued that XRP is not a security but rather a digital currency used for facilitating fast and low-cost international payments. They contended that the SEC’s regulatory approach was a classic case of ‘regulation by enforcement,’ lacking clear guidelines for the burgeoning crypto industry. This fundamental disagreement has fueled a protracted legal battle, with significant implications not just for Ripple and XRP, but for how digital assets are classified and regulated across the United States and potentially globally. The crypto community has closely watched every development, recognizing that the outcome could set a precedent for other cryptocurrencies and blockchain projects. The Significance of Judge Torres Ruling : A Deep Dive into Judicial Authority Judge Analisa Torres has been at the helm of this complex litigation, and her rulings have often been a source of major market movements for XRP. Her previous partial summary judgment in July 2023 was a landmark decision that brought significant clarity to the case. In that ruling, Judge Torres distinguished between Ripple’s institutional sales of XRP, which she deemed unregistered securities, and programmatic sales of XRP on exchanges, which she ruled were not securities. This nuanced distinction was a partial victory for Ripple and was widely celebrated by the crypto community, leading to a significant surge in XRP’s price and a sense of optimism about the case’s eventual resolution. The recent denial of the joint request for an ‘indicative ruling’ further underscores Judge Torres’s firm judicial approach. An indicative ruling is typically sought when a case is on appeal, and a party wants the trial court to indicate whether it would grant a motion (like dissolving an injunction or reducing a penalty) if the case were remanded. The denial suggests that, at this stage, Judge Torres sees no immediate reason to reconsider or modify her previous orders concerning the permanent injunction or the proposed Ripple penalty . This indicates a preference for allowing the legal process to unfold as prescribed, without premature interventions based on potential future appellate outcomes. Navigating the XRP Lawsuit : Implications for Holders and the Market The XRP lawsuit has cast a long shadow over the digital asset, impacting its market performance, liquidity, and perception within the broader crypto ecosystem. For years, the uncertainty surrounding its legal status led many exchanges to delist XRP or restrict its trading for U.S. customers. This created significant market fragmentation and hindered XRP’s growth compared to other major cryptocurrencies. The partial victory in July 2023 brought a wave of relief, with many exchanges relisting XRP, and its price experiencing a notable rally. However, the recent denial by Judge Torres injects a renewed sense of caution. While not a direct loss for Ripple, it signals that a quick and easy resolution, particularly concerning the financial penalties, might not be on the horizon. XRP holders, who have weathered significant volatility and legal uncertainty, continue to watch every development closely. The ongoing legal battles emphasize the need for regulatory clarity in the crypto space, as the lack thereof directly impacts market stability and investor confidence. The community’s sentiment often swings with each legal update, reflecting the deep personal and financial stakes involved. The Contested Ripple Penalty : Why the Reduction Was Denied At the heart of the recently denied joint request was the significant financial penalty that the SEC is seeking from Ripple. Originally, the SEC demanded approximately $2 billion in disgorgement, prejudgment interest, and civil penalties, alleging that Ripple illegally profited from unregistered XRP sales. Ripple, in response, argued for a much lower penalty, proposing a figure closer to $10 million. Their arguments for reduction centered on various factors, including the nature of their ODL (On-Demand Liquidity) sales, which they contended were not securities, and the lack of any investor harm from their programmatic sales. The joint request for an indicative ruling aimed to reduce this substantial monetary penalty by more than half and dissolve a permanent injunction that the SEC was seeking. While the exact legal reasoning for Judge Torres’s denial has not been fully detailed, common interpretations suggest that the court might view such a request as premature or unnecessary at this stage of the proceedings. It could imply that the court prefers to wait for the appellate process to potentially unfold or that it does not see sufficient grounds to alter its current position on the injunction or the penalty amount without further legal arguments or a definitive appellate decision. This denial means that the dispute over the exact size of Ripple’s financial penalty will continue to be a contentious point, potentially requiring further litigation or negotiation before a final figure is settled. The Role of the US District Court in Shaping Crypto Regulation The U.S. District Court for the Southern District of New York has become a crucial battleground for cryptocurrency regulation. Its decisions, particularly in high-profile cases like the SEC Ripple case , carry immense weight and often set precedents for how digital assets are treated under existing laws. The court’s meticulous approach in distinguishing between different types of XRP sales highlights the complexities involved in applying traditional securities laws to novel technologies. This court’s rulings are not just about Ripple; they are about defining the boundaries of regulatory authority in a rapidly evolving financial landscape. The challenges of regulating crypto are manifold: the global nature of digital assets, the decentralized characteristics of many projects, and the speed at which technology evolves often outpace legislative and regulatory frameworks. The judiciary, therefore, finds itself in a position of interpreting existing laws to fit new paradigms, a task that is inherently complex and often leads to prolonged legal battles. The denial of this joint request from the US District Court further underscores the judiciary’s commitment to due process and careful deliberation, rather than expediting outcomes that may have significant long-term implications for the entire crypto industry. What’s Next for the SEC and Ripple? Looking Ahead The denial of this joint request, while a significant development, is certainly not the final chapter in the SEC Ripple case . Both parties still have avenues to pursue. Ripple could appeal the aspects of Judge Torres’s ruling that went against them, particularly regarding the institutional sales. Similarly, the SEC could appeal the programmatic sales ruling. Settlement talks remain a possibility, though the current denial suggests that the path to a quick resolution is not straightforward. The court will likely proceed with determining the final penalty amount, which could involve further hearings or submissions from both sides. For investors and market participants, the key takeaway is that regulatory clarity for XRP and other digital assets remains a work in progress. While the lawsuit has provided some distinctions, the ultimate classification of various crypto assets continues to be debated. It is crucial for market participants to stay informed, understand the potential implications of ongoing legal proceedings, and consider how regulatory developments might impact their investment strategies. The long-term outlook for XRP will largely depend on the final resolution of this lawsuit and the broader regulatory environment that emerges in the U.S. Conclusion: A Definitive Step, But Not the End Judge Analisa Torres’s denial of the joint SEC and Ripple request to modify her ruling and reduce the Ripple penalty marks a definitive, if not final, step in this protracted legal saga. It reinforces the court’s intention to meticulously follow legal procedures and not rush to judgment, especially on matters of significant financial and legal consequence. While it may prolong the uncertainty for some, it also highlights the judiciary’s commitment to a thorough and deliberate process in shaping the future of cryptocurrency regulation. The crypto world will continue to watch closely, as every decision in this case has far-reaching implications for how digital assets are treated under the law, influencing everything from market dynamics to innovation in the blockchain space. To learn more about the latest crypto market trends, explore our article on key developments shaping XRP price action and institutional adoption. This post SEC Ripple Case: Judge Torres Issues Crucial Denial on Penalty Reduction first appeared on BitcoinWorld and is written by Editorial Team

Source: Bitcoin World