Cathie Wood’s ARK Sells $146M in Circle Stock Amid 250% Rally — What’s Driving the Exit?

2 min read

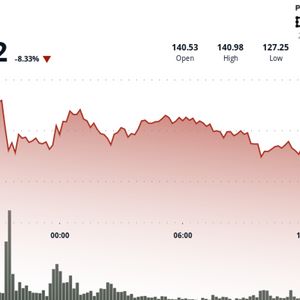

Cathie Wood’s ARK Invest offloaded $146.2 million worth of Circle (CRCL) shares on Friday, despite the stock surging nearly 250% since its June 5 debut on the New York Stock Exchange. Key Takeaways: ARK Invest sold $146M in Circle shares during a week where CRCL surged 248% post-IPO. Despite trimming its position, ARK remains Circle’s eighth-largest shareholder with $750M in holdings. While ARK cut exposure, other major backers like BlackRock have held firm. The latest move saw ARK sell 609,175 shares across three of its funds, including ARK Innovation ETF (ARKK), ARK Next Generation Internet ETF (ARKW), and ARK Fintech Innovation ETF (ARKF). ARKK led the divestment with 490,549 shares sold, followed by ARKW and ARKF with 75,018 and 43,608 shares, respectively. Ark Invest Sells Circle Shares, CRCL Up 248% Since Debut Friday’s sale coincided with a 20.4% gain in CRCL, closing at $240.30, a dramatic jump from its $69 opening price earlier this month. The transaction marked ARK’s third Circle sale within the week , bringing the total offloaded shares to 1.25 million and grossing roughly $243 million. Despite the aggressive trimming , ARK still holds a sizable stake in Circle. As of June 20, it remains the company’s eighth-largest shareholder with approximately $750 million in CRCL holdings. Notably, CRCL is now the top holding in the ARKW fund, representing 7.8% of its portfolio. Here are the current top 15 largest holdings in Cathie Wood and Ark Invest’s $ARKK ETF Tesla $TSLA – 10.15% Coinbase $COIN – 8.31% Circle $CRCL – 7.84% pic.twitter.com/SBQcYUqIip — ETF Tracker (@TheETFTracker) June 20, 2025 The largest Circle holder remains IDG-Accel China Capital Fund II with 23.3 million shares, followed by General Catalyst and James Breyer. Notably, ARK is the only major Circle investor to significantly reduce exposure post-IPO. Other backers, including BlackRock, reportedly eyeing a 10% stake in the company, have not disclosed any sales. Executives at Circle, however, have sold portions of their holdings. CEO Jeremy Allaire, co-founder Sean Neville, and CFO Jeremy Fox-Geen were listed in the prospectus as planning to sell 8%, 11%, and 11% of their holdings, respectively. Ether Slides After US Strikes Iran Nuclear Sites, Bitcoin Holds Ground Ether dropped sharply on Sunday after former President Donald Trump announced U.S. airstrikes on Iran’s key nuclear sites. The token fell as much as 7.7% to $2,200, its lowest level in over a month, while Bitcoin briefly dipped below $101,000 before stabilizing. Donald Trump said American bombers targeted Fordow, Natanz, and Isfahan, citing concerns over Iran’s uranium enrichment. The market had already been jittery throughout the week amid speculation of a possible strike. Pantera Capital’s Cosmo Jiang noted that the confirmation of the attack likely marked a local bottom for crypto prices. “Bitcoin tends to lead the market out of a bounce during geopolitical uncertainty,” Jiang told Bloomberg . The post Cathie Wood’s ARK Sells $146M in Circle Stock Amid 250% Rally — What’s Driving the Exit? appeared first on Cryptonews .

Source: cryptonews