SOL Slips Below $144 Even as Sol Strategies Eyes Nasdaq to Deepen Its Bet

2 min read

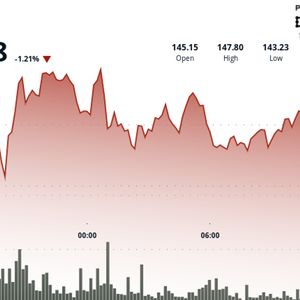

Solana’s native token, SOL SOL, dropped to $143.38 Tuesday, down 1.21%, closing near the day’s low after failing to hold above $147, according to CoinDesk Research’s technical analysis model. The weakness came even as the ecosystem drew fresh institutional backing: Canadian blockchain investor Sol Strategies filed with the U.S. Securities and Exchange Commission on June 18 to pursue a Nasdaq listing under the ticker STKE. While the filing itself is not an immediate market mover, it highlights a growing institutional commitment to Solana’s long-term outlook. Sol Strategies disclosed earlier this month that it holds more than 420,000 SOL, worth over $61 million, and has made SOL the centerpiece of its treasury strategy. The firm is also seeking regulatory approval in Canada to raise up to $1 billion, in addition to an earlier $500 million convertible note issuance in April used to acquire and stake SOL. Despite these bullish signals, SOL continues to trade defensively. Price action has been confined to a horizontal band for much of the past week, with the most recent breakout attempt above $147.80 failing to generate follow-through. Bears regained control during the final hours of trading, pushing SOL below the $144 psychological support. With price trending below major moving averages and volume tapering off mid-session, sentiment remains fragile even as long-term backing intensifies. Technical Analysis Highlights SOL traded in a 24-hour range from $143.23 to $147.80, a 2.83% swing. Resistance held at $147.80 after a failed breakout during the 22:00 UTC candle on June 18. Price declined steadily to $143.38, closing near the low after weak recovery attempts. Sellers were active between 13:46–14:00 UTC, with a drop from $144.62 to $143.38 on strong downside momentum. The $144–$145 zone remains critical; failure to reclaim it may open a path toward deeper support near $140. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk’s full AI Policy .

Source: CoinDesk