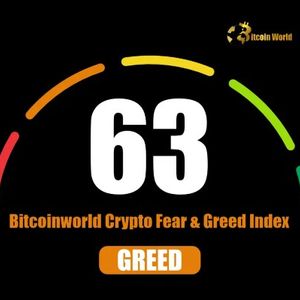

Crypto Fear and Greed Index Hits 63: Navigating the Greed Zone

6 min read

BitcoinWorld Crypto Fear and Greed Index Hits 63: Navigating the Greed Zone The cryptocurrency market is a dynamic environment, often driven as much by emotion as by fundamental analysis. Understanding the prevailing sentiment is crucial for investors and traders alike. One of the most popular tools for gauging this collective mood is the Crypto Fear and Greed Index . Recently, this index has shown a significant shift, rising to 63 and firmly positioning itself within the ‘Greed’ zone. What is the Crypto Fear and Greed Index and Why Does it Matter? The Crypto Fear and Greed Index is a unique tool designed by Alternative.me to visualize the emotional state of the cryptocurrency market. It aggregates various data points to produce a single number between 0 (Extreme Fear) and 100 (Extreme Greed). The core idea is that extreme fear can indicate a potential buying opportunity for those brave enough to enter a falling market, while extreme greed can signal that the market is due for a correction. Why does this matter? Because human psychology plays a massive role in financial markets. Fear can lead to panic selling, driving prices down further than fundamentals might suggest. Greed can lead to irrational exuberance, FOMO (Fear Of Missing Out), and speculative buying, pushing prices into bubble territory. The index provides a snapshot of this emotional temperature, helping participants potentially make more rational decisions by understanding the crowd’s current mindset. Breaking Down the Crypto Fear and Greed Index Score The index categorizes sentiment across a spectrum: 0-24: Extreme Fear 25-49: Fear 50-74: Greed 75-100: Extreme Greed A reading of 63, as recently reported, falls comfortably within the ‘Greed’ category. This indicates that market participants are feeling optimistic, perhaps even euphoric, about current and future price movements. While not yet in the ‘Extreme Greed’ territory, it suggests a strong positive bias is currently dominating the Crypto Market Sentiment . Historically, periods of ‘Extreme Fear’ have often coincided with market bottoms, presenting opportunities for long-term investors. Conversely, periods of ‘Extreme Greed’ have sometimes preceded market tops or significant pullbacks, as speculative excess becomes unsustainable. How is the Bitcoin Fear and Greed Index Calculated? While often referred to in the context of the broader crypto market, the index is heavily influenced by Bitcoin’s performance, given its market dominance. The calculation incorporates six key factors, each weighted differently: Volatility (25%): Measures the current volatility and maximum drawdown of Bitcoin compared to average values. High volatility often indicates a fearful market. Market Momentum / Volume (25%): Compares current market volume and momentum to historical averages. High buying volume in a positive market suggests greedy or optimistic behavior. Social Media (15%): Analyzes tweets and posts for specific terms related to crypto, tracking sentiment and engagement speed. High interaction and positive sentiment can indicate growing greed. Surveys (15%): Polls users about their market sentiment. (Note: As mentioned in the source, surveys are currently paused, which might slightly affect this component’s input, although the weighting is applied to the remaining active factors). Bitcoin Dominance (10%): Measures Bitcoin’s share of the total cryptocurrency market cap. Rising dominance can indicate fear (as investors move to the perceived ‘safer’ asset, BTC) or simply strong performance in Bitcoin itself. Falling dominance can signal increasing greed as altcoins rally more aggressively. Google Trends (10%): Analyzes search queries related to Bitcoin and other cryptocurrencies. Rising search interest, especially for terms like ‘Bitcoin price manipulation’ or ‘Bitcoin bubble’, can signal fear, while terms related to buying or specific projects might suggest greed. By combining these diverse data points, the index aims to provide a more holistic view of the underlying Crypto Market Sentiment than simply looking at price charts alone. What Does Being in the ‘Greed Zone Crypto’ Mean for You? A reading of 63 in the ‘Greed’ zone carries several implications for those involved in the market: Potential Implications: Increased Optimism: Participants are generally feeling positive about the market’s direction. Higher Risk Appetite: Investors may be more willing to take on risk, potentially moving into more speculative altcoins. FOMO Setting In: The fear of missing out on potential gains can drive impulsive buying. Potential for Overheating: Markets driven purely by emotion and speculation can become detached from underlying value, increasing the risk of a sharp correction. While ‘Greed’ isn’t ‘Extreme Greed’, it serves as a yellow flag. It suggests caution is warranted. Prices may continue to rise, but the probability of a