With over $500 million in options expiring today, traders are bullish on this crypto

2 min read

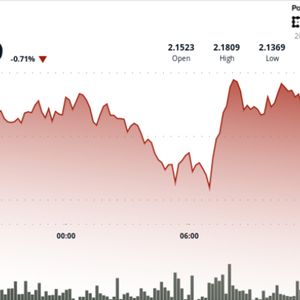

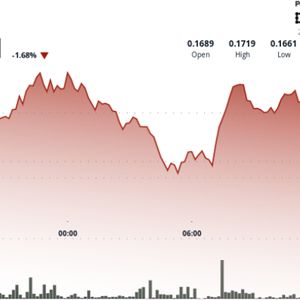

Over $546 million worth of Ethereum ( ETH ) options contracts are set to expire today, representing 216,922 individual contracts according to data from Deribit . Expiring ETH Options. Source: @DeribitOfficial The options data reveals a notably bullish sentiment among Ethereum traders . Deribit statistics show a put-to-call ratio of 0.68 for the expiring contracts, indicating that call options significantly outnumber puts . This suggests traders are positioning for upward price movement rather than hedging against declines. The maximum pain price for today’s Ethereum options expiration sits at $2,600. With ETH currently trading around $2,550, the cryptocurrency is positioned just below this critical level where the most options would expire worthless. This bullish positioning stands in stark contrast to Bitcoin’s ( BTC ) options data from the same expiration. Bitcoin showed a balanced put-to-call ratio of 1.16, suggesting a slightly bearish sentiment among traders. Ethereum’s price analysis The bullish options positioning coincides with institutional demand that has surged dramatically in recent weeks. Spot Ethereum ETFs recorded net inflows totaling $861.3 million from June 2, representing the strongest performance since their launch. The price action itself has created a compelling technical setup. Ethereum recently reached a four-month high of $2,880 on June 11 before correcting to current levels around $2,550. Analysts have identified $2,800 as a key resistance level that needs to be flipped to support for sustained upward momentum. ETH 7-day price chart. Source: Finbold Currently, ETH is trading between its 200-day simple moving average at $2631.13, acting as resistance, and the 50-day simple moving average at $2435.54, providing support. Notably, the maximum pain price aligns closely with this key technical resistance level. Featured image via Shutterstock. The post With over $500 million in options expiring today, traders are bullish on this crypto appeared first on Finbold .

Source: Finbold