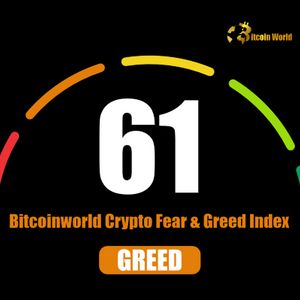

Crypto Fear and Greed Index: Unlocking Market Secrets as Greed Rises to 61

6 min read

BitcoinWorld Crypto Fear and Greed Index: Unlocking Market Secrets as Greed Rises to 61 Ever wondered what truly drives the rollercoaster ride of the cryptocurrency market? Beyond charts and news headlines, a powerful force is at play: human emotion . Fear and greed are the twin engines that can push prices to extremes. Understanding this underlying crypto market sentiment is crucial, and that’s where tools like the Crypto Fear and Greed Index come into play. What Exactly is the Crypto Fear and Greed Index ? Think of the Crypto Fear and Greed Index as a barometer for the emotional state of the crypto market. Developed by Alternative, this index aggregates data from various sources to provide a single number between 0 (representing Extreme Fear) and 100 (representing Extreme Greed). It’s designed to help investors gauge whether the market is currently dominated by panic selling (fear) or exuberant buying (greed). Why is this important? Historically, extreme fear can signal a potential buying opportunity (when others are panicking), while extreme greed might indicate the market is due for a correction (when everyone is overly optimistic). As of June 16, the index stands at 61, marking a slight increase from the previous day and firmly placing it in the ‘Greed’ zone. This reading suggests that market participants are feeling generally positive and confident. How is the Index Calculated? Breaking Down the Factors The Crypto Fear and Greed Index isn’t just a random number. It’s a composite score derived from six different weighted factors. Understanding these components gives you a deeper insight into what influences the overall sentiment: Volatility (25%): This measures the current volatility and maximum drawdowns of Bitcoin compared to average corresponding values of the last 30 and 90 days. High volatility, especially on the downside, often signals fear. Market Momentum / Volume (25%): This compares the current volume and market momentum to the average values of the last 30 and 90 days. High buying volume in a rising market indicates greed, while high selling volume during a dip reflects fear. Social Media (15%): This factor analyzes posts on various social media platforms, focusing on specific crypto-related hashtags and sentiment analysis of those posts. High levels of discussion and positive sentiment can contribute to a greed score. Surveys (15%): While currently paused, this component previously involved weekly polls asking people about their market sentiment. Bitcoin Dominance (10%): Bitcoin dominance measures Bitcoin’s share of the total cryptocurrency market capitalization. A rising Bitcoin dominance can sometimes indicate fear (people moving from altcoins to the relative safety of Bitcoin), while falling dominance might suggest increasing greed (people speculating on riskier altcoins). Google Trends (10%): This analyzes Google search data for crypto-related search terms. Spikes in search queries like “Bitcoin price manipulation” or “crypto crash” often correlate with fear, while searches for terms like “buy crypto” or specific altcoins during a rally can signal greed. By combining these diverse data points, the index aims to provide a holistic view of the prevailing crypto market sentiment . Navigating the ‘Greed’ Zone: What Does 61 Mean for Crypto Market Sentiment ? A reading of 61 firmly places the market in the ‘Greed’ territory, though not yet at the ‘Extreme Greed’ levels (typically above 75-80). This suggests a generally positive outlook among investors. People are more inclined to buy, hold, or even speculate, driven by positive price action or optimistic news. In the ‘Greed’ zone, you might observe: Increased buying pressure and rising prices. More discussion about potential profits and price targets on social media. Decreased perceived risk among retail investors. Higher trading volume as more participants enter or increase their positions. However, it’s important to remember that ‘Greed’ isn’t necessarily a signal to blindly buy. While positive sentiment can fuel rallies, the ‘Greed’ zone is also where caution becomes increasingly important. Markets driven by excessive greed can become overheated and prone to sudden pullbacks or corrections. Understanding Crypto Volatility in the Context of Sentiment Crypto volatility is a double-edged sword heavily influenced by sentiment. In periods of fear, volatility spikes downwards