Chainlink Sees $220 Million in Token Transfers to Binance: What It Means for LINK Price and Market Sentiment

4 min read

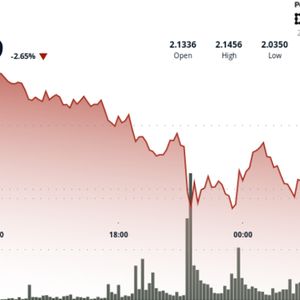

Chainlink’s token dynamics have reignited conversation with this move. A Non-Circulating Supply address transferred 4.875 million LINK tokens, worth around $61 million, to Binance. This large transfer marks the first movement from such an address in more than three months and is breaking a long stretch of silence from these addresses. This transfer also appears to be one part of a much larger recent wave of LINK deposits to Binance. In the past 12 hours, LINK deposits to Binance have seen a significant increase. As per on-chain data sources, several addresses identified as Non-Circulating Supply wallets have together deposited approximately $220 million worth of LINK into the exchange. The size and synchronized appearance of these transfers have raised alarms about possible short-term selling of the token. Một địa chỉ thuộc Non-Circulating Supply của Chainlink vừa chuyển 4.875 triệu $LINK lên Binance (trị giá 61 triệu USD) Đây là lần nạp lớn đầu tiên sau 3 tháng im ắng. Đây chỉ là 1 địa chỉ được đánh dấu Non-Circulating Supply trong số nhiều địa chỉ đã… pic.twitter.com/z7kWnzDnBg — Blog Tiền Ảo (@blogtienao_hq) June 21, 2025 A Surge in Exchange Deposits Sparks Speculation This sudden inflow of LINK tokens onto Binance has attracted the notice of the crypto community. It is an outflow from addresses presumed to hold non-circulating or locked supply. These addresses are thought to be used for team allocations, reserve tokens, and smart contract holdings that are not expected to be part of the circulating econ in the short term. This is the gist of a recent Twitter thread by 0xBoson, an account with a not-so-secret identity that has become a part of the Chainlink community. In this thread, Boer offers context and speculation about why Chainlink is behaving in this manner. These addresses being reactivated—along with the fact that they’re depositing tokens onto a major exchange—has led many analysts to believe a fresh sell-off is afoot. Selling pressure of this magnitude, particularly from such high-volume wallets, usually impacts token prices pretty immediately. And for LINK, this has meant renewed market volatility as traders adjust to the new supply situation. Even if not sold straightaway, simply taking tokens to an exchange often signals holders are switching to a more liquid posture and are ready or getting ready to liquidate. Historical Patterns Offer a Different Perspective It is curious that, despite the initial worry about these large transfers, historical data imply that significant unlocks of LINK and movements to exchanges do not always coincide with declines in price. Lookonchain, for instance, provides data suggesting that several earlier unlock events were followed by substantial price increases. Chainlink Noncirculating Supply wallets deposited 17.875M $LINK ($149M) into #Binance again today. Historically, #Chainlink has done 11 major unlocks—most were followed by price increases. https://t.co/edlAW6psdb pic.twitter.com/3NoK2yhDeo — Lookonchain (@lookonchain) June 21, 2025 This may be an odd pattern, but it could be the result of some market psychology and some investor expectations. When a large amount gets unlocked, it tends to attract attention and trading volume, and that in turn can lead to some visibility and interest from investors. And after the dust settles post-unlocking, LINK appears to find new support levels and enter recovery phases that can, at times, transition into some nice short-term rallies. Yet, it is necessary to proceed with caution. The timing and magnitude of this event—$220 million in deposits in a very short window—classifies it as something other than just your run-of-the-mill unlock event. If the market sees what is happening with these assets as something beyond just an unfortunate coincidence and interprets it as a sign that long-term holders or internal stakeholders are trying to sell large portions of their holdings, the psychological impact on the market could be significant. Short-Term Pressure, Long-Term Potential Chainlink’s fundamentals are solid, with the project constantly enlarging its part as an essential infrastructure layer for smart contracts, DeFi applications, and the tokenization of real-world assets. Its technology is universally accepted, and its partnerships with both crypto and institutional players keep multiplying. Even so, in the short term, it is supply-and-demand imbalances that typically steer price motions, not the long-term fundamentals of a situation. The sudden factor has introduced over $200 million worth of LINK tokens that are now available for sale on a major exchange. This could create a major market impact in the days or, at most, weeks ahead. At present, traders and long-term holders are keeping a close watch. Some may consider this a potential buying opportunity should prices decline, while others are taking the moment to hedge until the full brunt of the sell-side is absorbed. Like always, big on-chain moves from previously dormant or non-circulating addresses indicate changes in sentiment, strategy, or market structure. It’s not yet clear whether this recent uptick in LINK deposits means we’re headed for a short-term local bottom or a longer-term bearish trend, but what is clear is that the Chainlink token economy has entered a new phase—one marked by higher activity and, seemingly, by higher rates of token inflation. That’s something the market is certainly watching. Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services. Follow us on Twitter @nulltxnews to stay updated with the latest Crypto, NFT, AI, Cybersecurity, Distributed Computing, and Metaverse news !

Source: NullTx