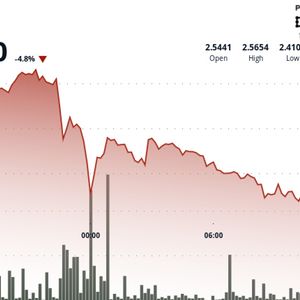

Filecoin Plunges 6% On Heavy Volume, Breaks Technical Support at $2.52 Level

2 min read

Filecoin FIL underwent a notable 5.8% decline over the 24-hour period, dropping from a high of $2.569 to a low of $2.406, according to CoinDesk Research’s technical analysis model. The token found support at the $2.41-$2.42 range, forming a potential consolidation zone after the sharp decline, the model showed. Filecoin is currently trading 4.9% lower, around $2.425. The broader market gauge, the CoinDesk 20 was 2% lower at publication time. Technical Analysis: FIL-USD underwent a notable 5.8% decline over the 24-hour period, dropping from a high of $2.569 to a low of $2.406. Heavy selling pressure occurred between 22:00-00:00 UTC when volume spiked to over 7 million units. The token found support at the $2.41-$2.42 range, forming a potential consolidation zone after the sharp decline. Technical analysis reveals a breakdown of the $2.52 support level that had previously held during the first half of the period. Resistance is now established at $2.56, where multiple rejection wicks formed before the downtrend accelerated. The high-volume selling suggests institutional distribution and potential further downside unless buyers can reclaim the $2.45 level. In the last hour, FIL-USD demonstrated notable volatility with a recovery attempt from the previous correction. Price action formed a V-shaped pattern, initially dropping to a low of $2.411 before staging a significant rally to reach $2.427 Volume peaked during the upward movement at over 55,000 units traded, suggesting strong buying interest at support levels. The asset has since consolidated between $2.415-$2.418, establishing a potential short-term horizontal support zone. Multiple rejection wicks formed at the $2.420 resistance level. This price action indicates potential stabilization following the earlier decline, though modest volume in the final minutes suggests caution before confirming a trend reversal. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk’s full AI Policy .

Source: CoinDesk