as panic selling ensues. Sharp, rapid price drops increase the volatility component of the index, pushing it towards ‘Fear’. Conversely, during periods of rising greed, volatility can also increase upwards as FOMO (Fear Of Missing Out) drives rapid price pumps. The index’s volatility component captures these movements, reflecting how stable or erratic price action is, which is often a direct result of market emotions. The Role of Market Momentum and Volume Market momentum , closely tied to trading volume, is a significant contributor to the index. When there’s strong positive momentum – prices rising quickly on high volume – it’s a clear sign of buying pressure, indicative of greed. Conversely, negative momentum with high selling volume signals fear. The index uses this data to see if recent price movements are supported by significant trading activity, validating the strength of the prevailing sentiment. A rising index often correlates with increasing positive market momentum . Actionable Insights: Using the Index in Your Crypto Trading So, how can you actually use the Crypto Fear and Greed Index ? It’s best used as one tool among many, not as a standalone trading signal. As a Contrary Indicator: Some experienced traders use the index contrarianly. Extreme Fear (low values) might be seen as a potential buying opportunity when others are panicking. Extreme Greed (high values) might be a signal to take profits or be cautious about entering new positions. The current level at 61 is ‘Greed’, suggesting increased caution might be warranted compared to when the index was in ‘Fear’. To Gauge Market Psychology: The index provides a quick snapshot of the market’s emotional state. Is there widespread panic or euphoria? This can help you assess the general mood and avoid getting swept up in emotional trading decisions. Combine with Other Analysis: Never rely solely on the index. Use it alongside technical analysis (chart patterns, indicators), fundamental analysis (project news, adoption), and macroeconomic factors. For example, if technical indicators show a potential resistance level while the index is in ‘Greed’, it might reinforce a decision to be cautious. Understand the Zones: Pay attention to the shifts between zones (Fear to Neutral, Neutral to Greed, etc.) and the extremes (Extreme Fear/Greed). These transitions can sometimes precede significant market moves. Remember, the index reflects *current* sentiment based on recent data. The market can change rapidly. Limitations of the Crypto Fear and Greed Index : It’s Not a Crystal Ball While useful, the index has limitations: It’s a Lagging or Coincident Indicator: It reflects sentiment based on what has already happened (price moves, search trends, social posts), not what *will* happen. Simplification: Reducing complex market dynamics to a single number is a simplification. It doesn’t account for nuanced market conditions or specific asset performance (beyond Bitcoin dominance). Potential for Manipulation: Some components, like social media or Google Trends, could potentially be influenced, although the index tries to mitigate this. Doesn’t Predict Magnitude or Timing: A high ‘Greed’ score doesn’t tell you *when* a correction will happen or *how large* it will be. Similarly, ‘Fear’ doesn’t guarantee a bottom. Therefore, it’s a valuable tool for context but should not be the sole basis for investment decisions. Conclusion: Staying Informed on Crypto Market Sentiment The rise of the Crypto Fear and Greed Index to 61, keeping it within the ‘Greed’ zone, is a clear signal of current positive crypto market sentiment . Driven by factors like price action, market momentum , and potentially shifts in Bitcoin dominance or changes in crypto volatility , this reading suggests investors are feeling optimistic. While ‘Greed’ can accompany upward price movements, it’s also a time for increased vigilance. Using the index as a gauge for prevailing emotions, combined with thorough analysis, can help you navigate the market more effectively. Understanding the underlying fear and greed dynamics, as reflected by this index, is a powerful step towards making more informed, less emotional trading and investment decisions in the volatile world of crypto. To learn more about the latest crypto market trends, explore our article on key developments shaping crypto price action. This post Crypto Fear and Greed Index: Unlocking Market Secrets as Greed Rises to 61 first appeared on BitcoinWorld and is written by Editorial Team

Source: Bitcoin World