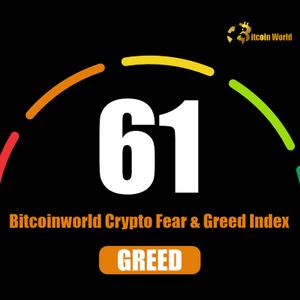

Crypto Fear and Greed Index Dips to 61: A Cautionary Tale in the Greed Zone

6 min read

BitcoinWorld Crypto Fear and Greed Index Dips to 61: A Cautionary Tale in the Greed Zone Hey crypto enthusiasts! Let’s talk about market vibes. The latest reading from the Crypto Fear and Greed Index , a popular gauge for tracking Crypto Market Sentiment , shows a slight cooling. As of June 13th, the index registered 61, a noticeable dip of 10 points from the previous day’s reading. Despite this decline, the index remains firmly within the ‘Greed’ territory. But what exactly does this number tell us, and how should you interpret it in the context of the broader market? Understanding the Crypto Fear and Greed Index Think of the Crypto Fear and Greed Index as a thermometer for market psychology. Developed by Alternative.me, it aims to quantify the emotional state of cryptocurrency investors and traders. Emotions like fear and greed can heavily influence market movements, often leading to irrational decisions. Extreme fear can signal a potential buying opportunity for those brave enough, while extreme greed might suggest the market is due for a correction. The index operates on a simple scale from 0 to 100: 0-24: Extreme Fear 25-49: Fear 50-74: Greed 75-100: Extreme Greed A score closer to 0 indicates that investors are highly fearful, likely selling off assets. A score closer to 100 suggests investors are getting overly greedy, potentially buying aggressively and pushing prices unsustainably high. What Factors Influence Crypto Market Sentiment? The Crypto Fear and Greed Index isn’t just a random number; it’s a composite score derived from analyzing six key factors. Each factor is weighted differently to reflect its perceived impact on overall Crypto Market Sentiment . Understanding these components helps provide a clearer picture of why the index moves the way it does. Here’s a breakdown of the factors: Factor Weighting How it’s Measured Volatility 25% Measures the current volatility and maximum drawdowns of Bitcoin and other major cryptocurrencies compared to their average values. High volatility often indicates increased fear or uncertainty. Market Momentum/Volume 25% Analyzes the current volume and momentum of the market. High buying volume in a rising market suggests greed, while low volume on a dip might indicate fear or lack of interest. Social Media 15% Scans social media platforms (like Twitter) for relevant posts about cryptocurrencies, counting mentions and analyzing sentiment (positive vs. negative). Surveys 15% Gauges public opinion through weekly crypto polls (currently paused). This provides a direct look at investor sentiment. Bitcoin Dominance 10% Examines Bitcoin’s share of the total market capitalization. Increasing Bitcoin Dominance can sometimes indicate fear (investors fleeing altcoins for the relative safety of BTC), while decreasing dominance might suggest greed (investors rotating into riskier altcoins). Google Trends 10% Analyzes Google search data for cryptocurrency-related terms. Spikes in searches for terms like “Bitcoin price manipulation” or “crypto bubble” can indicate fear, while terms like “buy crypto” or specific altcoin names might signal greed. As noted, the surveys component is currently paused, meaning the index is calculated based on the remaining five factors. The Current State: Why 61 is Still ‘Greed’ The recent drop of 10 points to 61 is significant, indicating a measurable shift in sentiment over a short period. However, 61 still falls comfortably within the 50-74 range, classifying it as ‘Greed’. This suggests that while some of the recent bullish fervor might have subsided, the prevailing mood among investors is still one of optimism and willingness to buy. A reading of 61 could mean several things: Some profit-taking might be occurring after a period of price increases. Recent negative news or a slight market dip might have tempered extreme optimism. The market is still viewed positively, with many expecting further gains, but perhaps with less intensity than when the index was higher (e.g., in the 70s or 80s). It’s a point where the market isn’t overly euphoric (Extreme Greed) but is definitely not fearful. Investors are generally confident, which can keep buying pressure relatively strong. What Does ‘Greed’ Imply for Your Trading Strategy? Being in the ‘Greed’ zone has important implications, especially when developing or adjusting your Trading Strategy . Historically, periods of high greed