significant downturn increases as sentiment moves higher into the greed spectrum. Using the Crypto Fear and Greed Index in Your Crypto Investing Strategy The index is best used as one tool among many, not as a standalone signal. Here’s how it can fit into a broader Crypto Investing Strategy : Benefits: Sentiment Check: Provides a quick, aggregated view of market mood. Contrarian Indicator: Can help identify potential opportunities during ‘Extreme Fear’ (buy when others are fearful) or warn of potential tops during ‘Extreme Greed’ (be cautious when others are greedy). Historical Context: Comparing current readings to historical levels can offer perspective on where the market might be in its cycle. Challenges & Limitations: Not a Crystal Ball: The index cannot predict future price movements with certainty. A high greed score doesn’t guarantee an immediate crash, nor does a high fear score guarantee a bottom. Lagging Indicator: It reflects *current* sentiment, which is often a reaction to recent price action, not necessarily a predictor of future action. Component Reliance: Changes in the calculation method or data sources (like paused surveys) can affect its reliability. Bitcoin-Centric: While indicative of the overall market, it’s heavily weighted towards Bitcoin. Altcoin sentiment might differ. Actionable Insights: Combine with Analysis: Use the index alongside technical analysis (charts, patterns), fundamental analysis (project utility, adoption), and macroeconomic factors. Manage Risk: High greed scores are a good time to review your portfolio, potentially take some profits, set stop-losses, or reduce leverage. Avoid FOMO: When the index is high in the greed zone, resist the urge to chase rapidly rising prices. Stick to your predefined investment plan. Look for Opportunities in Fear: Conversely, low fear scores can signal potential buying opportunities if fundamentals remain strong. Think of the index as a temperature gauge for the market’s emotional state. It tells you if people are hot (greedy) or cold (fearful), but it doesn’t tell you *why* or *how long* that temperature will last. Historical Examples and the Greed Zone Looking back, the Bitcoin Fear and Greed Index has often provided interesting insights. For instance, during the peak of the 2017 bull run and the late 2020/early 2021 rally, the index consistently registered in the ‘Extreme Greed’ zone (often above 90). These periods were followed by significant market corrections. Conversely, during major crashes, like March 2020 or the bear market lows of 2022, the index plummeted into ‘Extreme Fear’ (sometimes below 10), which in hindsight, represented strong accumulation zones for long-term holders. Being in the ‘Greed Zone Crypto’ at 63 isn’t as extreme as those historical peaks, but it places the market firmly in a state where caution should start outweighing excessive optimism. It’s a reminder that trees don’t grow to the sky and corrections are a natural part of market cycles. What Could Shift the Crypto Market Sentiment? The index is constantly reacting to market forces. Several factors could cause the Crypto Market Sentiment to shift from its current greedy state: Significant Price Drop: A sharp decline in Bitcoin or other major cryptocurrencies would quickly inject fear into the market. Negative News: Regulatory crackdowns, exchange hacks, or major project failures can trigger widespread panic. Macroeconomic Changes: Shifts in global interest rates, inflation data, or recession fears can impact risk-on assets like crypto. Positive Developments: Conversely, positive news like institutional adoption, regulatory clarity, or technological breakthroughs could push the index further into Extreme Greed. Monitoring these external factors alongside the index provides a more robust understanding of potential future movements. Conclusion: Navigating Greed with Caution The rise of the Crypto Fear and Greed Index to 63 signifies that optimism and confidence are currently the dominant forces in the market, placing it firmly in the ‘Greed’ zone. While this reflects positive price action and momentum, it also serves as an important reminder to temper enthusiasm with prudence. The index is a valuable sentiment tool, helping investors gauge the emotional temperature of the market and potentially act as a contrarian signal. However, it is not a standalone predictor. Successful navigation of the ‘Greed Zone Crypto’ requires combining this sentiment insight with thorough research, technical analysis, fundamental understanding, and disciplined risk management as part of a well-defined Crypto Investing Strategy . Stay informed, stay cautious, and avoid letting greed dictate your decisions. To learn more about the latest crypto market trends, explore our articles on key developments shaping Bitcoin price action and broader market sentiment. This post Crypto Fear and Greed Index Hits 63: Navigating the Greed Zone first appeared on BitcoinWorld and is written by Editorial Team

Source: Bitcoin World