Cardano (ADA) Price Struggles Below Resistance—Can Long Positioning Trigger a Breakout?

3 min read

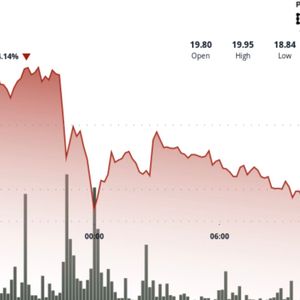

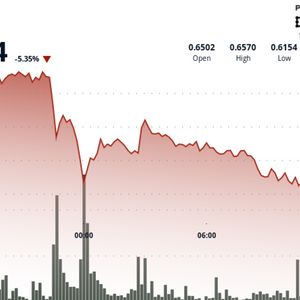

The post Cardano (ADA) Price Struggles Below Resistance—Can Long Positioning Trigger a Breakout? appeared first on Coinpedia Fintech News Cardano (ADA) is holding above $0.60, with $0.63 acting as a critical Fibonacci support zone, while upside remains capped by resistance near the $0.68–$0.72 EMA cluster. On-chain volume remains suppressed since early June, yet long/short ratios above 2.5 on Binance and OKX suggest traders are positioning for a bullish reversal. A breakout above $0.72 is needed to confirm a trend shift, while failure to hold $0.60 could expose ADA to a retest of the $0.48–$0.50 support range. Cardano On-Chain and Governance Update Cardano surpassed 1.3 million staking addresses this week, confirming its position as one of the most actively staked blockchains. Staking activity is expected to increase further with the upcoming launch of $NIGHT token rewards, which will be issued alongside regular ADA staking returns. Meanwhile, Charles Hoskinson’s $100M ADA treasury reallocation proposal continues to draw debate. The proposal aims to mint native stablecoins (USDM, USDA, iUSD), generate treasury yield, and bolster DeFi liquidity. This potentially transforming Cardano’s treasury into a decentralized sovereign wealth fund. Though ambitious, the plan has sparked division within the community. ADA/USD Technical View: Price Compression Beneath Resistance As of June 17, ADA is trading at $0.634 after rebounding from a local low of $0.62. Price action remains confined within a range, with key support found at the 0.618 Fibonacci retracement level ($0.60–$0.63), which has repeatedly acted as a defensive zone during previous corrections. Despite holding this support, ADA trades below a tightly stacked EMA cluster, including the 20-, 50-, 100-, and 200-day moving averages, currently between $0.68 and $0.72. This multi-timeframe confluence forms a strong resistance ceiling that bulls must clear to validate a breakout structure. The RSI (14) stands near 39.5, indicating mildly oversold conditions. MACD remains below the signal line, with a flattening histogram showing reduced downside pressure—but no bullish crossover yet. The Balance of Power indicator measures the strength of buyers versus sellers in the market, helping to identify momentum shifts. It is neutral-to-positive, reflecting accumulation attempts but subdued momentum. On-Chain Activity and Derivatives Sentiment On-chain volume has dropped over 45% since June 1, with ADA slipping from $0.69 to $0.63. This contraction reflects a possible consolidation phase, especially as traders wait for a macro or governance catalyst. Derivatives data shows ADA futures open interest holding around $752M, while the long/short ratio remains elevated at 2.65 on Binance and 2.43 on OKX. This suggests that speculative traders expect a bullish outcome. However, shrinking futures volume and stagnant spot flows signal that conviction remains weak. Coinbase saw minor inflows (~$367K), while OKX and Kraken registered outflows exceeding $700K each. Conclusion: Accumulation or Breakdown Ahead? Cardano’s fundamentals—staked address growth, treasury innovation, and DeFi integrations—continue to strengthen. But technicals remain pressured. A sustained breakout above the $0.68–$0.72 EMA cluster is needed to confirm trend reversal and attract fresh liquidity. Until then, ADA remains trapped between speculative long bias and structural fragility. Traders are watching $0.60 closely. If it holds, accumulation continues. If it breaks, downside targets shift to $0.50 and lower.

Source: coinpedia