have sometimes preceded market corrections. This is based on the idea that when everyone is overly optimistic and buying aggressively, the market can become overextended and vulnerable to a sharp downturn. Here’s how you might interpret the current ‘Greed’ reading for your Trading Strategy : Caution is Advised: A high greed score suggests the market might be getting warm. It’s generally not the ideal time for aggressive new long positions, especially for short-term trades. Consider Risk Management: If you have open positions, this might be a good time to tighten stop-losses, take some profits, or reduce position sizes. Look for Confirmation: Don’t rely solely on the index. Use it as one tool among many. Confirm the sentiment with technical analysis (like chart patterns, indicators) and fundamental analysis. Prepare for Volatility: High sentiment periods can often be accompanied by increased Crypto Volatility . Be prepared for potentially larger price swings. Some traders use the index as a contrarian indicator: buying when there is extreme fear and selling (or avoiding buying) when there is extreme greed. A reading of 61 isn’t ‘extreme’ greed, but it’s definitely on the side where caution becomes more important than chasing gains. The Role of Bitcoin Dominance and Crypto Volatility Two significant components of the index are Bitcoin Dominance and Crypto Volatility . Let’s briefly touch upon their influence. An increase in Bitcoin Dominance often happens when altcoins are bleeding value faster than Bitcoin, or when investors are consolidating their positions into the largest, most liquid cryptocurrency during uncertain times. While sometimes interpreted as fear, it can also reflect a strong run-up in Bitcoin itself, which then pulls the overall market sentiment up. Crypto Volatility is a constant factor in the market. High volatility can contribute to either fear (if prices are dropping fast) or greed (if prices are skyrocketing). The index measures this volatility relative to historical averages. If recent price swings have been larger than usual, this factor will likely contribute to a higher score if the movement is upwards (momentum is also strong) or push it towards fear if the movement is downwards. The index’s calculation of 61 incorporates the current state of both Bitcoin Dominance and Crypto Volatility , alongside market momentum, social sentiment, and Google Trends data, to arrive at the overall sentiment score. Navigating the Market: Actionable Insights So, with the Crypto Fear and Greed Index sitting at 61 in the ‘Greed’ zone, what are some actionable steps you can consider? Stay Informed: Keep an eye on the index’s movement daily. A rapid change in either direction can be a strong signal. Review Your Portfolio: Assess your current holdings. Are you comfortable with your exposure given the ‘Greed’ sentiment? Set Price Alerts: If you’re waiting for a dip, set alerts for key price levels you’d be interested in buying at. Avoid FOMO: The ‘Greed’ zone is where Fear Of Missing Out (FOMO) is highest. Stick to your pre-defined Trading Strategy and avoid making impulsive decisions based on hype. Consider Dollar-Cost Averaging (DCA): If you’re a long-term investor, DCA can help mitigate the risk of buying at a potential peak during a greed phase. Remember, the index is a sentiment tool, not a crystal ball. It doesn’t predict future price movements with certainty but provides valuable insight into the market’s psychological state, which is a crucial driver of short-to-medium term trends. Conclusion The dip in the Crypto Fear and Greed Index from 71 to 61 signals a slight cooling in market enthusiasm, yet the persistent ‘Greed’ reading suggests investors remain largely optimistic. This current state highlights the ongoing positive sentiment but also serves as a cautionary signal that the market is not in ‘Fear’ territory, where historical opportunities for aggressive buying are often found. By understanding the factors like Bitcoin Dominance and Crypto Volatility that contribute to the index, and integrating this sentiment gauge into your overall Trading Strategy , you can make more informed decisions in the dynamic world of cryptocurrencies. To learn more about the latest Crypto Market Sentiment trends, explore our article on key developments shaping Crypto Market Sentiment price action . This post Crypto Fear and Greed Index Dips to 61: A Cautionary Tale in the Greed Zone first appeared on BitcoinWorld and is written by Editorial Team

Source: Bitcoin World