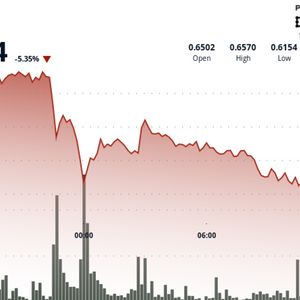

ADA Slides to $0.615 as Sell-Off Deepens and Support Faces Pressure

2 min read

Cardano’s ADA ADA token traded at $0.6154 Monday afternoon, extending its decline to 5.35% over the past 24 hours. The token dropped steadily through multiple support levels after a late-session sell-off began around 22:00 UTC on June 16. Despite a brief recovery attempt earlier in the session, the bearish structure remained intact heading into midday Tuesday. The correction mirrors broader risk-off behavior across digital assets as global macroeconomic conditions remain tense. Trade disputes and monetary tightening across major economies have added pressure to risk markets, dragging ADA and other large-cap tokens lower. Still, some technical analysts have pointed to potential signs of a reversal in ADA’s structure. A brief bounce from $0.622 to $0.626 earlier in the session formed a small upward-sloping channel, with price testing the $0.624–$0.625 band multiple times. That area has now emerged as a potential pivot zone, though volume has since tapered and volatility has narrowed. With ADA trading just above its daily low, bulls are watching for stabilization around $0.615–$0.620. A clear directional move from here may depend on whether that support zone holds and if broader market conditions begin to recover. Technical Analysis Highlights A sharp decline began at 22:00 UTC on June 16 as ADA broke below the $0.650 support level on high volume. Multiple failed attempts to reclaim $0.630 created a new resistance band around $0.640. Lower highs formed with each bounce, confirming downward pressure throughout the period. A support zone developed between $0.620 and $0.622 as volume picked up at those levels. Price entered a descending channel with consistent lower highs and lower lows. A brief recovery from $0.622 to $0.626 created an upward-sloping micro channel amid increasing volume. Resistance formed at $0.626, with the $0.624–$0.625 area acting as a pivot range during repeated tests. Recent candles showed decreasing volatility and volume, signaling consolidation near local lows. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk’s full AI Policy .

Source: CoinDesk